The fall in stock values widened significantly today; unemployment rose to recession levels; oil prices say stagflation through the summer; and the Houthis still rule.

Here’s a quick rundown on the economy from today’s news.

Stocks take a bath

Stocks are still tanking. Today, the Dow joined the tumble again, falling more than 500 points. The Nasdaq continued its decline; only it already does looks less like money just rotating out of growth stocks and into value stocks. It became more of a broadband sell-off of all stocks today:

Thursday’s sell-off appeared broader than tech alone. All but one of the 11 sectors that comprise the S&P 500 traded lower, while nine out of every 10 Dow members also saw losses. Even the small-cap focused Russell 2000, which has run up amid expectations for forthcoming interest rate cuts, dropped about 1.9%….

Stocks may be due for a rough time in the near term, according to Evercore ISI.

In a Thursday note, Evercore ISI head of technical analysis Rich Ross said that he’s grown more concerned tactically as stocks enter their worst stretch shortly.

There’s more room for “tactical downside in the weeks to come as we enter the gauntlet of the weakest two months and only consecutive losing months for equities, with markets at all time highs,” he elaborated.

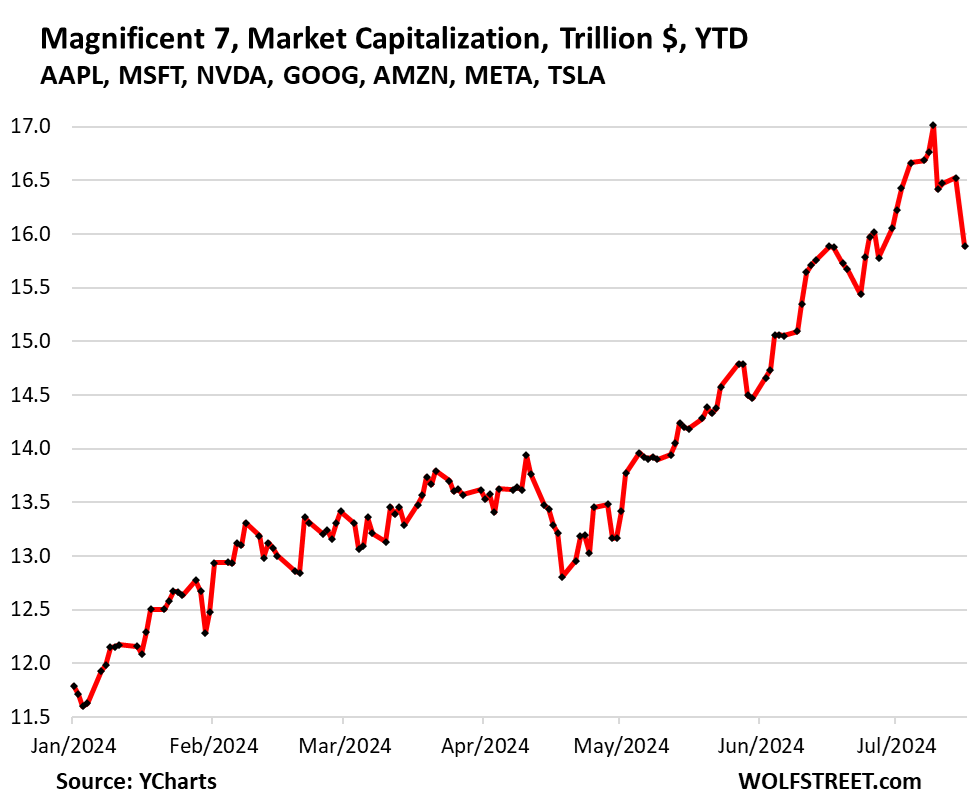

One economist, Wolf Richter, noted that the “Magnificent 7” stocks have lost $1.1-trillion in just five days.

These numbers are just crazy when you actually think for one second about it:… If that happened in Commercial Real Estate over a 12-month period it’s considered a massacre, calling for bailouts and rate cuts….

Here it’s just kind of a blip.

In other words, so crazy was the mania pumping money into those stocks throughout the first half of the year that a more-than-trillion-dollar loss is but a blip. Well, maybe a little more than a blip, but most of the year’s gains remain:

Nvidia, recently the biggest stock in the world, gained $20-trillion in the first half of the year. Now it’s fallen 12% in five days, showing how these high-and-mighty stocks certainly can come down, even if they are the new world for business. It’s now fallen back out of the trillion-dollar club and is third to Apple and Microsoft.

Unemployment rises above recession level

The labor market, which had seen a one-week drop in unemployment, proved that to be a head fake and went back to rising unemployment. We are now higher than the Maginot Line of the Sahm Rule that says we should be entering recession right away.

Jobless claims for the week ending July 13 rose by 20,000 to 243,000 from 223,000 the previous week, the Labor Department reported Thursday. It’s the eighth straight week claims came in above 220,000. Before that stretch, claims had been below that number in all but three weeks so far in 2024….

“Add today’s weekly jobless claims to the list of rate-cut-friendly data points….”

Few analysts expect the Fed to cut rates at its meeting later this month, however most are betting on a cut in September.

The total number of Americans collecting unemployment benefits rose after declining last week for the first time in 10 weeks….

And there have been job cuts in a range of sectors in recent months, from the agricultural manufacturer Deere, to media outlets like CNN, and elsewhere.

Oil still foils Fed hopes

Oil is holding its summer inflation as stockpiles continue to drop under driving demand. West Texas Intermediate was hanging out at $83/bbl this morning, but finally dropped down to $82.33 as of this writing. Bullish patterns in oil pricing say demand is outweighing supply.

In recent days, US prices have gained at a faster pace than the global Brent benchmark. That has left WTI with its smallest discount relative to Brent since October.

Seasonal demand and production cuts are said to be driving this summer rally. While US production is at its highest level ever, summer storms interrupted some of that.

Globally, the production scenario is more bullish. OPEC+ has extended its oil production cuts into next year, and Russia just this week said it would cut production even more than its OPEC+ quota dictated because it has pumped above its quota for months. It plans to cut additional production in the warm seasons of this year and next.

Rulers of the Red Sea

Meanwhile, the Houthis continue to rule the Red Sea, as predicted here. Therefore …

Container Ship Backlogs and Soaring Rates Drive Supply Chain Congestion Concerns

- Goldman Sachs’ supply chain congestion index nears “Congest” level for the first time in 1.5 years due to rising container ship backlogs and soaring ocean shipping rates.

- Apollo Management warns of returning supply chain stresses as container rates surge, driven by disruptions at Asian ports and demand for restocking.

So, the Fed is betting somewhat against the odds in thinking that tiny downward blip reported in the latest CPI numbers is going to give it space to cut rates in September, as the Fed would like to do now that the Sahm Rule says, as of today, recession is squarely here. The labor metrics, which have long obscured signs of recession, are finally giving way, saying the Fed can’t fight inflation any longer without deepening a recession that is already starting. That is where I’ve said for a long time they will end up … and we with them! If only they had given inflation the extra tap on the head it needed back in January and more certainly in March, maybe they’d be able to more safely back down a little now.

I want to be careful to say, though, that the supply troubles mentioned above are not highly significant in terms of cost increases yet, but they are moves in the wrong direction that put at risk the Fed’s hopes that dying inflation will give it room to add its usual support to a sinking economy.

114 views