by John-Wetter-2310

If you’re picturing a bunch of bank executives in capes, cackling maniacally as they raise interest rates, you’re not alone.

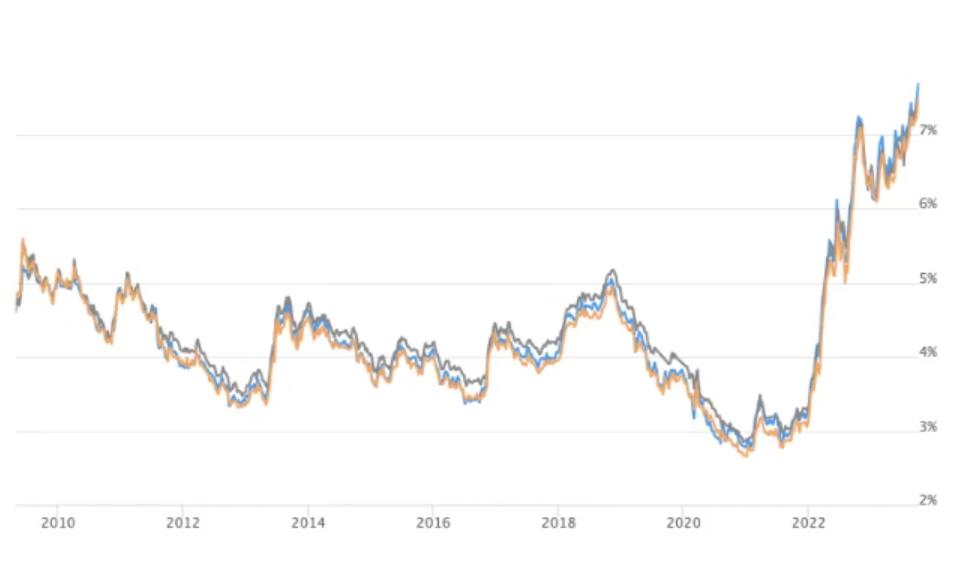

The incredibly sharp rise in mortgage rates has left prospective buyers shocked.

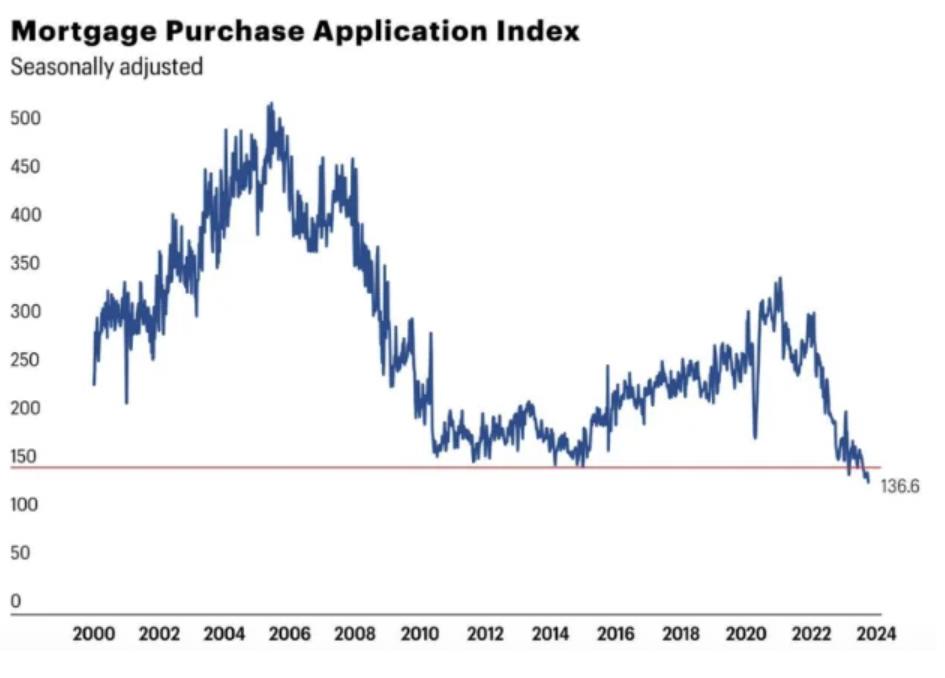

In fact, mortgage demand is at its lowest levels since 1995.

Why is this happening?

Two main reasons:

- The Federal Reserve’s hawkish view and rising interest rates.

- Mortgage rates and the 10-year yield are closely related. And the 10-year Treasury yield is reaching levels it hasn’t seen since 2007. Rising 10-year yield = Rising mortgage rates.

But this is only half the problem. There is also a lack of supply.

Homeowners who have locked in low rates don’t want to sell and lose their current rate, leaving little inventory for those looking to buy.

The plug for this data was here