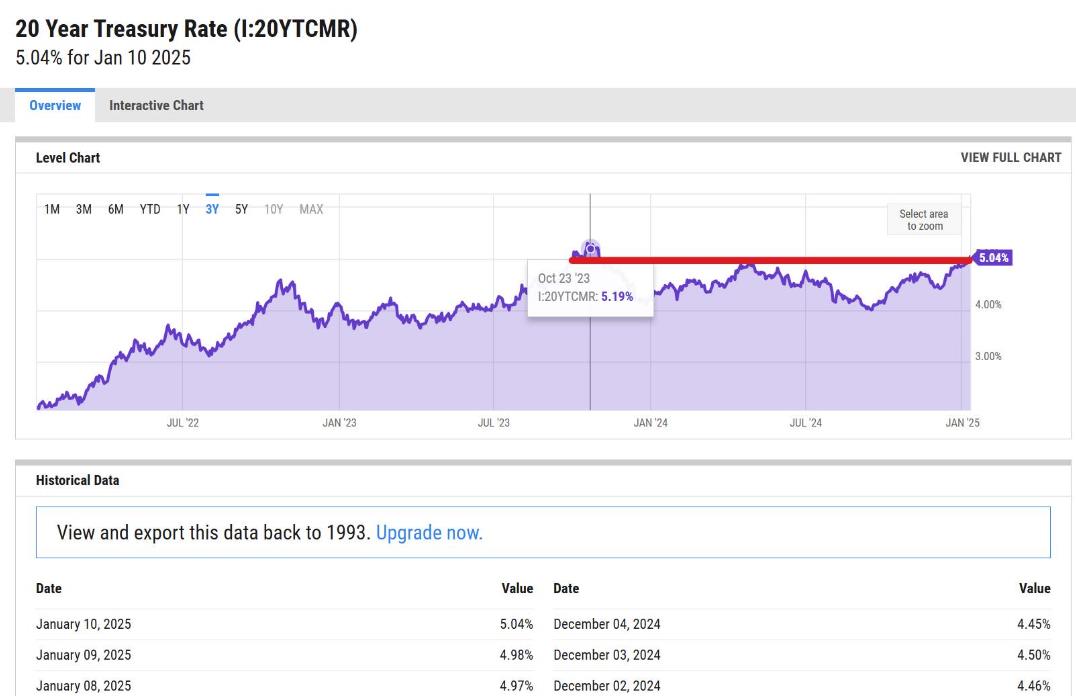

A high 20-year Treasury yield of 5% can negatively impact the stock market in several ways:

- Increased borrowing costs: Higher yields make borrowing more expensive for companies, impacting their profitability and potentially slowing down economic growth. This can reduce investor confidence and negatively impact stock prices.

- Reduced attractiveness of stocks: When Treasury yields rise, they become more competitive with stocks as an investment option. This can divert investment capital away from the stock market towards safer, higher-yielding bonds.

- Impact on corporate earnings: Rising interest rates can increase the cost of debt for companies, squeezing profit margins and potentially slowing down earnings growth. This can negatively impact investor expectations for future earnings and depress stock prices.

- Economic slowdown: Higher interest rates can slow down economic growth by making borrowing more expensive for consumers and businesses. This can lead to lower corporate earnings and a weaker stock market.

195 views