via Mike Shedlock

On January 1, 2023, 38 states had noteworthy tax changes. 37 of the changes put extra money in people’s pockets. Here’s the result in pictures.

The Tax Foundation noted State Tax Changes Taking Effect January 1, 2023

On January 1, 2023, thirty-eight states have noteworthy tax changes taking effect. Most of these changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

Eleven states have individual income tax rate reductions taking effect on January 1: Arizona, Idaho, Indiana, Iowa, Kentucky, Mississippi, Missouri, Nebraska, New Hampshire (interest and dividends income only), New York, and North Carolina. Three of these states—Arizona, Idaho, and Mississippi—are converting from graduated-rate income tax structures to flat tax structures on New Year’s Day.

One state, Massachusetts, has an income tax rate increase taking effect. Massachusetts’s individual income tax will convert from a flat to a graduated-rate tax with a new rate of 9 percent on income exceeding $1 million.

Five states—Alabama, Delaware, Iowa, Rhode Island, and Nebraska—are newly exempting all or a portion of retirement income or military pension income from income taxation.

Two states, Hawaii and Illinois, will expand their earned income tax credits (EITCs).

Personal Income Three Ways

Personal Income Chart Notes

- Disposable income means after tax

- Real means adjusted for inflation

- The three spikes, one in 2020 and two in 2021, are free money Covid fiscal stimulus payments, the third of which was under Biden and fueled inflation.

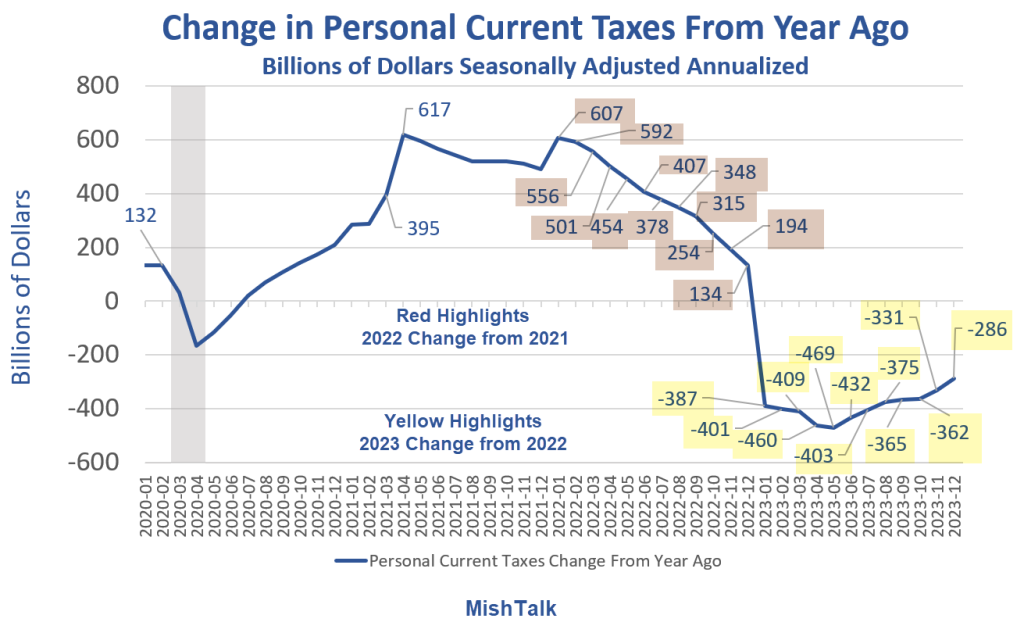

In January of 2023 disposable personal income surged. The first chart shows how much extra money people had to spend each month thanks to tax cuts. And spend they did.

Real Income and Spending

It’s real (inflation adjusted) spending that drive GDP and the surge is easy to spot (yellow highlight).

Real hourly wages rose less than one percent. But on top of the tax cuts, more people held multiple jobs.

Multiple Jobholders to the Rescue

The index of average hourly earnings rose from 109.8 in 2020 to 131.2 in December of 2023. That’s a gain of 19.5 percent.

Adjusting for inflation wages rose from 103.2 to 103.8. That’s a gain of 0.6 percent total for three years.

4th Quarter GDP Blows Past Consensus

The Bloomberg consensus estimate for fourth-quarter GDP was 2.0 percent. Instead GDP rose 3.3 percent annualized.

On January 25, I noted 4th Quarter GDP Blows Past Consensus, Up a Strong 3.3 Percent

Moral of the Story

If you tax less, people will spend more.

Now, if Congress can just do something about massive deficit spending and $34 trillion in debt.

Debt Soaring Out of Sight

GDP is fueled by both consumer debt and government debt. Regarding government debt, Republicans are in on the deal.

For example, The GOP Supports a Child Tax Credit Boost and Affordable Housing Expansion

Without passing anything but continuing resolutions, we went from a House Speake Kevin McCarthy’s proposal of $1.471 trillion bill to Mike Johnson’s $1.66 trillion bill that does not include, Ukraine, Israel, or the US border with Mexico.

And not only did consumers spend their tax cuts, they also racked up credit card debt.

Consumer Credit Hits Record $5 Trillion

For discussion, please see Retail Sales Surge 0.6 Percent, Beating Economist’s Expectations

Consumers keep spending more and more, and much of that spending is online.

Also see How Did Covid Change Your Propensity to Buy Things Online?

So, if you were at all inclined to think Bidenomics is to credit for anything good, please think again.