Source: https://www.federalreserve.gov/data/files/scoos_202306.pdf

Summary

The June 2023 Senior Credit Officer Opinion Survey on Dealer Financing Terms (SCOOS) collected qualitative information on changes in credit terms and conditions in securities financing and over-the-counter (OTC) derivatives. In addition to the core questions, the survey included a set of special questions about the funding of clients engaged in Treasury cash-futures basis trading and other relative-value trades involving Treasury securities. The 21 institutions participating in the survey account for almost all dealer financing of dollar-denominated securities to nondealers and are the most active intermediaries in OTC derivatives markets. The survey was conducted between May 9, 2023, and May 22, 2023. The core questions asked about changes between mid-February 2023 and mid-May 2023.

Core Questions

(Questions 1–79)1

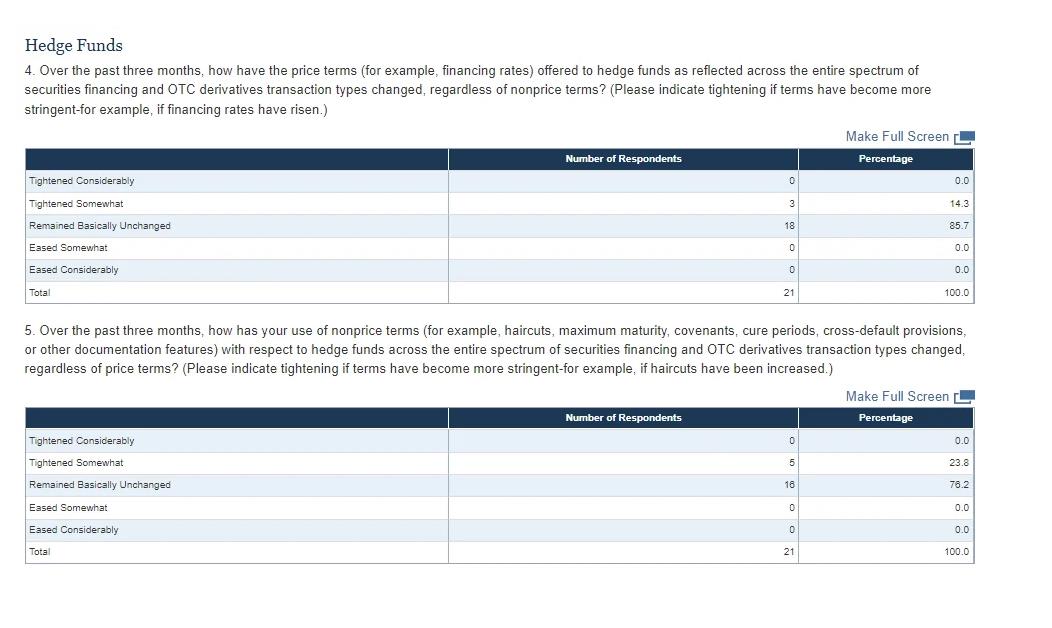

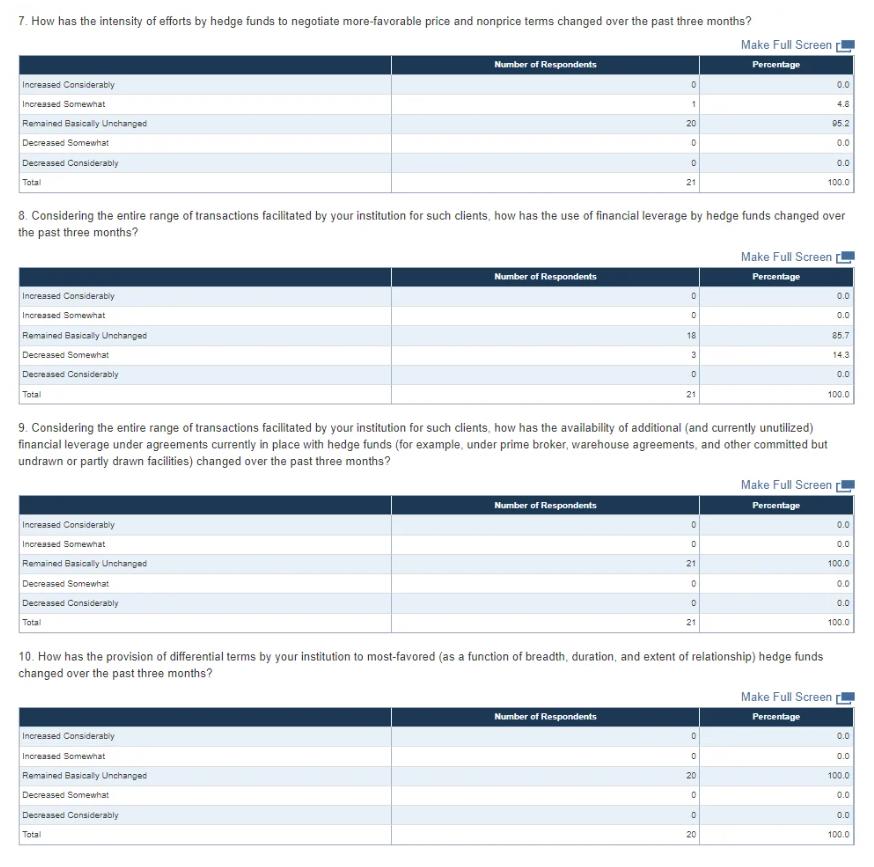

With regard to the credit terms applicable to, and mark and collateral disputes with, different counterparty types across the entire range of securities financing and OTC derivatives transactions, responses to the core questions revealed the following:

- Two-fifths of dealers, on net, reported they had increased the resources and attention they devoted to managing their concentrated credit exposure to other dealers and other financial intermediaries over the past three months (see the exhibit “Management of Concentrated Credit Exposures and Indicators of Supply of Credit”). Around one-fifth of dealers, on net, reported they had increased the resources and attention they devoted to managing their concentrated credit exposure to central counterparties. More than three-fifths of respondents indicated that changes in central counterparty practices have affected, at least to a small degree, the credit terms they offer to clients on bilateral transactions that are not cleared.

- For hedge funds, around one-fourth of dealers, on net, reported that nonprice terms tightened somewhat on securities financing transactions and OTC derivatives over the past three months. Smaller net fractions of dealers reported that price terms tightened. Dealers cited worsening in general market liquidity and functioning, reduced willingness of their institution to take on risk, and deterioration in current or expected financial strength of counterparties as the main reasons for the tightening.

- For trading real estate investment trusts (REITs), around one-third of dealers, on net, reported that price terms on securities financing transactions and OTC derivatives tightened over the past three months. Respondents reported that nonprice terms, such as haircuts, maximum maturity, or covenants remained mostly unchanged. Dealers cited deterioration in current or expected financial strength of counterparties as well as worsening in general market liquidity and functioning as the main reasons for the tightening.

- For nonfinancial corporations, mutual funds, exchange-traded funds, pension plans, and endowments, around one-fourth of dealers, on net, reported that price terms on securities financing transactions and OTC derivatives tightened over the past three months. A smaller net fraction of dealers reported that nonprice terms had tightened.

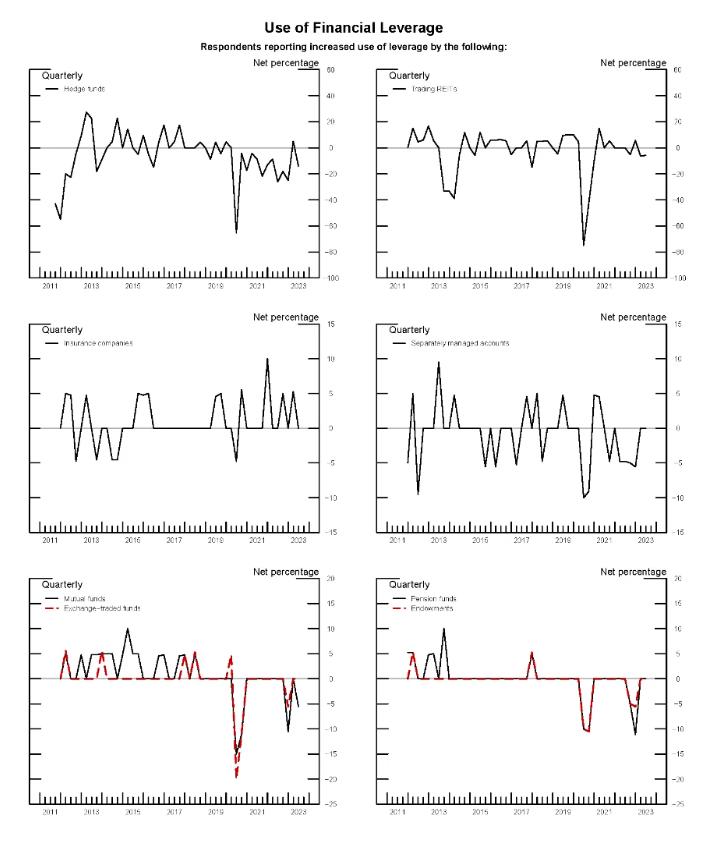

With respect to clients’ use of financial leverage, responses to the core questions revealed the following:

- For hedge funds, a small net fraction of dealers reported that the use of financial leverage decreased somewhat over the past three months (see the exhibit “Use of Financial Leverage”).

With respect to OTC derivatives markets, responses to the core questions revealed the following:

- Initial margin requirements and nonprice terms in master agreements were both reported to be mostly unchanged, on net, for all types of OTC derivatives.

- Around one-fifth and one-fourth of dealers, on net, indicated that the volume of mark and collateral disputes for foreign exchange and equity OTC derivatives, respectively, decreased over the past three months.

With respect to securities financing transactions, respondents indicated the following:

- Around one-third and one-fifth of dealers, on net, indicated the tightening of terms for collateral spreads and haircuts, respectively, for high-yield corporate bonds, non-agency residential mortgage-backed securities, commercial mortgage-backed securities, and consumer asset-backed securities over the past three months. The tightening of terms for collateral spreads, but not of terms for haircuts, was similarly indicated for high-grade corporate bonds.

- Around one-fifth of dealers, on net, indicated increased demand for funding of high-grade corporate bonds and increased demand for term funding of high-grade and high-yield corporate bonds over the past three months (see the exhibit “Measures of Demand for Funding and Market Functioning”). For equities (including through stock loans), a small net fraction of dealers indicated that demand for funding decreased over the past three months.

- Around one-third of dealers, on net, indicated that liquidity and market functioning for commercial mortgage-backed securities deteriorated over the past three months. Smaller net fractions of dealers indicated that liquidity and market functioning for high-grade corporate bonds and agency residential mortgage-backed securities deteriorated over the past three months.

- The volume, duration, and persistence of mark and collateral disputes remained mostly unchanged, on net, across all collateral classes over the past three months.

Special Questions on the Funding of Clients Engaged in Treasury Cash-Futures Basis Trading and Other Relative-Value Trades

(Questions 81–95)

Special questions asked dealers about their provisioning of Treasury securities financing for clients that engage in relative-value trading involving Treasury securities as well as demand for such financing. Where possible, dealers were asked to differentiate between activity related to Treasury cash-futures basis trading and activity related to other relative-value trading involving Treasury securities.2

Almost two-thirds of dealers indicated that they provide a material amount of financing for clients engaged in relative-value trading involving Treasury securities. These dealers indicated the following:

- For clients that engage in relative-value trading involving Treasury securities, the terms offered for funding collateralized by Treasury securities were reported to be mostly unchanged, on net, over the past three months.

- More than three-fifths of these respondents indicated that they provided Treasury financing in which clients also held offsetting futures positions. Of this subset, one-half of the respondents indicated that more than 5 percent of such financing allows for cross-margining between the two positions.

- More than one-half of these respondents indicated that they were able to distinguish Treasury cash-futures basis trading activity from other relative-value trading related activity.

With respect to activity related to Treasury cash-futures basis trading, respondents who were able to distinguish Treasury cash-futures basis trading from other relative-value trading involving Treasury securities indicated the following:

- About three-fifths of such dealers indicated that they provide a material amount of financing to clients engaged in Treasury cash-futures basis trading.

- Of those dealers, one-half, on net, indicated that both the demand for financing and the level of financing volume for Treasury cash-futures basis trades over the past three months were above their average levels seen over the previous two years and that such demand and volumes had increased over the past three months. Respondents cited increased availability of trading opportunities as the main reason for the increased demand.

With respect to activity related to other relative-value trading involving Treasury securities, respondents who were able to distinguish Treasury cash-futures basis trading from other relative-value trading involving Treasury securities indicated the following:

- Nearly three-fourths of such dealers indicated that they provide a material amount of financing to clients engaged in other relative-value trading involving Treasury securities.

- Of those dealers, two-fifths, on net, indicated that both the demand for financing and the level of financing volume provided for other relative-value trading involving Treasury securities over the past three months were above their average levels seen over the previous two years and that such demand and volumes had increased over the past three months. Respondents cited increased availability of trading opportunities and Treasury securities interest rate uncertainty as the main reasons for the increased demand.

With respect to activity related to relative-value trading involving Treasury securities, respondents who were unable to distinguish Treasury cash-futures basis trading from other relative-value trading involving Treasury securities indicated the following:

- Both the demand for financing and the level of financing volume provided for clients that engage in relative-value trading involving Treasury securities over the past three months were reported to be about average, on net, relative to their typical levels over the previous two years and that such demand and volumes were mostly unchanged, on net, over the past three months.

TLDRS:

The Senior Credit Officer Opinion Survey (SCOOS) conducted in June 2023 sought to understand how credit terms and conditions have changed in securities financing and OTC derivatives markets. Here’s what they found:

- A good chunk of dealers have ramped up their efforts to manage credit exposure to other dealers and financial intermediaries, and some also increased their focus on exposure to central counterparties. More than 60% said that changes in central counterparty practices have impacted the credit terms they offer to clients in some way.

- Terms have generally tightened for hedge funds, with about a quarter of dealers saying non-price terms (like duration, credit limit, etc.) got stricter on securities financing transactions and OTC derivatives. Why? Worsening market liquidity, reduced risk appetite, and worries about counterparties’ financial health are the main culprits.

- For trading REITs, price terms tightened according to about a third of dealers, but non-price terms (like collateral requirements, maximum maturity, etc.) mostly stayed the same. The reasons are pretty much the same: worries about counterparties’ financial health and worsening market liquidity.

- Price terms also tightened for nonfinancial corporations, mutual funds, ETFs, pension plans, and endowments, with about a quarter of dealers reporting this change. A smaller fraction reported non-price terms tightening.

- A small fraction of dealers reported that hedge funds have reduced their use of financial leverage.

- Most dealers reported no significant changes to initial margin requirements and non-price terms in master agreements for all types of OTC derivatives. Some dealers reported decreases in the volume of disputes over marks and collateral for FX and equity OTC derivatives.

- Dealers reported tightening terms for collateral spreads and haircuts, particularly for high-yield corporate bonds, non-agency RMBS, CMBS, and consumer ABS. Meanwhile, there was increased demand for funding high-grade corporate bonds and term funding for high-grade and high-yield corporate bonds. But for equities, some dealers reported a decrease in demand for funding.

- About a third of dealers noticed that market liquidity for commercial mortgage-backed securities worsened. Smaller fractions noted deterioration in liquidity for high-grade corporate bonds and agency residential mortgage-backed securities. The volume, duration, and persistence of mark and collateral disputes mostly stayed the same.