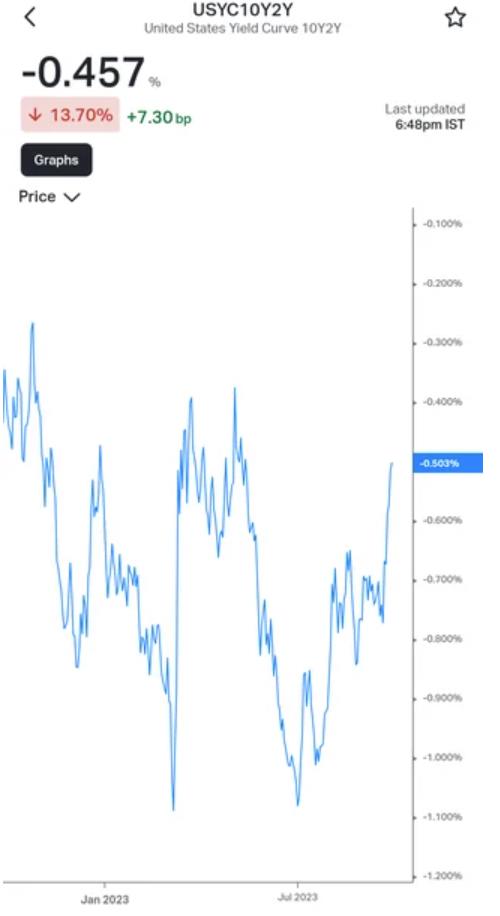

Historically, a bull steepener with the short end of the curve dropping is what typically correlates with bear markets. A bear steepening of the yield curve with LTTs selling off indicates the bond market thinks the economy is running strong (or at least stronger than what was previously thought), which in a roundabout way is also bearish I think, as it translates to higher rates for longer from the Fed’s perspective.