While month-over-month data appears promising for markets, concerns loom as 6 and 3-month rates surpass estimates, potentially signaling trouble ahead for the Fed amidst inflation worries. With the 3-month annualized core PCE rate climbing to 4.4% from 3.7%, and the 6-month rate holding at 3%, stock futures exhibit a cautious downturn following the release.

Key Points:

- PCE price index for March beats expectations, rising 0.3% against forecasted 0.3% increase.

- Annually, PCE inflation reaches 2.7%, surpassing economists’ expectations of 2.6%.

- 3-month annualized ROC for CORE PCE 4.43%.

- Excluding volatile components, PCE price index also exceeds forecasts, climbing 0.3% last month.

- Annual core PCE inflation hits 2.8%, outpacing expected 2.7%.

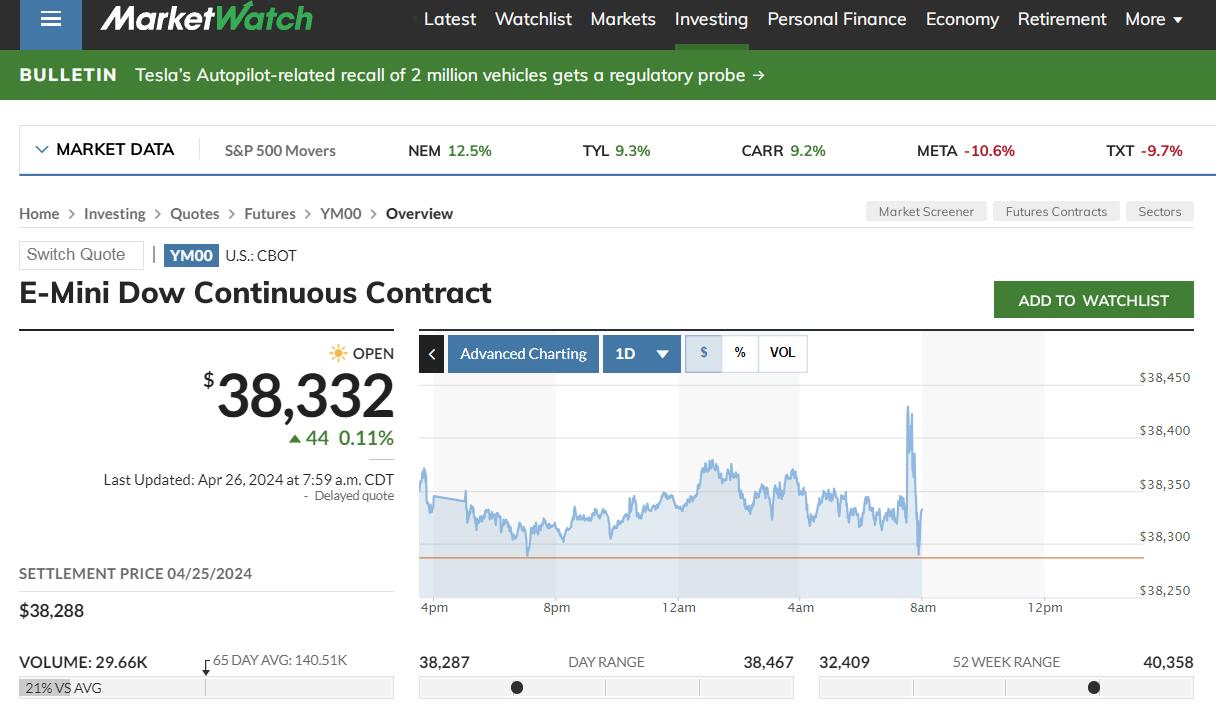

- Dow e-minis rise 0.32%, S&P 500 e-minis climb 0.92%, Nasdaq 100 e-minis surge 1.12%.

Sources:

https://www.marketwatch.com/investing/future/ym00

Month-over-month data in line may be good news for markets BUT 6 and 3-month rates were above estimates

NOT GOOD NEWS FOR THE FED which will eventually be bad for markets

3-month annualized core PCE rate up to 4.4% from 3.7%

6-month rate 3% no change

Chart: Liz Ann Sonders pic.twitter.com/HAtQ6MzeEx

— Global Markets Investor (@GlobalMktObserv) April 26, 2024

3-month annualized ROC for CORE PCE 4.43% pic.twitter.com/vCplWfOdBC

— Michael J. Kramer (@MichaelMOTTCM) April 26, 2024