Thirteen affluent countries are now in a per capita recession, including economic powerhouses like Canada, Germany, France, the UK, and Australia. Japan teeters on the brink with a forecasted minus 2% growth, and the US barely scrapes by, limping just above population growth.

This economic malaise is the aftermath of a reckless spree of money printing and budget deficits. The great money-printer hangover has struck, leaving behind a debt-fueled tissue fire and the grim prospect of years of stagflation. Most of the West is ensnared in this trap, as green mandates de-industrialize manufacturing and mass immigration strains social services. Countries like Canada, Australia, Germany, France, and the UK are underwater, their citizens growing poorer as economic growth stalls and inflation bites harder.

Japan is poised to join this list following a disastrous GDP read, and even the Biden administration’s optimistic numbers reveal the US is barely keeping up with population growth. This is the bleak outcome of $6 trillion in money printing and $8 trillion in budget deficits: global stagflation that’s eroding economic stability and prosperity.

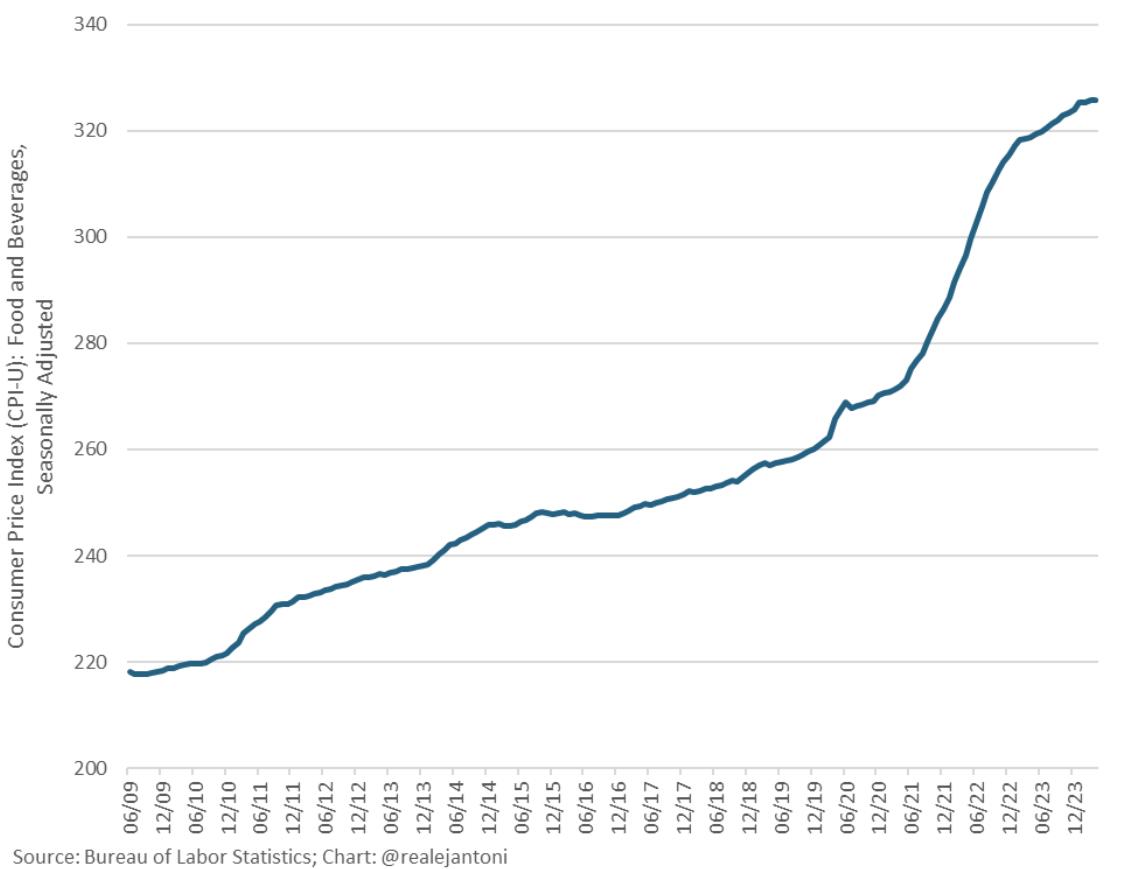

The inflation picture is dire. Biden’s statisticians report 20% food inflation, but real-world evidence—people posting receipts online—paints an even grimmer picture, with some reporting 100% increases. The Bureau of Labor Statistics confirms a 20.4% rise in food prices since January 2021, but many staples have surged far more. The reality for consumers is stark: they are feeling the pinch at the checkout and adjusting their spending accordingly.

For those hoping inflation will abate, there’s little good news. Typically, copper prices (a key inflation indicator) lead inflation by five to six months, and current trends suggest this time will be no different. The M2 money supply, which had stopped declining on October 30, 2023, has surged by nearly $1 trillion in just six months, causing inflation to remain stubbornly high and fueling a speculative frenzy in financial markets.

Financial conditions, despite macro adjustments, are loosening rapidly. The Chicago Fed reports that the national financial conditions index is at its lowest level in over two years, with the collapse of the risk subindex appearing unbelievable and unrealistic. This unexpected easing complicates the inflation fight, making it harder to predict and control economic outcomes.

Adding to the chaos, orange juice prices have hit another all-time high, emblematic of the broader inflationary pressures squeezing consumers. Fed officials, it seems, are grappling with the unpredictability of U.S. inflation, struggling to get a handle on a situation that seems to be spiraling out of control.

In this landscape of global economic distress, the stakes are high and the challenges numerous. As economies grapple with stagflation, the path forward remains fraught with uncertainty and difficulty. The global economic order is being tested like never before, and the road to recovery looks long and arduous.

Sources:

Stagflation is going worldwide, with 13 rich countries now in per capital recession.

Including Canada, Germany, France, UK, and Australia.

Japan's about to join the list at minus 2% growth.

And the US is limping barely above population growth.

The great money-printer… pic.twitter.com/voSGHx8Xvm

— Peter St Onge, Ph.D. (@profstonge) May 22, 2024

Biden's statisticians say 20% food inflation. Real-world reports — people posting receipts online — say 100%.

I suspect even if voters believe government numbers, they'll vote what they actually pay 🫡 https://t.co/o7KL9jNpK8

— Peter St Onge, Ph.D. (@profstonge) May 22, 2024

ANOTHER historically proven, tell-tale inflationary sign. https://t.co/pE0pvZDU59

— Uncle Milty’s Ghost (@his_eminence_j) May 22, 2024

M2 money supply stopped declining on October 30, 2023 (along with asset price declines).

Since then Money supply has 📈 $700 billion almost $1 trillion in 6 months.

This has caused inflation to stay “sticky” & caused a massive speculative orgy in financial markets. pic.twitter.com/7WlueZBpc9

— The Coastal Journal (@1CoastalJournal) May 22, 2024

Even w/ macro adjustments, conditions are loosening very fast, index at lowest level in more than 2 years: https://t.co/VNczbVqwAH pic.twitter.com/EWihC0z6Hu

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 22, 2024

Orange Juice won't stop as it hits another all-time high 🚨 pic.twitter.com/25RIzMfRLh

— Barchart (@Barchart) May 22, 2024

⚠️BREAKING: Fed officials seem like they have ‘no idea’ what is going on with U.S. inflation, @GregCrennan says https://t.co/VAQo2q7Jdc

— The Coastal Journal (@1CoastalJournal) May 22, 2024

What’s Jamie trying to tell us? pic.twitter.com/pNDU9sFNjA

— Gay Bear Research, LLC (@GayBearRes) May 22, 2024

127 views