By Pam Martens and Russ Martens: November 8, 2023 ~

Yesterday, the regulator of the Federal Home Loan Bank system, the Federal Housing Finance Agency (FHFA), released a report on its recommended changes going forward. The report was in response to the questionable conduct of the Federal Home Loan Banks in the leadup to the banking crisis this past spring.

The core mission of the 11 regional Federal Home Loan Banks is to “provide liquidity to their members to support housing finance and community development through all economic cycles.” In short, the Federal Home Loan Banks are supposed to make it possible for banks to provide home mortgages to low-income folks. The banks that failed this spring were engaged in crypto (Silvergate and Signature Bank), providing loans to the super wealthy (First Republic Bank), and in the case of Silicon Valley Bank, it was more of a Wall Street IPO pipeline. (See our report: Silicon Valley Bank Was a Wall Street IPO Pipeline in Drag as a Federally-Insured Bank; FHLB of San Francisco Was Quietly Bailing It Out.)

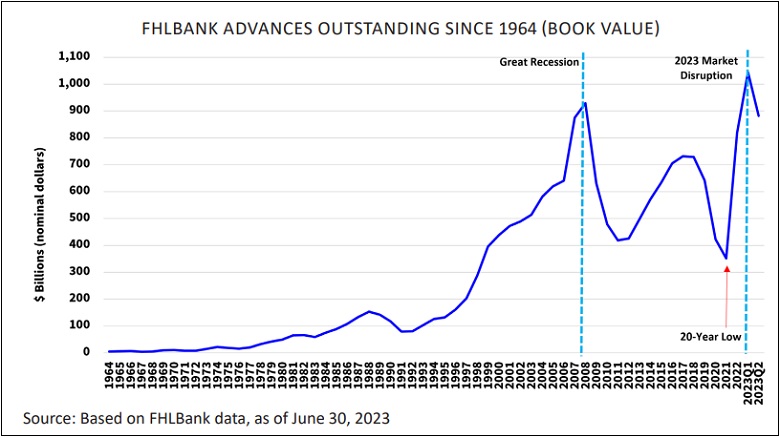

As the chart above, from the report, indicates, one of the shockers is that commercial banks were in such desperate need for cash this past spring that they borrowed more from the Federal Home Loan Banks than they did during the financial crash of 2008 – which was the worst financial crisis since the Great Depression. This suggests that perhaps the severity of this spring’s bank run has been downplayed by federal regulators.

Another troubling revelation in the report is that JPMorgan Chase, the largest bank by both assets and deposits in the U.S., has not repaid the money that First Republic Bank had borrowed from the Federal Home Loan Bank of San Francisco. JPMorgan Chase (with much controversy because it is already the riskiest bank in the U.S.) was allowed by regulators to acquire First Republic Bank when it failed on May 1. The FHFA report notes the following:

“On May 1, 2023, the California Department of Financial Protection and Innovation closed First Republic Bank, which was acquired by JPMorgan Chase. Of the FHLBank advances to First Republic Bank at the time of its acquisition, $26.4 billion remained outstanding as of September 29, 2023.”

JPMorgan Chase’s 10-Q report for the quarter ending September 30 that it filed with the Securities and Exchange Commission indicated that it had $37.88 billion in outstanding advances from Federal Home Loan Banks as of the end of the third quarter. It reported that $26.2 billion of that was related to its acquisition of First Republic Bank. That would mean that the largest bank in the United States – which has the ability to borrow from the Federal Reserve’s Discount Window or the Fed’s $500 billion Standing Repo Facility – elected instead to tap almost $12 billion from a government mortgage program for low income families and not repay another $26 billion owed in relation to its acquisition of First Republic Bank.

…