by DesmondMilesDan

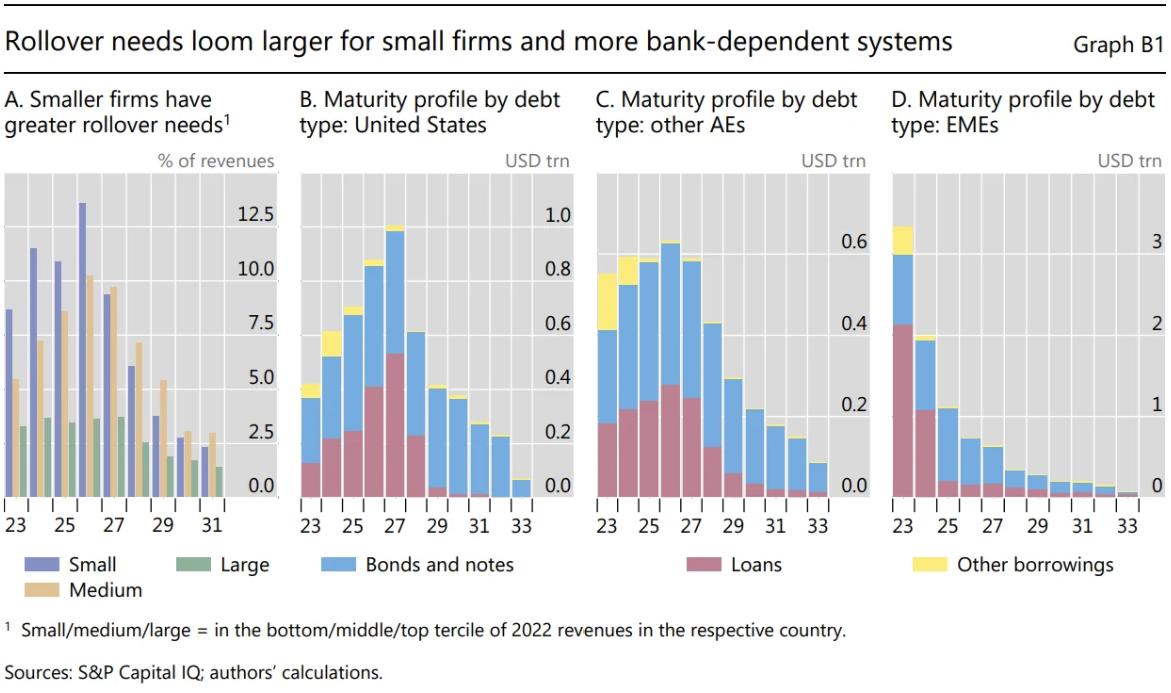

BIS today came out with a new narrative. It’s the EMs that will suffer most from debt rollover. And then Bofa came up with a research piece that shows SPX500 debt maturing in manageable term but no Russell. Meaning if rate cuts do happen russell and EMs will benefit the most atleast in the short term.

Breakout – real or fake? pic.twitter.com/hre7lNB4MV

— Longview Economics (@Lvieweconomics) December 4, 2023