The Federal Reserve is Running on Empty.

‘What passes for central banking today is really a perverse form of Wall Street-pleasing monetary manipulation. It employs the vocabulary of central banking, but in practice it fundamentally undermines main street prosperity, even as it showers the 1% (the top wealthiest people) with unspeakable financial windfalls.

Stated differently, virtually everything the Fed does for the alleged benefit of the American economy is both unnecessary and a ruse. The Fed has actually become a captive of the Wall Street traders, gamblers and high rollers, and functions mainly at their behest.

The proof of this proposition starts with the startling historical fact that the post-war US economy did just fine without any interest rate targeting, heavy-duty bond-buying or general macroeconomic management help from the Fed at all. For all practical purposes today’s omnipresent Fed domination of the financial and economic system was non-existent at that point in time.

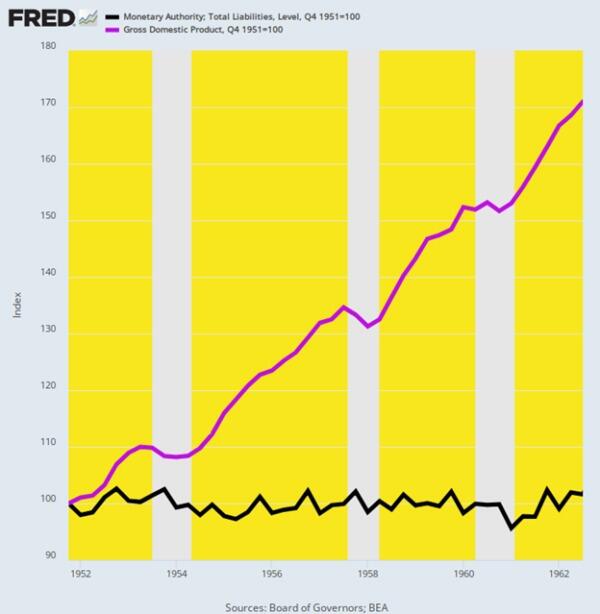

We are referring to the full decade between Q4 1951 and Q3 1962 when the balance sheet of the Fed remained flat as a board at just $51 billion (black line). Yet the US economy did not gasp for lack of monetary oxygen. GDP grew from $356 billion to $609 billion or by 71% (purple line) during the period. That’s nominal growth of 5.1% per annum, and the majority of it represented real output gains, not inflation.

Change in Federal Reserve Balance Sheet Versus GDP, Q4 1951 to Q3 1962.

As it happened, this halcyon span encompassed the immediate period after the so-called Treasury-Fed Accord of March 1951, which finally ended the WWII expedient that had pegged Treasury bills at 0.375% and the long-bond at 2.5o% in order to finance the massive flow of war debt.

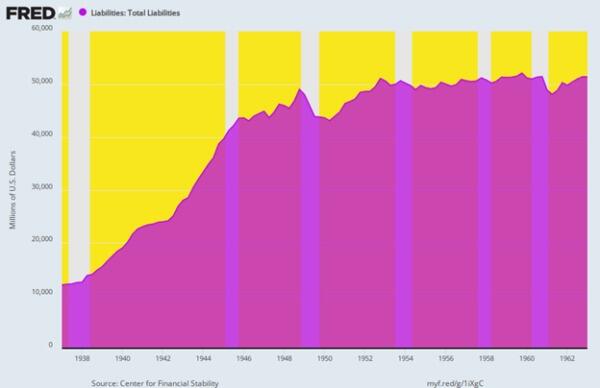

The effect of the WWII pegs, of course, was that the Fed had been obliged to absorb any and all US Treasury supply that did not clear the market at the target yields. Not surprisingly, the Fed’s 1937 balance sheet of $12 billion had risen by 4.3X to $51 billion by the time of the Accord, thereby reflecting what amounted to the original version of backdoor monetization of the public debt, which was justified at the time by the exigencies of war.

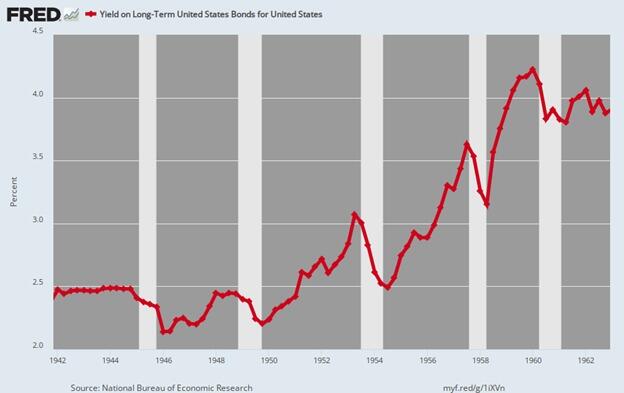

By contrast, in the post-peg period shown below interest rates were allowed by a newly liberated Fed to find their own market clearing levels. So there was no continuous guessing game on Wall Street about where the next monthly Fed meeting would peg short-term interest rates. Back then, it was understood that the forces of supply and demand down in the bond pits of Wall Street were fully capable of discovering the right interest rates, given the financial and economic facts then extant.

The combination of high growth, robust investment, strong wages and smartly rising real family income, on the one hand, and rock-bottom inflation on the other, surely constitutes the gold standard of performance for a modern capitalist economy.

And yet, and yet. It was all accomplished under a regime of persistent “light touch” central banking that assumed free market capitalism would find its own way to optimum economic growth, employment, housing, investment and main street prosperity. No monetary Sherpa at the Eccles Building was necessary.

Even more crucially, no money printing was necessary, either. The sterling economic results depicted below happened during a 11-year period when the Fed did not purchase one net dime of U.S. Treasury debt!

Per Annum Change, Q4 1951 to Q3 1962

- Real Final Sales: +3.8%.

- Real Domestic Investment: +4.1%.

- Nonfarm productivity growth: +2.5%.

- Real hourly wages: +3%.

- Real Median Family Income: +2.3%.

- CPI Increase: +1.3%

Federal Reserve Liabilities, 1937 to 1962

There is absolutely nothing about this period that makes the superior macroeconomic performance summarized above aberrational, flukish or unreplicable. In fact, President Eisenhower cut defense spending sharply and eliminated the fiscal deficit entirely during his second term. So, the cumulative increase in the public debt during this 11-year period was just $30 billion or a tiny 0.6% of GDP owing to Korean War borrowing early in the period.

But even this modest debt increase wasn’t monetized by Fed bond-buying. Instead, it was effectively financed out of private savings in the bond pits. Long-term bond yields, therefore, actually rose from the 2.5% pegged level shown below for 1942 to 1951 to upwards of 4% by the end of the period, as dictated by supply and demand. Still, the CPI averaged just 1.2% during 1959-1962, meaning that real yields bordered on +3.o% during the early 1960s.

That is to say, at the time, the Fed had seen no need to push real rates to zero and even into negative territory as has been the case for much of the last two decades. The fact is, the main street economy prospered mightily even when inflation-adjusted rates were providing a solid return to savers and investors.

Long-Term US Treasury Bond Yield, 1942 to 1962

What ended the benign economics of 1951 to 1962, of course, was the scourge of War Finance. LBJ (Lyndon B. Johnson) escalated the Vietnam War dramatically after 1963, causing the debt to soar and the 10-year UST to climb to nearly 6% by early 1968. But Johnson was not about to allow market clearing interest rates to fund his misbegotten venture in bringing the blessings of the Great Society to southeast Asia.

So he gave “the treatment” to the Fed Chairman at his Texas ranch and ordered to cut the Federal funds rate to accommodate LBJ’s surging Federal deficit. The latter had grown from $4.8 billion and -0.8% of GDP in 1963 to $25.2 billion and -2.8% of GDP by 1968.

Unfortunately, after steadily and appropriately raising the Fed funds rate from 2.9% in December 1962 to 5.75% by November 1966 as Johnson’s inflationary deficits grew, the funds rate was brought down rapidly to 3.8% by July 1967. In turn, that unleashed a red-hot wave of speculation and inflation, with the CPI rising from a 1% Y/Y (year-on-year) gain in August 1964 to a +6.4% peak in February 1970.

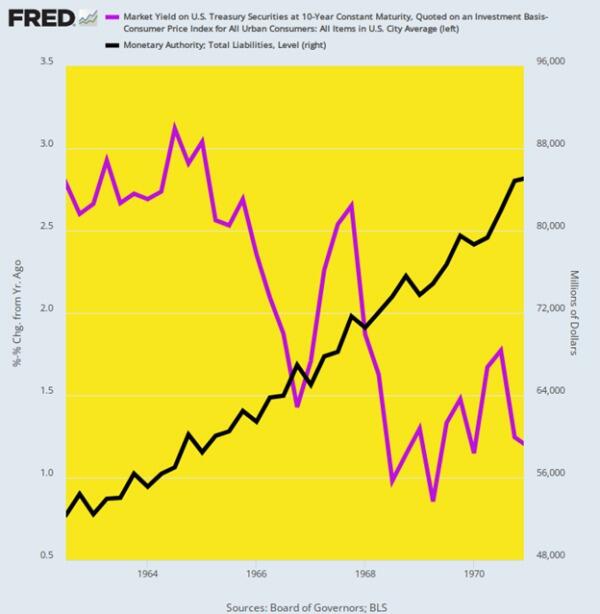

There is no mystery as to why the inflationary genie was now out of the bottle. Between Q3 1962 and Q4 1970, the Fed’s heretofore flat balance sheet (black line) soared skyward, rising from $52 billion to $85 billion over the eight-year period. That amounted to a 6% per year gain, meaning that the precedent for aggressive balance sheet expansion had now been firmly established.

Inflation-Adjusted Yield on 10-Year UST Versus Fed Balance Sheet Growth, 1962 to 1970

The first victim, of course, was inflation-adjusted bond yields (purple line above). As shown above, the healthy +3% real yield of 1962 fell to barely +1% by the end of 1970.

Yet the crucial essence of this “guns and butter” breakdown cannot be gainsaid. To wit, the Fed was not driven to this first round of post-war money-printing and debt monetization because the private economy had gone into a mysterious swoon or failure mode and therefore needed a helping hand from the nation’s central bank.

To the contrary, this was a Washington driven departure from sound central banking pure and simple. And as we will amplify below, it was off to the races of Rogue Central Banking from there.

Once the inflation genie was out of the bottle with the CPI clocking in at 6% by the fall of 1970, the Fed struggled for more than a decade to put it back. Consequently, any focus on stimulating growth, jobs, housing and investment was infrequent and definitely secondary to inflation-fighting.

We amplify the 1970s flood of central bank money and the resulting inflationary mess below, but it is important to note at the onset that despite four recessions (1970, 1975, 1980 and 1981) and very little pro-growth help from what was now an inflation-preoccupied Fed, the US economy did expand at a decent clip during the interval between Q4 1969 and Q2 1987.

The economic growth rate (real final sales basis) averaged a solid +3.1% per annum, but that occurred due to the inherent growth propensities of private capitalism and despite the roadblocks thrown up by periodic bouts of monetary stringency. In fact, three Fed chairman served during that 17.5-year interval—Burns, Miller and Volcker—and with varying degrees of success their focus was overwhelmingly on suppressing inflation, not goosing growth.

As it happened, the growth rates of jobs, productivity and real median family income during this period were not especially outstanding, but these metrics didn’t plunge into an economic black hole, either.

Self-evidently, these outcomes on main street were the work of market capitalism, not the central bank. The latter was leaning hard against inflation during most of the period—so this absence of central bank “help” is just further proof that easy money stimulus is not necessary for solid growth and main street prosperity.

Per Annum Change, Q4 1969 to Q2 1987

- Real Final Sales of Domestic Product: +3.1%.

- Labor hours employed: +1.5%.

- Nonfarm productivity: +1.8%.

- Real Median Family Income: +1.2%.

For avoidance of doubt, here is the path of the Federal funds rate as the above macroeconomic performance was unfolding. To wit, the Fed’s recurrent anti-inflation initiatives caused the funds rate to gyrate wildly like some kind of monetary jumping bean. In the run-up to each of the four recessions designated by the shaded areas of the graph, the increase in the Fed funds rate was as follows:

- 1970: +340 basis points.

- 1974: +960 basis points.

- 1980: +1,290 basis points.

- 1981: +440 basis points.

Needless to say, these successive rate-raising campaigns amounted to hammer blows to the main street economy. There is no way that these violent interest rate swings and the consequent start and stop economic cycles—four recessions in only 17 years— were a tonic for growth during this era of high and volatile inflation.

In effect, the reasonably solid macroeconomic performance quantified above represents a kind of free market minimum. It reflects the relentless drive of workers, consumers, entrepreneurs, businessmen, investors, savers and speculators to better their own economic circumstances—even in the face of inflationary roadblocks and anti-inflation financial manipulation by the central bank.

Federal Funds Rate, August 1968 to June 1987

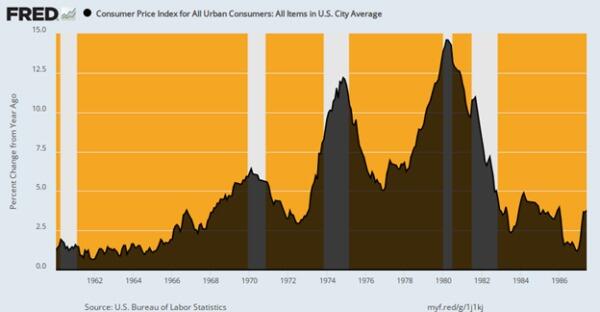

Of course, the inflationary roadblocks were enormous, and far beyond any prior peacetime experience. Compared to the 1.3% inflation average during 1951 to 1962, the CPI rose at a 5.6% rate over 1969:4 to 1987:2.

And that included the benefit of the sharp drop in inflation engineered by Paul Volcker during the final four years of the period. Thus, during the decade of the 1970s through the Y/Y inflation peak at 14.6% in April 1980, the CPI rose by an average of 7.7% per annum.

In turn, this introduced the wage-earning classes for the first time to the treadmill of robustly rising nominal wage rates, which become almost entirely consumed by sharply rising consumer prices. Thus, during the decade ending in the inflationary peak of Q2 1980, average hourly earnings in nominal terms rose by 7.6% per annum. But, alas, what stuck to the walls of workers’ bank accounts was a gain of only 1.1% per annum during the same period. All the rest was eaten up by inflation.

Y/Y Change in the CPI, 1960 to 1987

If the wage/price treadmill effect introduced after 1969 was the whole story, the impact might be considered minimally tolerable. The resilience of market capitalism was shown to be sufficiently strong so as to overcome much of the inflationary headwinds, along with the Fed’s punishing cycles of anti-inflation tightening.

Unfortunately, however, what also materialized out of the 1970s inflation era were two exceedingly harmful corollaries.

The first was the notion that the job of the central bank was to manage the rate of change in the general price level, rather than the far more modest original remit. The latter presumed the presence of noninflationary gold-backed money—so inflation-management would have been an oxymoron. Consequently, the Fed’s actual statutory mandate was simply to provide liquidity and reserves to the banking system based on market rates of interest. The Fed heads didn’t need to know from the CPI, PCE deflator or any other modern inflation measuring stick that had not yet been invented.

As it happened, however, management of the short run pace by which the general price level is rising was a fateful portal into statist central banking and the plenary management of the macro-economy in which the inflation indices are inextricably embedded. Eventually the bastard son of this strategic opening to vastly expanded state power materialized as the holy grail of 2% inflation.

Yet, here’s the thing. Until the gold-backed dollar was deep-sixed by Nixon in August 1971 and the possibility of rising, persistent and eventually double-digit peacetime inflation materialized in the 1970s, the idea of central bank management of the inflation rate didn’t even exist. That’s because peacetime price stability was the default condition of the gold standard world. Indeed, from the Napoleonic Wars forward, “inflation” and wartime were pretty much synonymous because fiat money was almost invariably a temporary wartime expedient.

The other legacy of the inflationary 1970s was the breakout of high and ever rising unit labor costs in the US economy. This unnecessary but pervasive economic deformation eventually resulted in the massive offshoring of the US industrial economy.

The implication, of course, is that it would have been far better to stick with William McChesney Martin’s golden era of high growth, low inflation, a flat Federal Reserve balance sheet and interest rates driven overwhelmingly by supply and demand forces in the private financial markets. But as it happened, the Fed’s balance sheet during the decade of high inflation was the very opposite of flat.

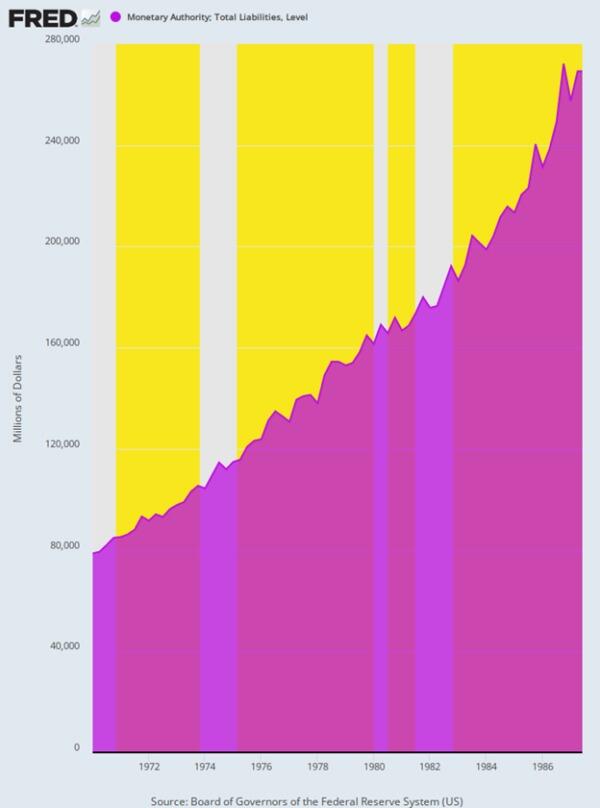

Under the three successive Chairmen, the Fed’s balance sheet grew at the following compound annual rates:

- Arthur Burns (Feb. 1970 to March 1978): +6.9%.

- William Miller (March 1978 to August 1979): +9.5%.

- Paul Volcker (August 1979 to August 1987): +6.8%.

Growth Lift-off of Federal Reserve Balance Sheet, Q1 1970 to Q2 1987

In a word, Volcker sharply slowed the runaway growth of the Fed’s balance sheet which had occurred under the regime of William Miller – the hapless former CEO of a conglomerate which made golf carts, snowmobiles and Cessna aircraft. But when all was said and done, the Volcker Fed still pumped new money into the economy at a rate barely below that of Arthur Burns. And Burns, of course, was the villain central banker who had ignominiously succumbed to Nixon’s entreaties to “give me money, Arthur” in support of his re-election campaign in 1972.

The amount of money the US government spends on foreign aid, wars, the so-called intelligence community, and other aspects of foreign policy is enormous and ever-growing. It’s an established trend in motion that is accelerating, and now approaching a breaking point. It could cause the most significant disaster since the 1930s. Most people won’t be prepared for what’s coming. That’s precisely why bestselling author Doug Casey and his team just released an urgent video with all the details.

Lest we forget, M2 Money printing exploded with Covid and kept increasing under Biden’s Reign of (Economic) Error.