via JOHN RUBINO:

People keep talking about the “box” in which profligate countries will someday find themselves, where the tools that used to work no longer do and everything falls apart.

Japan might be in that box. After years of soaring government debt and central bank “financial repression” to make that debt manageable, it now finds itself in the following situation:

The yen is plunging:

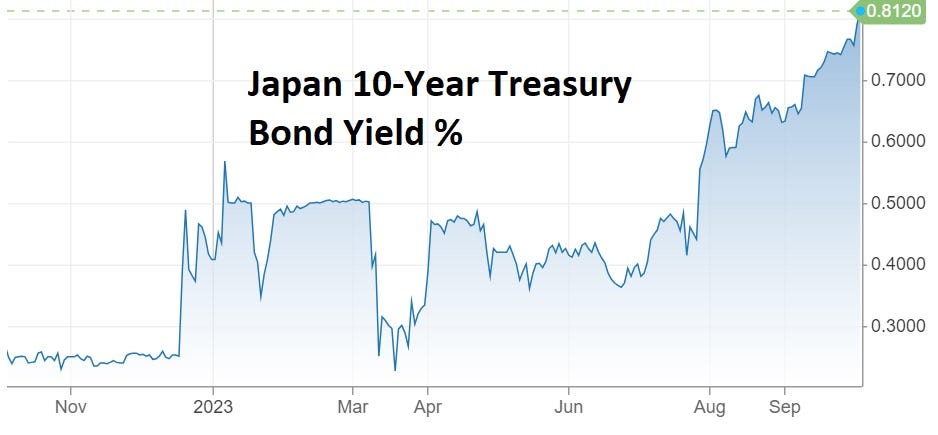

Interest rates are spiking:

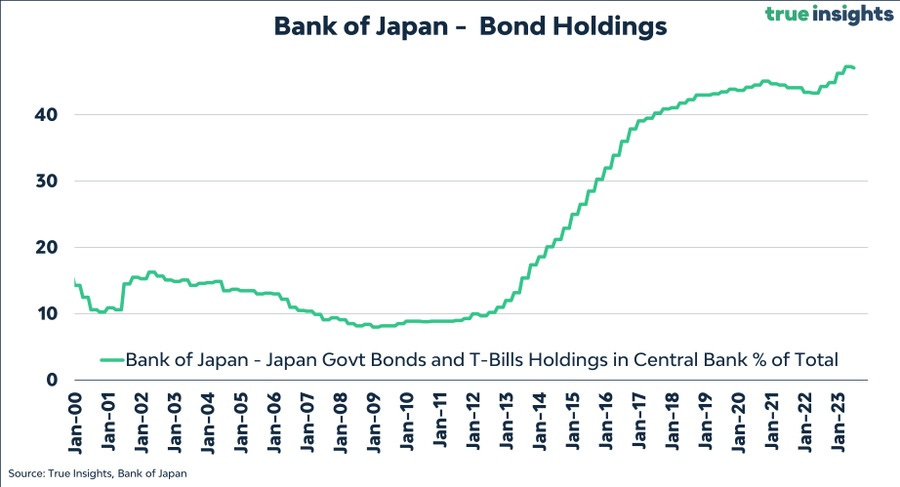

And the Bank of Japan already owns about half of all outstanding government debt:

Mutually exclusive policy tools

So how does the BoJ respond to spiking interest rates and a plunging currency? With tools that cancel each other out:

Bank of Japan hikes bond buying as benchmark yields hit decade peak

(CNBC) – The Bank of Japan announced it’s increasing its bond purchases at Wednesday’s auction, as a spike in government bond yields tests its resolve to defend its yield curve control policy.

In a statement Monday, the Japanese central bank said it will conduct an unspecified amount of additional purchases of Japanese government bonds with tenures of more than five years and up to 10 years. This adds to the BOJ’s reported 300 billion yen ($2 billion) Friday bond purchase with similar maturities.

Japan hints that even slow yen sell-off may trigger intervention

(Nikkei Asia) – Comments by Japan’s top currency diplomat on Wednesday suggest that Tokyo may be ready to defend the currency even from moderate declines, market watchers said, as high inflation remains a risk.

The speculation over Japan’s stance on intervention comes after the currency reversed sharply Tuesday from a one-year low of just over 150 yen to the U.S. dollar.

Masato Kanda, Japan’s vice finance minister for international affairs, neither confirmed nor denied that Japan had taken action. But he told reporters Wednesday that “if one-way movements accumulate and a very large movement occurs within a certain period of time, it may be considered excessive volatility.”

Kanda on Wednesday specifically pointed to the currency’s drop of more than 20 yen against the dollar since the start of this year, hinting at the possibility of intervention based on not only moves over the course of a day or a week, but even a slow slide over a longer period.

Add in an equities bear market

Propping up a weak yen by buying the currency and retiring it while forcing interest rates down by buying bonds with newly-created yen is analogous to inflating and deflating a balloon at the same time. One thing negates the other and antagonizes everyone with a stake in the financial system. Here’s what Japan’s stock market thinks of the BoJ’s recent incoherence:

Add an equities bear market to the mix and the BoJ faces three emerging crises: a plunging currency, spiking interest rates, and falling stock prices. Are we about to see a three-pronged attack in which the BoJ simultaneously buys stocks, bonds, and yen with newly-created currency? Very possibly. The result? At least one and maybe all three markets implode, ending the experiment. Stay tuned.