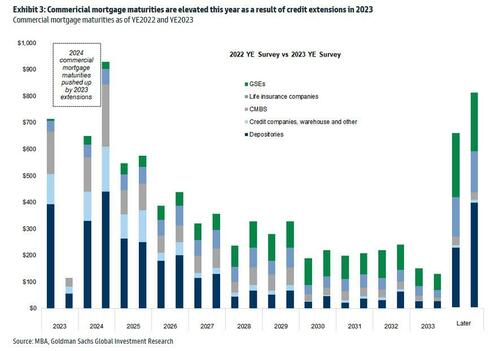

Holders of commercial real estate (CRE) debt are riding the tiger. Meaning that if interest rates don’t come down, there will be a lot of pain and suffering.

“We’re far from neutral now,” said America’s Fed Chairman, Jerome Powell, to the Senate Banking Committee. As The Fed moves closer to cutting rates.

All those rent-seekers stacked up with commercial real estate holdings nodded in violent agreement. That of course includes the nation’s regional banks, which continue to succumb to the power of their systemically important rivals, now so big that they cannot possibly be allowed to fail.

And this has turned America’s banking behemoths into for-profit wards of the state, recipients of an unspoken but ironclad insurance policy that underwrites catastrophic losses and adds them to the national debt.

“Interest rates right now are well into restrictive territory. They’re well above neutral,” added Chairman Powell without, well, sharing his definition of the word ‘well’. And truth be told, no one really knows the definition of ‘neutral’ when it comes to interest rates.

Economic PhDs will generally tell you that the neutral real interest rate is 0.50%. Their level of confidence is inversely proportional to the amount of capital they have at risk in markets — which would have been Newton’s Fourth Law had he bothered to study the art of economics.

Those of us less academically gifted, who must resort to taking risk for a living, lack the conviction of Nobel Laureates. We see that there are times in an economic cycle when 0.50% real rates stimulate growth, and times when they restrict economic activity.

Sometimes neutral rates have no effect at all. Which is to say that the economic impact of real rates simply depends. Like now when signals are far from uniform. Stock markets hit all-time highs despite collapsing commercial real estate, crypto and gold prices are soaring to records, massive government stimulus programs like the IRA are cranking up, student debt is being forgiven in successive waves, unemployment is near record lows, core inflation is starting to rise again, and the budget deficit is around 6% despite robust GDP growth.

All of which screams that a 0.50% real rate is preposterously low to everyone but economic PhDs.