by BoatSurfer600

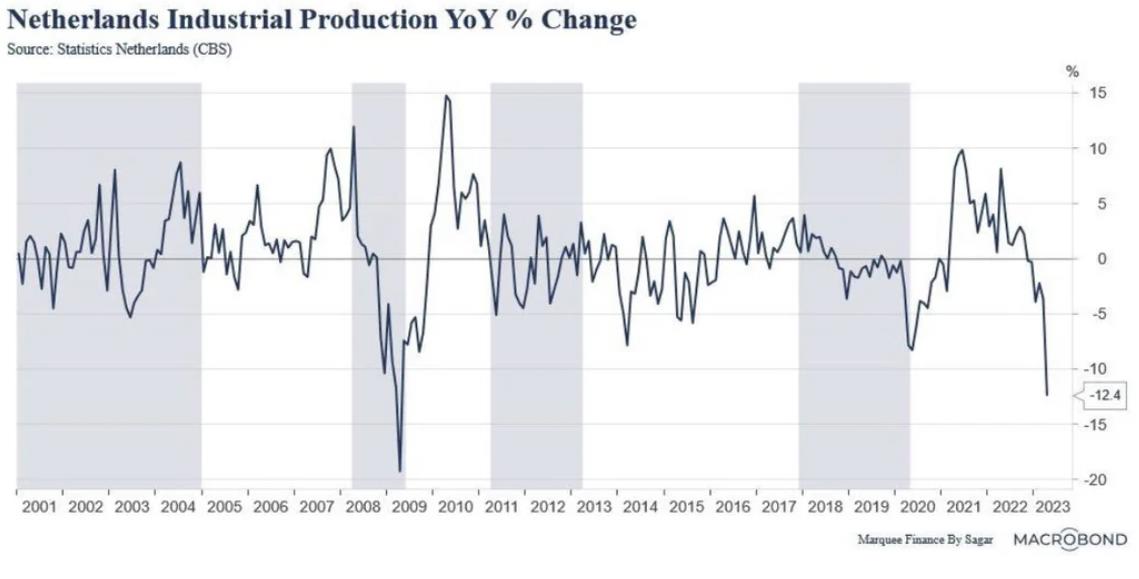

The cyclical sectors of the economy are facing a sharp downturn as growth slowdown and high cost of capital hurt businesses. Stagflation is the most likely outcome for Europe.

Source: Sagar Singh

The Entire Euro System Faces Failure

The lull in bad news conceals a deteriorating situation. In common with other markets, Eurozone bond yields are rising, and banks are now visibly trying to reduce their excessive balance sheet leverage. This is bound to lead to credit shortages in the coming months, maintaining or even driving interest rates higher. Contracting credit could lead to funding dislocations for highly indebted Eurozone governments, all mired in debt traps.