The probability or recession keeps slowly rising in numerous reports and metrics, leading stocks to fall today, while the Red Sea War is measurably pushing the risk of inflation higher.

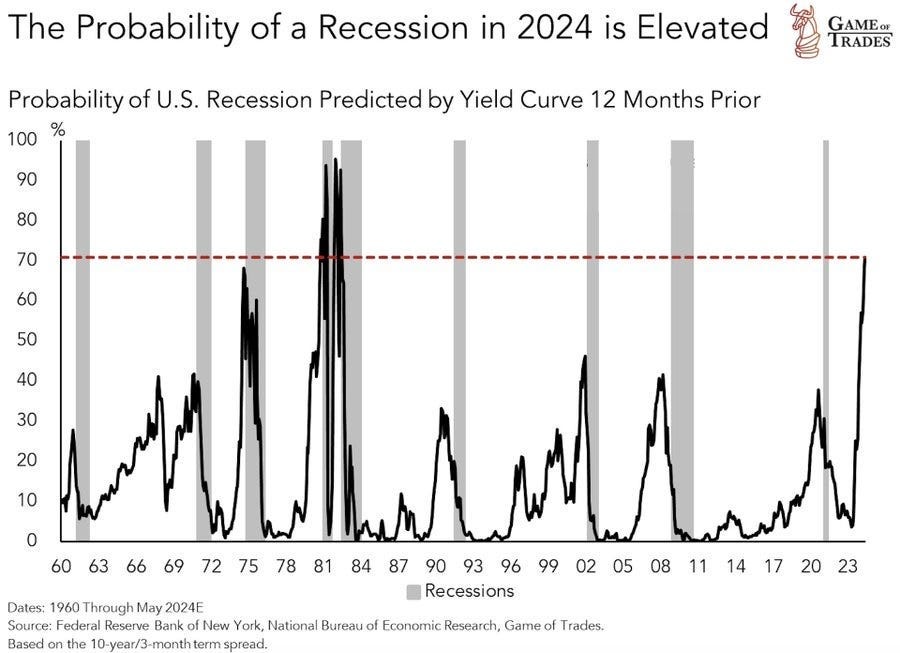

The probability of a recession is starkly high based on the extreme period in which the yield curve—which the Fed says is its best recession predictor—has remained inverted.

We see this leaning into recession again in the news today as the Dow dropped 100 points because of earnings reports that are failing to meet the most downwardly revised expectations ever and because of declining forecasts for 2024 sales and earnings. Goldman says the market is now set up for momentum buyers to abandon ship, predicting a large outflow if the market manages to rise and a much larger outflow if the market starts to fall.

The bells are tolling

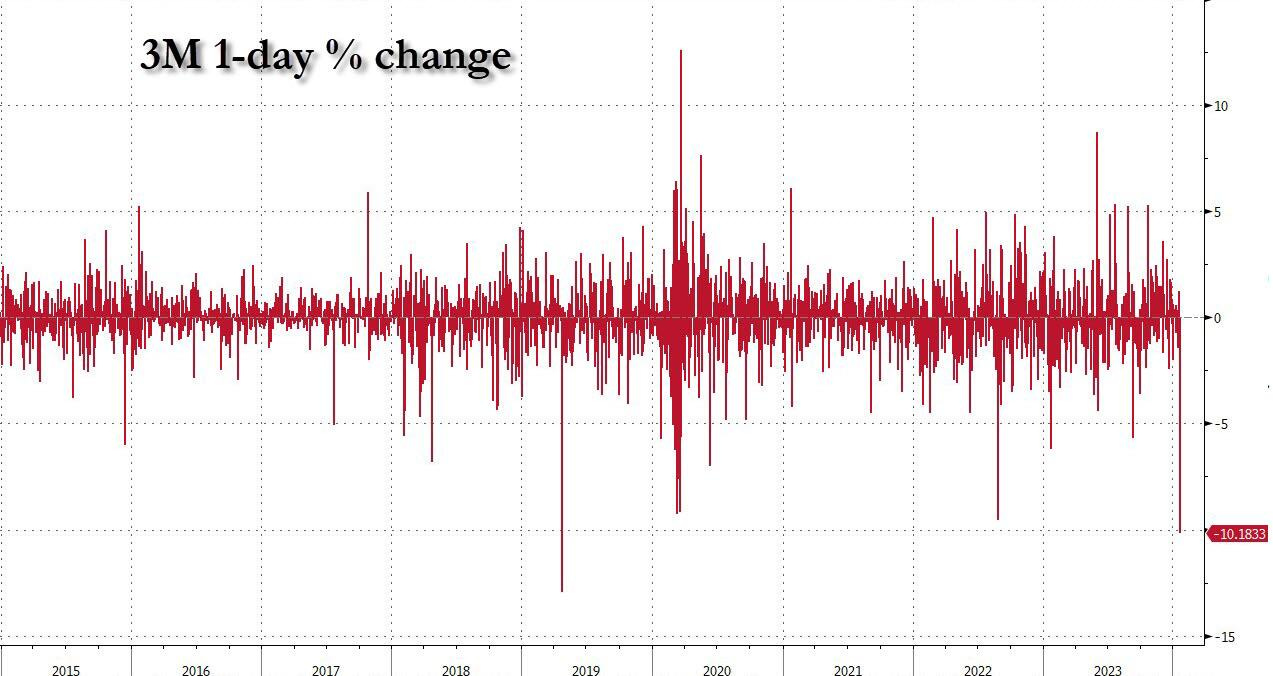

Some bellwether companies, like 3M—maker of everyday products—are performing badly. 3M, whose stock crashed its worst in five years today, is considered an omen for the economy ahead when its outlook plunges and sign of how other stocks will do because, when such everyday products fail to meet low earnings or growth expectations, things must be pretty generally bad. 3M failed due to its projections for 2024 growth, not due to its earnings in 2023, indicating the economy ahead is expected by 3M to be worse than the economy behind, which has been anything but grand with both the Philly Fed, Richmond Fed and NY Fed all showing industries in long decline.

“Profit levels, in particular for Nasdaq are the growing concern, with positioning and profits extended,” Montagu said. “The average long position is near 5% in profit, elevating the risk of profit taking unwinds and creating a potential headwind for a continued rally in the near term.”

Thus said Goldman, noting that the boat is heavily leaning with nearly all trades on one side, but the momentum crowd is getting ready to run to the other side over the course of the next week. Will they take others with them?

For the Dow, all of this means that the record milestone that the index punched its way up to of 38,000 didn’t hold today. The possibility is a little stronger now that the loading of momentum trade that is shifting to the other side of the boat will capsize the DOW or, at least, keep it back below its new milestone, though the momentum traders mean a lot more to the NASDAQ, which did fine today.

Breaking China

The stock market that is doing exceptionally bad is China’s where government rescue packages have been approved to the equivalent in yuan of $278 billion dollars, and market analysts are still doubting that the rescue will do the trick. History is on their side as China attempted numerous rescues for the fading yuan and other markets throughout 2023, and all of them failed to hold.

This is why I was stating through all of last year and, really, since the Covidcrash of 2020 and the Ukraine War that got many worked up about China supplanting the US economically, that China is going the path that Japan went when everyone in the early 80s was worried about Japan dominating the American economy. Evidence keeps building that the communist economy of China, in spite of its marginal capitalist revisions over the past decade, has serious troubles of its own, due in good part to its dictatorial Covid policies.

Seeing Red

Finally, the Red Sea war is bringing on more and more market analysts who are reporting that the situation is seriously stacking up some future inflation as it disrupts major industries, including particularly automobile manufacturers, and creating uncertainty in the oil market. One article today, “Chaos in the Red Sea is starting to bite into companies’ profits” talks particularly about how the recent shipping crisis has pinched companies hard enough that they will be forced to pass along their substantial cost increases to consumers. It is also likely to roil stock markets more:

With the Red Sea crisis roiling shipments of everything from cars to energy, it’s a matter of time before soaring costs and supply-chain strains show up in companies’ earnings reports.

Several firms are already warning of the impact. Electric-vehicle maker Tesla Inc. plans a two-week production halt at a German plant due shipment delays, while Sweden’s Volvocar AB has announced a three-day stoppage at its Belgian factory. British retailers Tesco Plc, Marks & Spencer Group Plc and Next Plc have all flagged the risk of higher prices for consumers.

All that’s because at least 2,300 ships are taking lengthy detours to avoid Houthi militants’ attacks in the Red Sea…. It’s forcing analysts to re-think companies’ earnings estimates for the coming year….

Current container shipping costs, if sustained, could add to headline inflation in the UK and euro area from late 2024 and early 2025, Bloomberg Intelligence estimates.

While the US is less impacted by the Suez route, the impact is still significant and will likely add to headline inflation in the US, too.