by Jhoffman12

To start, I am not a Doomer and I have money in the market.

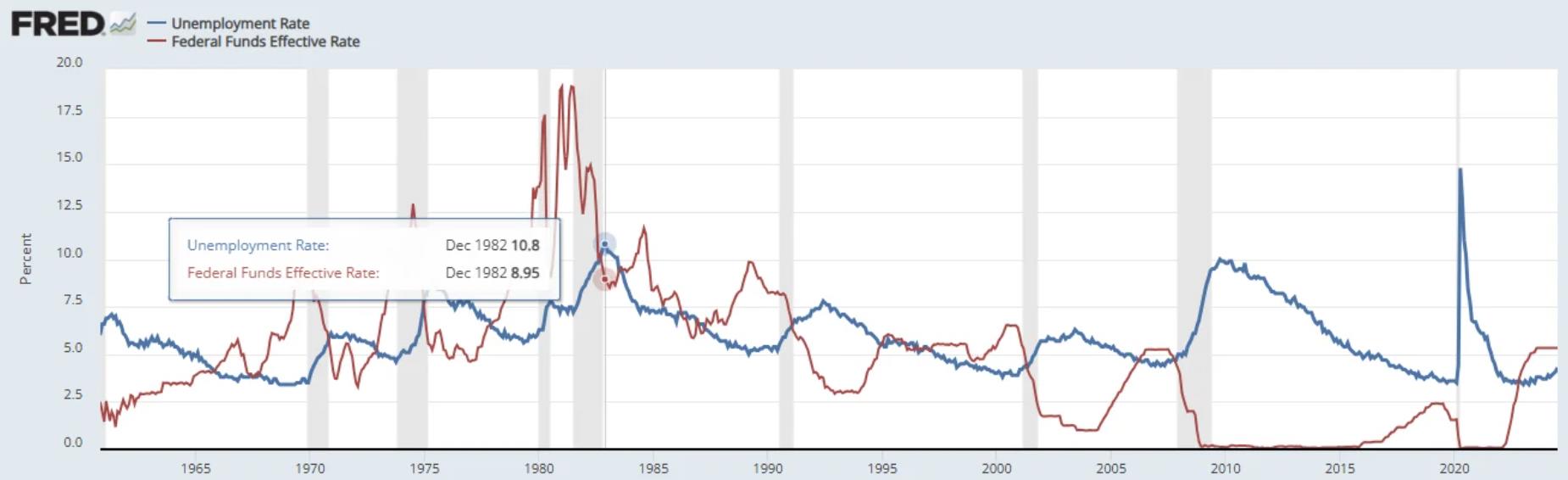

I was looking at the unemployment rate recently just out of curiosity and saw a correlation between a recession and whenever there was a rise, which makes sense of course. What struck me though is when I started adding other variables and eventually ended up with the combination you see now. Since the 70s, the intersection of falling interest rates and increasing unemployment have occurred around 6 months before or 6 months after each recession.

In 2023-2024 Slowly and without garnering much attention, unemployment has risen .9% over the last 7 months or so. While this doesn’t sound like a lot, if it continues, there will be a major problem. This is because in the last 70 years, a 1% increase of unemployment in a time frame less than 1 year a recession followed. While this wouldn’t have been case closed, with the addition of the interest rate there is an even more clear trend.

Interest rates have a very clear relationship with unemployment that when looked at more carefully show a bleak picture. What is also very interesting is the timing of everything is eerily similar to the 2008 interest rate and unemployment numbers. In September of 2007, interest rates were initially lowered, which is almost identical timing as today. At the same time unemployment started to creep up from 4.4% to 4.7% which is where they eventually intersected, and the great recession was triggered.

Interest rates have held steady at 5.33% over the last 9 months or so, but with the announcement from the fed and Powell that they are going to start lowering the interest rates, the trend that has occurred over 6 times (excluding covid) is starting to play out.

Unemployment is currently at 4.3% and all it needs to do is increase another .5% while interest rate are cut down to 4.8% which would only take around two .25 cuts to intersect with each other.

There is NO example in the last 55 years in which when unemployment rate increases to interest with falling interest rates that a recession was not triggered. I also suspect with the revision of 818k jobs creation that there are more false numbers being reported. I think there is a chance that the entire economy is being propped up on false numbers until after the election.

82 views