via Ronni Stoeferle

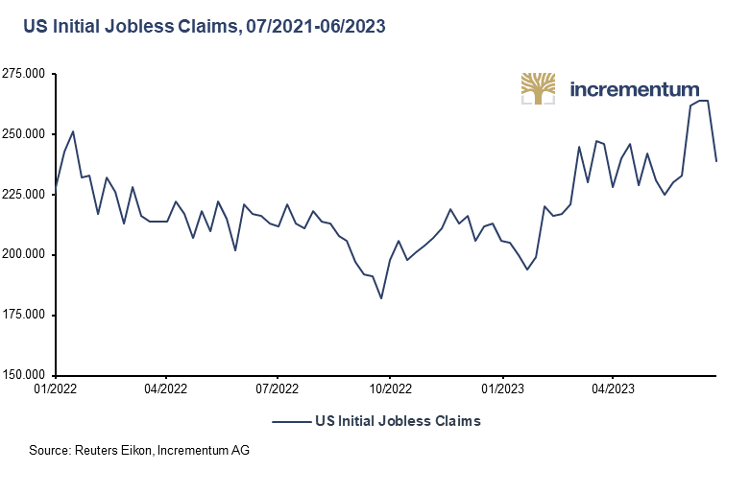

It is considered the most anticipated recession of all time – the one looming in the US. And although countless indicators ranging from the yield curve, the Leading Economic Index (LEI) and PMIs to producer prices and international trade volumes have been pointing to a recession for months, it has not yet materialized in the USA. However, the labor market, which has been more than robust up to now, is now showing the first signs of a slowdown. A labor market which, due to demographic change, is structured completely differently than it was in the 1970s. Initial jobless claims have been on an upward trend since last fall.

Despite this increasingly widespread gloom, it is not too late to ask the question: Which asset classes are now proving to be good investments in a recession, and which are bad? To this end, we have conducted an in-depth analysis.

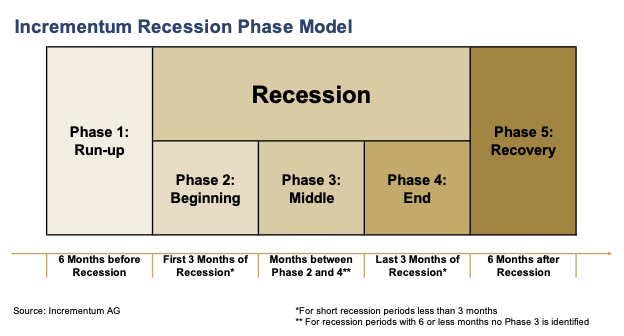

The following analysis does not consider the recession as a uniform block. The Incrementum Recession Phase Model (IRPM) divides a recession into a total of five distinct phases. Dividing a recession into different phases can help reduce the risk of losses and maximize gains. It helps investors develop a balanced investment strategy that takes into account the different phases of a recession. This is because, as will be seen, individual asset classes sometimes exhibit significant differences in performance across the five recession phases. After all, each of the five recession phases has unique characteristics.

- The run-up phase (phase 1) of a recession is characterized by burgeoning volatility on the financial markets. In this phase, the market increasingly starts to price in an impending recession.

- In phase 2, the so-called initial phase, there is a transition between increased uncertainty and the peak of the economic slowdown. In this phase, the slowdown in economic momentum can also be documented for the first time with negative macroeconomic data.

- In the middle phase (phase 3), the negative economic data manifest themselves. It also marks the low and turning point of the recession.

- In phase 4, the final phase, a stabilization of the economy gradually occurs, resulting in a return of optimism on the markets.

- In the fifth and final phase of the recession model, the recovery phase, the economy returns to positive growth figures.

In the case of a short recession, such as in the spring of 2020, there are phases that last less than 3 months, so phase 3 is irrelevant if the recession goes on only 6 months or less. For our model, we chose the NBER’s recession definition, which states that a recession has occurred when there is a significant decline in economic activity that spans the entire economy and lasts longer than a few months. The Federal Reserve also follows this definition.

We know that official recession declarations are always announced with some delay, be it according to the criteria of the National Bureau of Economic Research (NBER) or other alternative definitions such as the technical recession definition of two consecutive quarters of negative GDP growth. It often takes months for the final quarterly GDP numbers to be released. This poses a major challenge to investors, who should always be one step ahead of the actual development. Therefore, it is of great importance to recognize a recession at an early stage in order to position oneself as an investor in the best possible way.

What are the key messages of the Incrementum Recession Phase Model?

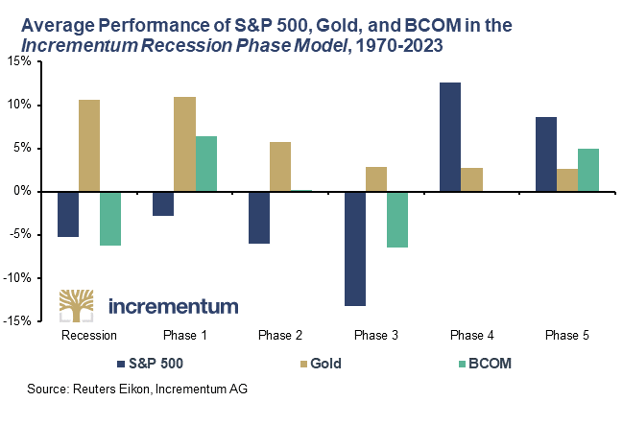

Let’s now look at the performance of the S&P 500 as well as gold and the BCOM index, which tracks commodities, during the last eight recessions since 1970 and broken down into the five recession phases.

Over the entire recession, equities lost an average of 5.3% in value. However, the 2007/2008 Global Financial Crisis is an exception that strongly influences the average. If we look at the median, we see a lower negative performance of -1.6% for equities during a recession.

In the various phases of a recession, equities exhibit significant differences in performance. Particularly in the third phase, the peak of the recession, stocks suffered heavy losses. However, once the last three months of the recession (phase 4) were reached, equities recovered exceptionally well in all eight cases considered. This positive trend even continued in the first months after the recession. Based on the recession phase model, it is therefore advisable to reduce the share of equities in the portfolio at an early stage. Once the peak of the recession has been reached, an increase in the equity share then makes it possible to benefit from the subsequent recovery rally.

Gold, the perfect recession hedge

Unsurprisingly, gold has lived up to its reputation as a recession hedge, averaging an impressive 10.6% performance throughout the recession. Most notably, gold has averaged positive performance in all phases of the recession. Gold’s largest price increases are seen in Phases 1 and 2, likely due to the increased uncertainty in the markets during these phases. Another explanation for gold’s strong average performance in Phase 1 is the 120.1% price increase in the initial phase of the recession in 1980, which is an outlier.

In the first three phases of a recession, gold tends to be ahead of equities. It is interesting to note, however, that the tide turns as soon as the first signs of an economic recovery appear, and market uncertainty gradually subsides. In the terminal and recovery phases, equities can often outperform gold. Especially in the early stages of the model, gold manages to act as an ideal recession hedge. It provides excellent diversification, helping to stabilize portfolio performance in times of economic turbulence.

Let us now dive into the world of commodities. The average performance of the BCOM index during a recession since 1970 is -6.3%. This means that commodities perform worse overall than equities in our analysis.

If we look more closely, however, clear differences emerge in each phase of the recession. While commodities show gains in phase 1, the run-up phase, and phase 5, the recovery phase, no clear trend can be identified in phase 2, the initial phase, and phase 4, the final phase. The negative performance therefore mainly occurs in phase 3, the middle phase, when the economy reaches its low point.

Our analysis therefore shows that, from a portfolio perspective, an increased weighting of commodities in the run-up to and recovery phase of a recession is beneficial. This finding is also supported by theoretical considerations suggesting that precious metals, especially gold, are a suitable hedge against uncertainty before the peak of a recession. In addition, energy and base metal commodities prove to be particularly beneficial due to the reflationary effect associated with picking up growth after the peak of a recession.

Finally, we also want to take a look at silver and the mining stocks.

Silver is not a reliable recession hedge, with an average performance of -9.0% throughout the recession. This is probably because silver is perceived much more as a cyclically sensitive industrial metal than as a monetary metal in the midst of the downturn.

Mining stocks also showed a positive performance over the entire recession, but this was only about half as high as that of gold. The significant decline in phase 3, the low point in the recessionary trough, is a major contributor to this.

| Average Asset Performance – Incrementum Recession Phase Model | ||||||

| Asset | Recession* | Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 |

| Gold | 10.6% | 10.9% | 5.7% | 2.9% | 2.7% | 2.6% |

| Silver | -9.0% | 31.5% | 0.8% | -10.9% | 3.5% | 17.4% |

| Stocks | -5.3% | -2.8% | -6.0% | -13.2% | 12.6% | 8.6% |

| Commodities | -6.3% | 6.4% | 0.2% | -6.5% | -0.2% | 5.0% |

| Mining Stocks | 5.4% | 8.9% | 8.5% | -11.7% | 8.3% | 24.3% |

Conclusion

Our analysis reveals how different assets perform during a recession. It becomes clear that there are significant differences in performance and investors need a strategic approach to succeed in each phase of the recession cycle. What stands out is the brilliant dominance of gold as the ultimate recession hedge, with an average performance of 10.6% and positive performance in every phase of a recession.

On the other hand, equities and commodities show negative performance on average during a recession, with equities performing best in phase 5 at 12.6% and commodities in phase 1 at 6.4%. However, mining stocks show that not all equities post losses during a recession. It is also striking that, with the exception of commodities, all assets are able to gain in phases 4 and 5.

In light of these findings, however, it is also clear that investors need to implement extreme caution and a well-thought-out strategy to successfully navigate the turbulent waters of a recession.

by Ronald-Peter Stöferle, Incrementum AG