by CrimsonRunner

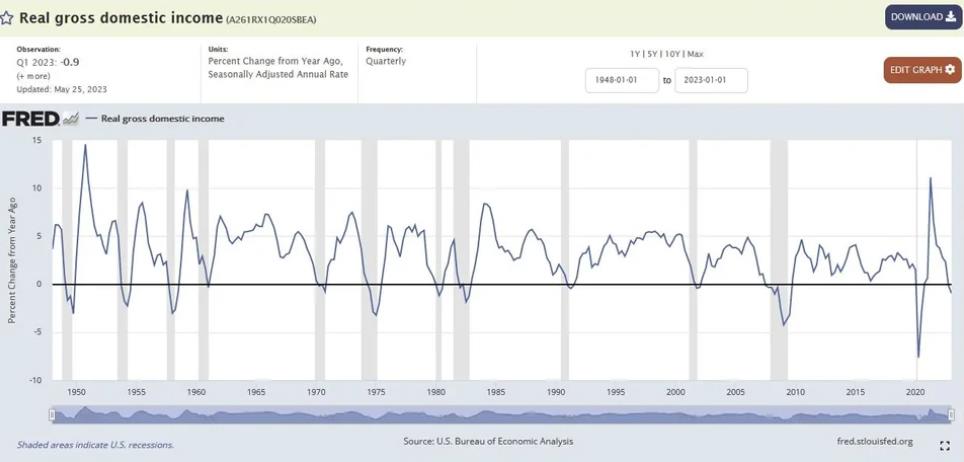

Gross Domestic Income (GDI) measures the income generated from producing the Gross Domestic Product (GDP).

Real GDI (or Real anything, really) is the inflation-adjusted measurement.

The current Real GDI is negative (Q4’22 was also negative but just barely), meaning the US economy as a whole lost money YoY for the second quarter in a row.

The chart also overlays the shaded areas for every official recession in the US and as you can see, every time, without exception, Real GDI has gone negative since Real GDI was measured (1948) the US has been in a recession and there have also been 0 recessions where the Real GDI didn’t go negative.

As such, either we’re about to witness the first time there isn’t a recession when Real GDI is negative since we’ve started gathering this data (over 75 years), or we’re already in a recession and it just hasn’t been announced yet. Fyi, recessions get announced retroactively with a lag of many months, maybe even over a year.