by bitkogan

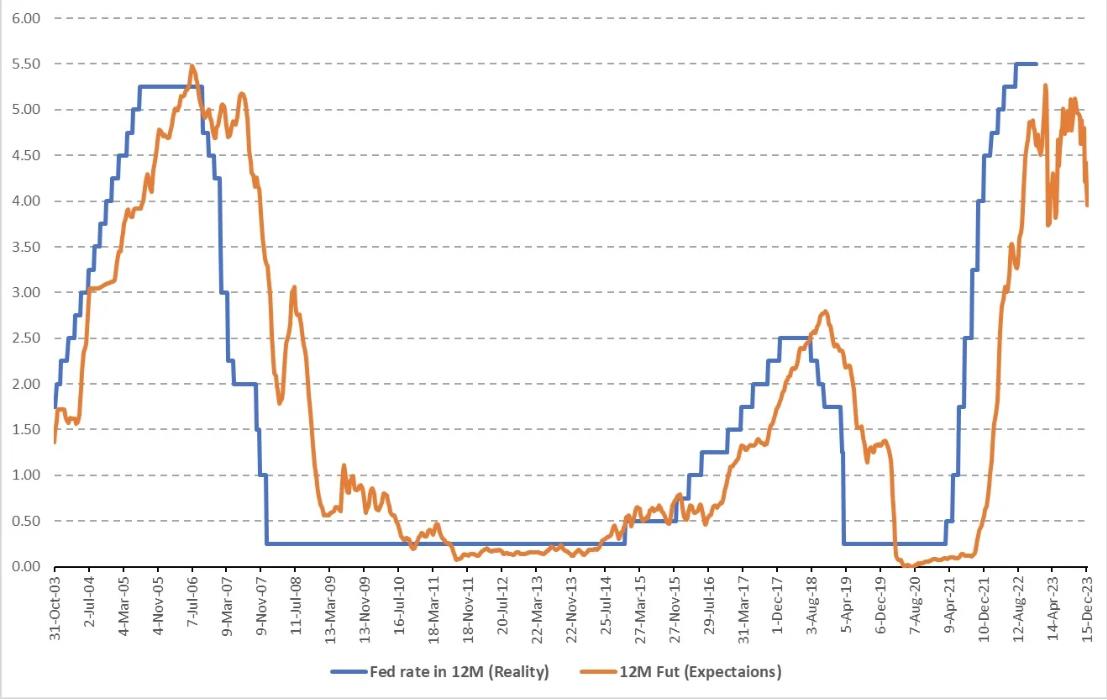

Based on 12-month Federal Reserve rate futures, the market expects the rate to be around 4% by the end of 2024. This is a plausible scenario. However, futures on rates have their nuances. Even when investors correctly predict the direction of rate changes (which isn’t always the case), they often underestimate the speed of these changes. This happens both during rate increases and decreases.

In other words, if the rate starts to decrease next year, it will likely end up significantly lower than 4% by year-end. But this doesn’t mean we should rush into buying stocks, gold, or TMF. Usually, the Fed acts decisively not out of choice, but due to serious market problems.

Currently, it’s hard to envision these market issues, but by spring, I think they will become more apparent.