The latest inflation report says we’re still 50% over the Fed’s target. Is that really close enough? Will inflation disappear by itself? Why is Jerome Powell so close to giving up the inflation fight?

From Peter Reagan at Birch Gold Group | Reading time: 3 minutes

Morgan Stanley thinks the Federal Reserve could start cutting rates as early as September, based on the idea that “inflation is finally under control.”

(Except it isn’t under control yet.)

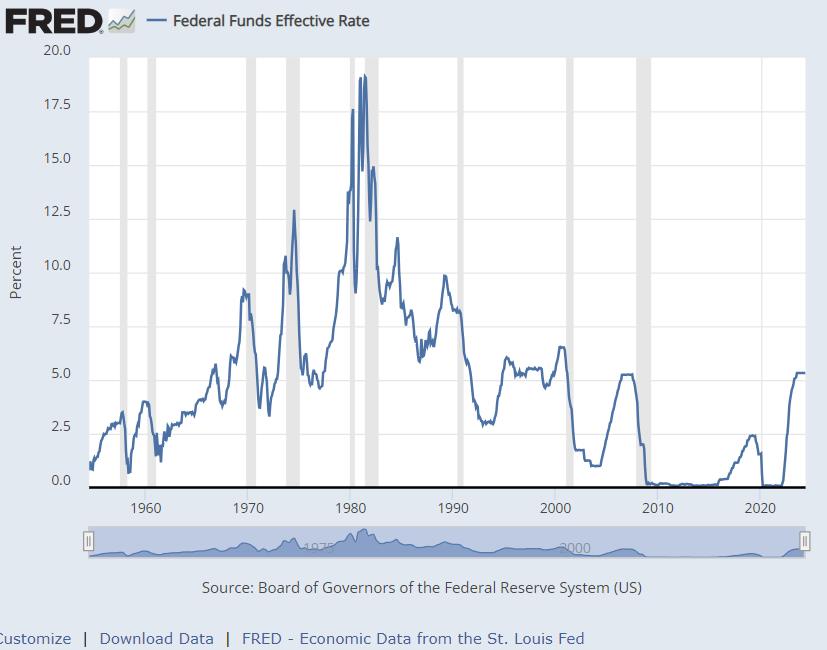

The Federal effective funding rate has been held at 5% or higher since May 2023, as you can see on the graph below:

(You can also see how the rate was left over 6% – at one point a mind-boggling 19% – for an incredible 17 years to quell the stagflationary lost decade of the 1970s.)

But Powell seems intent on rolling the dice. Gambling the Fed’s done enough, kept rates tight enough for long enough that inflation rate will coast below 2% by itself. According to a recent NBC News report:

“The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%,” Powell said.

Powell also said that a “hard landing” for the U.S. economy was “not a likely scenario.”

But keep in mind, Powell also called inflation “transitory” back in 2021, which ended up becoming a historic miscalculation.

In other words, what if he’s making yet another miscalculation about the potential for a “hard landing” – where does that leave the economy?

Powell’s “mission accomplished” moment

Right now, the United States economy is a mess, no matter how you might look at it.

The Fed has maintained higher rates under the impression that inflation would ease back under its target inflation rate of 2%. That hasn’t happened yet.

But mortgage rates have climbed to their highest point in 14 years, which makes both getting a mortgage and paying a mortgage more challenging for American families.

Higher rates have also put the United States economy on an unsustainable path:

Because of its excessive spending, the U.S. government is not able to fully retire its debt as it comes due and reduce the total amount. Instead, it has to borrow even more to cover its new spending. It must also roll over debt for money it has previously borrowed and cannot fully pay off. Worse, it is doing all that at today’s interest rates, which are higher than when the debt being rolled over was borrowed.

What makes that problem unsustainable is that excessive federal government spending contributes to inflation. The inflation unleashed by U.S. politicians in recent years forced the Fed to respond by hiking interest rates to get it back under control. Today’s modestly elevated interest rates make today’s excessive spending unsustainable.

Unfortunately, Federal Reserve Chairman Jerome Powell is a power unto himself, so he can declare “Mission Accomplished” any time he likes.

But here’s the deal…

Normally, he isn’t supposed to play politics. But it’s an election year and Washington is getting impatient. They want rate cuts and cheap debt back, and they NEED to juice the economy just in time for the upcoming election so they can finally create a convincing case that Bidenomics really did work

Should your savings end up as collateral damage when inflation heats up again, or the economy does suffer a hard landing, Powell and his cronies won’t care a bit about that.

There’s one piece of good news about inflationary rate cuts

Should Powell capitulate to his Wall Street cronies or play politics with your retirement, there is still the potential for good news to come out of the situation:

Gold prices rose more than 1% to a record high Tuesday, as investors flocked to the safe-haven asset after comments from Federal Reserve officials cemented expectations of a U.S. interest rate cut in September.

Here’s why investors could flock to gold if Powell cuts rates in September: Cuts could be another signal pointing to a slowing economy, leading people to seek a safe-haven for their money.

Rate cuts could also lead to a weaker U.S. dollar, which means precious metals could see another spike in demand.

Physical gold is also a historically proven hedge against the inflation that has ravaged the savings of many Americans over the last four years. If it heats up again, there could be renewed demand in that case, too.

The bottom line is this: By making the right moves now, you also have an opportunity to put yourself in a potentially better financial position for the future.

That would happen through proper diversification of your retirement dollars into assets that could help you preserve as much buying power as possible.