I have noticed a fair amount of recent posts of people being overly confident that a 2008 event can never repeat. Sure it may be less likely but I think we are all overly confident of safeguards.

After the 2008 financial crisis, several regulations most notably Dodd Frank was passed. Though watered down, it was a consequential build.

What has changed since then?

Extreme Republican led deregulation and destruction of accountability (not even political statement, just facts).

Most notably major pieces were repealed in 2018 during the Trump Administration when the Economic Growth, Regulatory Relief, and Consumer Protection Act (S.2115) Bill passed.

https://www.investopedia.com/terms/c/crapo-bill.asp

Some say the fact it eased restrictions was directly related to Silicon Valley Bank’s and many other smaller banks failures. The article I shared from 2018 even calls out the risk.

“Unlike earlier attempts, the Crapo bill focused on easing bank rules. However, critics of the Crapo Bill argue that reducing the number of banks that face more stringent oversight will increase the odds that banks will fail during a financial crisis in the future. They also point out that data collection requirements relating to mortgages would be relaxed, allowing smaller banks and credit unions to avoid having to report this data.”

The second point is around accountability. You may have noticed that over the years starvation of regulatory agencies has led to repeated high profile crisises in many areas. Beyond the PPP funds that were dispersed look at the following sampling:

Aviation – Boeing 737 Max and FAA safety https://www.washingtonpost.com/transportation/2023/11/15/faa-report-near-misses-safety/

FDA – Baby Formula crisis

Department of Labor – Record child labor violations https://www.americamagazine.org/politics-society/2024/05/01/child-labor-law-violations-247831

Do we really think mortgages and financial institutions are the one place that has ironclad regulations and oversight, especially given all their lobbying money.

Doesn’t mean a crisis will 100% happen but don’t feel confident that the the driver’s not asleep at the wheel.

Edit: Since people keep bringing up subprime mortgages, Duke and Dartmouth professors analysis show that mostly prime borrowers defaulted in 2008. Don’t think that

https://www.fuqua.duke.edu/duke-fuqua-insights/adelino-subprime

“We found there was no explosion of credit offered to lower-income borrowers. In fact, home ownership rates among the poorest 20 percent of Americans fell during the boom because those buyers were being priced out of the market. Instead, we found credit was expanded across the board. Everybody was playing the same game. But credit expanded most drastically in areas where house prices were rising the most, and these were markets that were beyond the reach of lower-income borrowers.

The overwhelming majority of mortgages were going to middle income and relatively high income households during the boom, just as they have always done.

But what caused the financial crisis was that middle- and high-income borrowers – including speculators who bought up homes to sell for profit – began defaulting at unprecedented rates. We had a crisis because non-subprime borrowers defaulted, where previously they very rarely had.”

Related:

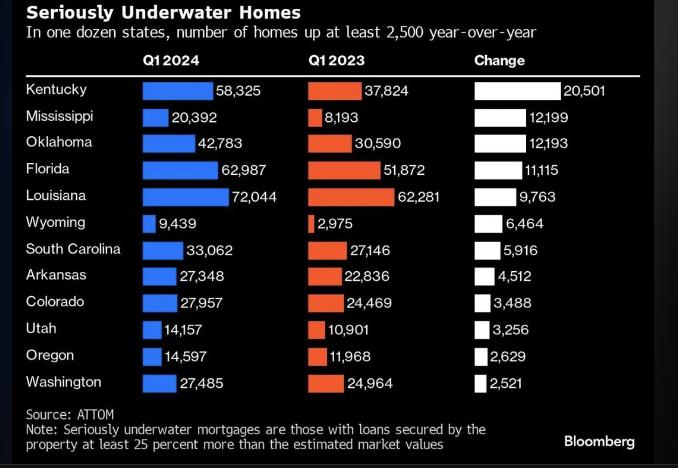

‘Seriously Underwater’ Home Mortgages Tick Up Across the US

There are just six cities where the median-priced home is affordable for median-income earners, per FOX:

Pittsburgh

Cleveland

St. Louis

Memphis, Tennessee

Indianapolis

Birmingham, Alabama— unusual_whales (@unusual_whales) May 9, 2024

FDIC insured banks have realized losses on Securities for the 8th consecutive quarter.

This is the longest streak in history. pic.twitter.com/BDAO3tqkyZ

— M.B. (@741trey) May 9, 2024