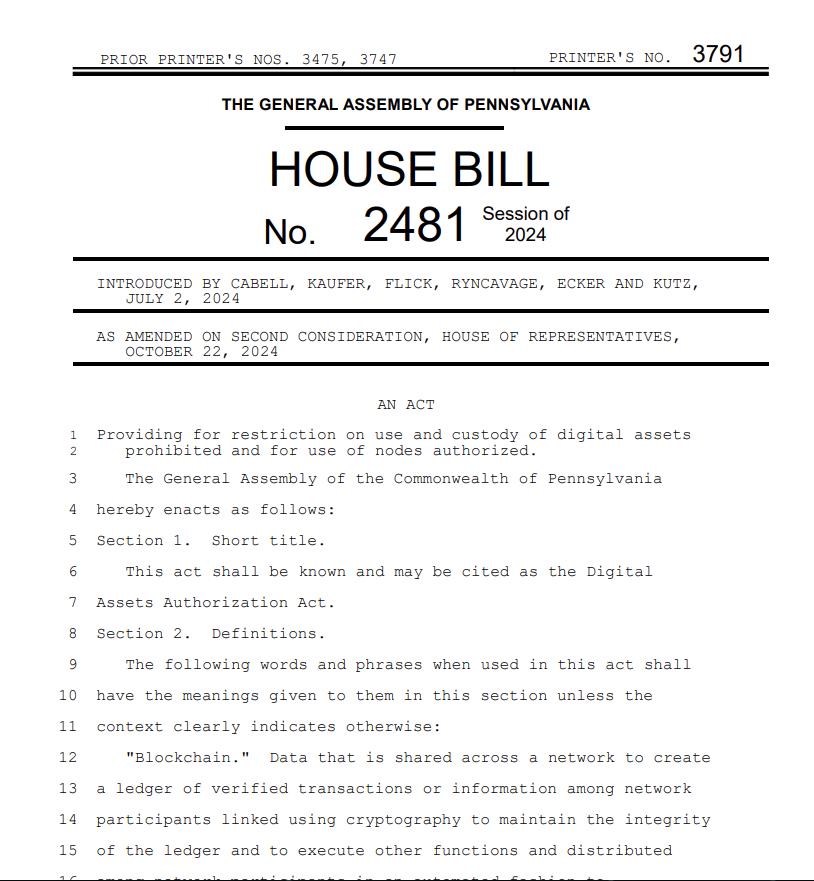

On October 24, 2024, Pennsylvania made a significant leap into the future of finance by passing House Bill 2481, known as the Bitcoin Rights Bill, with an impressive bipartisan vote of 176-61. This groundbreaking legislation aims to protect the rights of Pennsylvanians to self-custody their digital assets and use Bitcoin (BTC) for payments.

The bill’s self-custody provision ensures that residents can manage their cryptocurrencies independently, free from the constraints and risks posed by third-party intermediaries. This empowerment gives individuals greater control over their financial assets and reduces potential losses associated with relying on external services.

Moreover, the Bitcoin Rights Bill establishes clear guidelines for using Bitcoin as a payment method. Businesses across the state can now accept Bitcoin, enhancing its utility as a medium of exchange and opening doors to a new customer base eager to engage in cryptocurrency transactions.

Crucially, the legislation also provides regulatory clarity regarding taxation and security for digital assets. This clarity is essential as Pennsylvania joins other states like Utah and Wyoming in establishing a framework for the fast-growing crypto industry. The overwhelming support for the bill reflects a growing acknowledgment of the importance of clear regulations in this evolving space.

Impact on Local Businesses and Consumers

Local businesses stand to gain significantly from this legislation. By integrating Bitcoin into their payment systems, they can attract tech-savvy customers and diversify their payment options. The bill’s protections also foster a safer business environment for those navigating the complexities of digital assets.

For consumers, the right to self-custody means enhanced security and control. This shift empowers individuals to manage their Bitcoin holdings without the risks associated with third-party services. Additionally, the guidelines set forth in the bill clarify tax obligations related to buying, selling, and trading Bitcoin, alleviating concerns about potential legal ramifications.

Potential Benefits and Risks

While the Bitcoin Rights Bill offers a range of benefits—such as increased financial freedom, innovation, and consumer protection—it also presents potential risks. The volatile nature of Bitcoin’s value can impact purchasing power, while ongoing regulatory changes may create uncertainty for businesses and consumers alike. Furthermore, the environmental impact of Bitcoin mining remains a critical concern due to its significant energy consumption.

Overall, the passage of the Pennsylvania Bitcoin Rights Bill marks a pivotal moment in the integration of Bitcoin into mainstream finance. As the state embraces cryptocurrency, it sets a precedent for others to follow, paving the way for a more secure and innovative financial landscape.

Sources:

- The Street: Pennsylvania Passes Landmark Bitcoin Rights Bill

- CoinDesk: Pennsylvania House of Representatives Passes Crypto Bill to Bring Regulatory Clarity

- AMBCrypto: Bitcoin Rights Bill Passed: How Pennsylvania Plans to Support Crypto

- Bitcoin News: Pennsylvania Bitcoin Rights Bill

- Crypto Briefing: Pennsylvania Bitcoin Bill Passes

- House Bill 2481