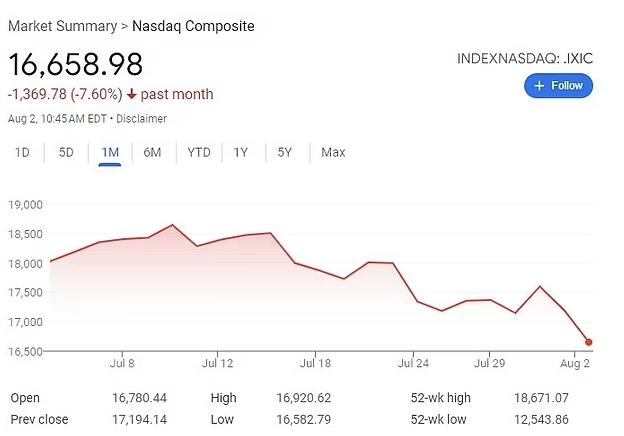

Over $2.9 trillion has been wiped out from major indices and stocks this morning due to growing fears of a global recession.

byu/External-Noise-4832 inconspiracy

Stocks sunk on Friday morning after investors were spooked by a weak jobs report.

The unemployment rate fell to the lowest level in almost three years – hitting 4.3 percent in July.

The Nasdaq dropped 2.2 percent, pushing it into correction territory, down more than 10 percent from a record high on July 11.

The S&P 500 was headed for its worst session in around two years, as recession fears accelerated on Wall Street.

The sell-off is a blow to Americans with retirement savings in 401(K) plans, which tend to be invested in major stock market indices. It will also impact interest rates, which set a guidepost for credit card and mortgage rates.