via theorganicprepper:

When banks began collapsing one after another back in March, a lot of people were spurred into action. They pulled out cash, moved large sums of money around, and made tangible investments to protect themselves. Then, First Republic failed a few months later. But then something mysterious occurred. People became complacent about the economy.

Maybe it’s because the failures didn’t affect them directly. Perhaps it’s because the government coughed up the money to cover deposits well beyond the FDIC’s promised cap. Or it could be that folks just don’t want to think about our system going totally belly-up, Venezuela-style.

I think it’s a very dangerous mistake to be lulled into feeling that everything is fine.

Not only is our own economy precarious, but the global economy is as well. While things may seem somewhat okay now, we’re sitting on a ticking bomb with a very delicate trigger mechanism. All it will take is a jiggle the wrong way and everything will blow up past redemption.

Here’s why now is not the time to be complacent about the economy.

While things may seem tolerable now, you don’t have to dig very deep to see that things with our economy are anything but okay.

Inflation is exorbitant. Our purchasing power has been eroded dramatically. Rents and interest rates are skyrocketing. We’re looking at a new homelessness crisis – one of formerly comfortable working-class people. The price of heating your home, if you’re lucky enough to have a home, is also hitting record highs. The cost of food and essentials creeps up weekly. Today’s $100 trip to the grocery store buys far less food than last year’s and a fraction of what it bought five years ago. This article outlines some of the increases in the cost of living. This upward trend of expenses shows no sign of stopping.

Finding work is hard, if not impossible. We recently published an article about “ghost jobs,” which make it seem like our economy is loaded with opportunities for those who want to work. Unfortunately, these are just a rigging of the system which the Biden administration uses to demonstrate our “thriving job market.” The jobs do not exist.

Next is the looming implementation of Central Bank Digital Currencies (CBDCs). I wrote about how FEDNOW, which is currently being launched, is the gateway to CBDCs. This transition to digital currency is not far off, and you’ll be hard-pressed to avoid using it. This means your every expenditure could soon be tracked, and financial controls can far more easily be put into place.

Our National Debt has passed $31.8 Trillion dollars. And it climbs by the second. This hurts domestic policies and international relations, leading to eventual destabilization. The interest payments on our debt alone are nearly equivalent to our entire defense spending budget. Incidentally, nearly 30% of this needs to be refinanced within a year. This could potentially lead to a huge crisis.

But still, despite all that, people are blithely going on with their lives.

I think because it doesn’t directly devastate tons of people all at the same time, many are clinging to the illusion that things will be A-okay. We might be paying more for gas and groceries, but we can still function fairly normally. We can still have nice meals, a roof over our heads, and a little bit of money in our savings accounts.

It doesn’t feel like an economic disaster. It isn’t how we expected an economic collapse to look, this slow-motion slip toward the edge where we can still dig our nails in and stay on top of the cliff. We thought it would be a plummet off the cliff to an inevitable crash at the bottom. We thought there’d be an event we could mark on our calendars and say, “This is the day our country collapsed.”

Instead, it’s that whole “death of a thousand cuts” or “frog in a pot of boiling water” scenario. It’s hard to see how bad it is while we’re in it, surviving day by day and staying on top for yet another month. When we have homes, food, bank balances, and retirement funds, we know things are tight, but it still feels okay.

I don’t believe it is okay.

We need to get on top of this ASAP.

You need to stop what you’re doing right now and pay attention to this. Now is not the time to be complacent. Things aren’t just going to gently course-correct. They’ll get worse – far worse – before they get better. Just because you can get by right now doesn’t mean that things won’t become more and more difficult.

Here are some steps you can take.

1.) Cut your living expenses. I’m in a position where I can make this cut a bit more dramatically than some people. I gave up my lease in the US when the price of it went up $550 a month at renewal time. I chose to live in places where the cost of living is extremely low in temporary dwellings so that I could save as much money as possible over the past six months. Now, obviously, this isn’t going to work if you own your home, if you have a job that you go to, or if you have children in school. But you can make your own radical cuts to your finances. Even if you aren’t forced to by necessity, you should consider doing so by choice to build yourself a cushion.

2.) Don’t incur new debt. A lot of people will tell you that becoming debt-free is the best option. For many people, this is the case. However, if you are deeply in debt right now, you may be better off trying to put aside an emergency fund instead of dumping all your money into debt repayment. If you are in dire financial straits, you may need to focus your financial energy elsewhere. But avoid incurring new debt, whatever you do.

3.) Make tangible investments. Instead of socking a bunch of cash away under the floorboards, you may want to consider making tangible investments instead. Real estate, food that will last for a long time, tools, and supplies you know you’ll use may be more useful than saving money that will just continue to decrease in value. A meal is a meal. Your choice is whether those same ingredients cost $3 now or $12 later.

4.) Look into precious metals. I’ve written before about the importance of precious metals for holding your money. Once you have your bases covered with a cash emergency fund and tangible assets, you may want to consider putting excess money into gold and silver that you hold yourself. (Don’t get involved in one of those schemes where a company holds it for you – if you don’t have it, you don’t own it.) For more advice from experts on how to convert some of your savings to PMs, book a free, no-obligation call with my friends at ITM Trading. That’s the only company I recommend for this information.

Even the banks themselves are holding gold.

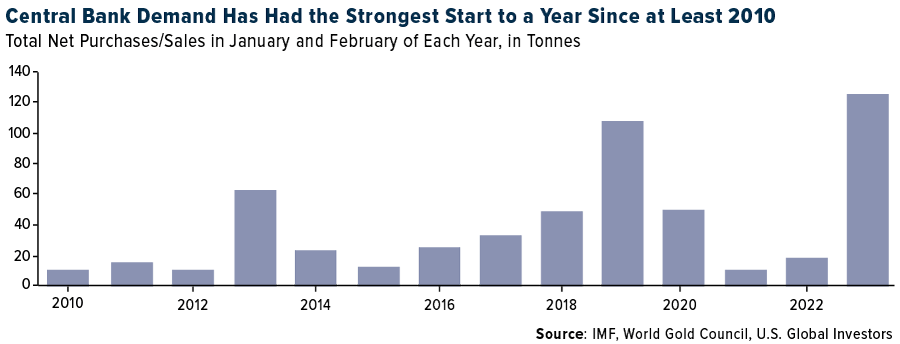

When even the banking system has switched to precious metals, you know that things are changing fast. Central banks around the world are snapping up gold at a record pace.

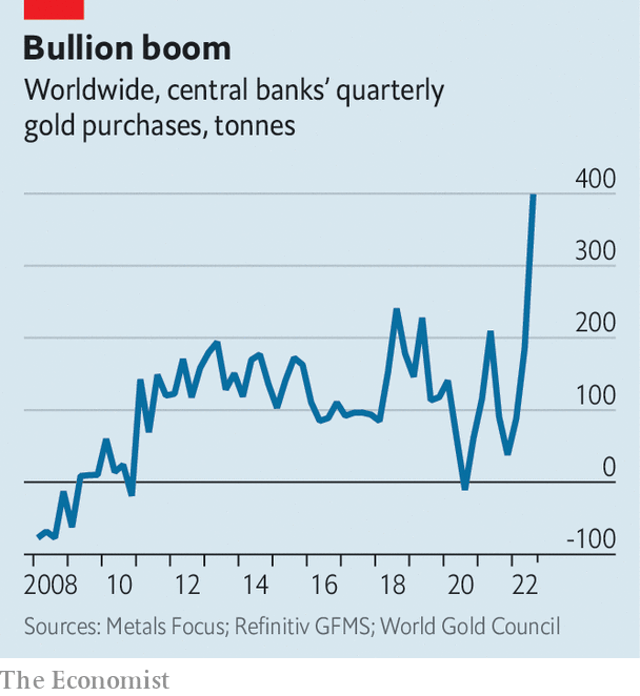

Gold is a way that other countries are getting rid of their US dollars because they see the writing on the wall – the dollar is dying. The Economist reports on one other time gold was purchased at this pace:

In 1968 the London Bullion Market closed for two weeks. The world’s largest precious-metal market had run out of gold, drained by a five-month run on America’s stash by European central banks. The crisis marked the beginning of the end for the Bretton Woods standard that had kept the dollar pegged to gold, and currencies elsewhere to the dollar, since 1944.

Now central banks are furiously buying gold again (see chart). In the third quarter alone 400 tonnes moved into their reserves. That has pushed the total from January to September to 670 tonnes, a pace unseen since the Bullion Market debacle. In May Turkey snapped up almost 20 tonnes in one go. India and Qatar are also ravenous. The metal now makes up two-thirds of Uzbekistan’s reserves, months after it planned to reduce gold to under half. Kazakhstan is also doubling down.

In part this is because gold, snubbed in good times because it generates no yield, recovers its shine in times of volatility and high inflation. In the long run, it is seen as a store of value and, not tied to any individual economy, seems immune to local political and financial turmoil. Central bankers may also think they are getting a bargain. Even though it has resisted better than most, the price of the metal has dropped 3% this year. Gold bugs expect a rebound.

Here’s the chart they mentioned.

The Central Banks obviously know a lot of things we are not privy to. We’d be very wise to look at their actions and not their words in cases like this.

We’ve been warned.

To me, it seems smart to invest in gold while the market is down. You’ll get it for a better price and when things improve – as they always do eventually – you’ll be left with a lot more value than those potentially useless dollars in your bank account.

But I’m no expert. Please don’t be complacent. Do not be lulled into a false sense of security because things are decidedly NOT okay. Talk to experts. You can do so right here. Be careful consulting with financial planners who are so tied to the system they can’t foresee a world in which the system goes sideways.

Make your decisions based on the way things really are, not how you wish they were. I feel like all the events in the market so far this year have been our early warning signs. Sort of like the foreshocks before the massive, devastating earthquake. As preppers, we pay attention to the signs and we know that the faster we respond to a disaster the more likely we are to survive it. A financial disaster is no different.

But what do you think?

Do you feel like the system is going down? Why do you think folks are so complacent about the economy? Do you think that we’ll be able to continue on like we are indefinitely, or do you expect the situation to worsen? What do you suggest people do to prepare?

Let’s discuss what’s ahead in the comments section.

87 views