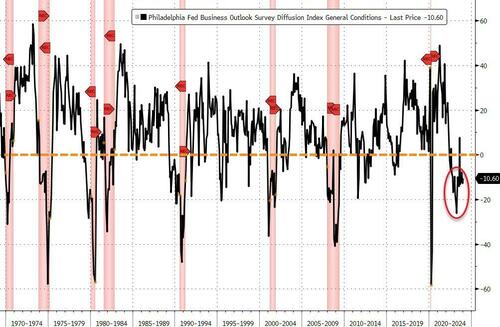

It’s not always sunny in Philadelphia! And not because the Eagles got stomped by Baker Mayfield and the Tampa Bay Bucs.

Source: Bloomberg

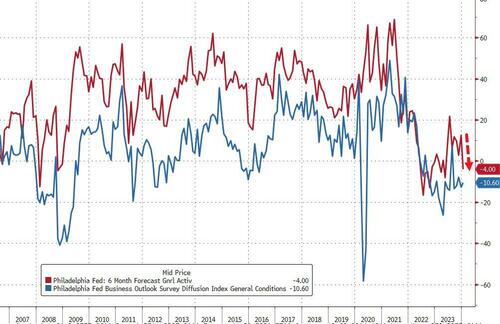

More worrying is the fact that hope appears to be dwindling fast as the six-month-forecast for the survey plunged back into contraction (from +12.6 to -4.00)…

Source: Bloomberg

Philly Fed’s demise is consistent with the collapse of hope as ‘soft’ survey data has slumped in the last month, back to its weakest since July (as ‘hard’ data improves relative to expectations)…

Source: Bloomberg

On the bright side for the doves, the dis-inflationary trend remains in tact as priced paid and prices received both plunged in January. However, we highlight the fact that Philly businesses expect price pressure to return in the next six months…

Source: Bloomberg

Overall, the ‘bad news’ in this report should buoy stocks and bonds (lower inflation and lower growth enables sooner and faster cuts)… But will it.

Green man (The Federal Reserve) will stike again!

WTF are dancing sandwiches??