www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2023Q2

www.newyorkfed.org/microeconomics/hhdc.html

Wut mean?:

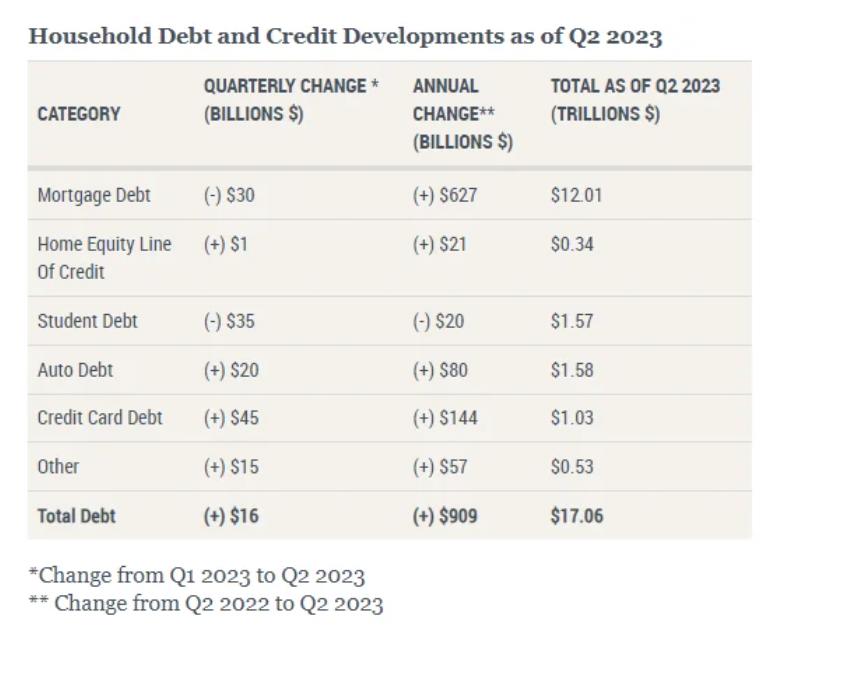

- Credit Card Balances: A notable increase of $45 billion to a record $1.03 trillion, along with a rise in credit card account limits to $4.6 trillion.

- Mortgages: Balances remained steady at $12.01 trillion. Mortgage originations, including refinances, were at $393 billion, up by $70 billion from Q1.

- Auto Loans: Increased by $20 billion to continue the upward trend since 2011. New auto loan volumes were at $179 billion, reflecting high loan values despite fewer new loans compared to pre-pandemic numbers.

- Student Loans: Decreased by $35 billion, totaling $1.57 trillion. Delinquencies remain historically low due to the ongoing federal repayment pause set until August 31, 2023.

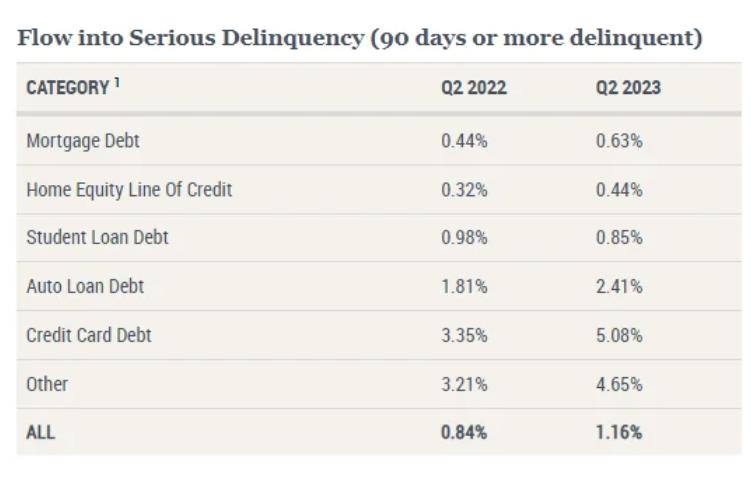

- Delinquency Rates: Mostly stable, with a slight uptick in delinquency rates for credit cards and auto loans. Credit card delinquency rates are back to pre-pandemic norms after a period of notably low rates.

- Housing Debt: $393 billion of newly originated mortgage debt was recorded in Q2, with new foreclosures remaining low.

- Federal Student Loans: payments remain suspended until October 2023 and missed payments on federal student loans will not be reported to credit bureaus until Q4 2024. Because of these policies, less than 1% of aggregate student debt was reported 90+ days delinquent or in default in Q2 2023.

Remember:

- Total consumer credit increased at an annual rate of 4.3% in June 2023.

- For the second quarter, consumer credit increased at an annual rate of 4%.

- Revolving credit (credit cards) increased at an annual rate of 11.2%–DEBT is BALOONING WAY FASTER THAN 2%!

- Nonrevolving credit (mortgages, loans) increased 4% year-over-year.

Regarding the total outstanding consumer credit as of June 2023:

- The total outstanding consumer credit was $4,997.09438 billion (UP 5.7% from a year ago!). (All time high–for now)

- Revolving credit accounted for $1,262 billion of the total outstanding consumer credit. (just below all time high)

- Nonrevolving credit constituted $3,740.38 billion of the total outstanding consumer credit. (NEW ALL TIME HIGH, for now…)

It is not getting better:

Consumer Lending:

Banks tightened standards for credit card and other consumer loans; moderate tightening observed for auto loans.

Banks made stricter requirements for credit card loans: higher minimum credit scores, reduced credit limits, and stricter granting processes.

Auto loans saw increased rate spreads and more stringent credit score requirements.

For other consumer loans, terms tightened through increased rate spreads and stricter credit requirements.

Demand for credit card loans remained stable overall, but large banks saw a slight decrease in demand, while other banks noticed an increase.

Declined demand observed for auto loans and other consumer loans in the second quarter.

- Free Credit Balances (a broker/dealer’s liability to customers, which the customers can cash out on demand) in Customers’ Securities Margin Accounts the lowest EVER in June. It likely means folks buying more securities or are covering margin requirements

- NY Fed report finds Americans increasingly facing borrowing troubles: The overall rejection rate for credit applications has risen to 21.8%, the highest since June 2018. The average reported probability of loan application rejection increased sharply across all loan types, hitting new series highs.

- Credit application rates in the past year have dropped to 40.3%, the lowest since October 2020, with declines in auto loans and credit card limit requests.

- However, there was an increase in applications for credit cards, mortgages, and mortgage refinances.

- The overall rejection rate for credit applications has risen to 21.8%, the highest since June 2018, with the most rejections among those with credit scores below 680.

- The rejection rate for auto loans hit a new high at 14.2%, up from 9.1% in February.

- Despite these trends, the proportion of respondents planning to apply for credit in the next year slightly increased to 26.4%.

- However, the average reported probability of loan application rejection increased sharply across all loan types, hitting new series highs for auto loans, mortgages, and credit card limit increase requests.

TLDRS:

- Credit Card Balances: A notable increase of $45 billion to a record $1.03 trillion, along with a rise in credit card account limits to $4.6 trillion.

- Mortgages: Balances remained steady at $12.01 trillion. Mortgage originations, including refinances, were at $393 billion, up by $70 billion from Q1.

- Auto Loans: Increased by $20 billion to continue the upward trend since 2011. New auto loan volumes were at $179 billion, reflecting high loan values despite fewer new loans compared to pre-pandemic numbers.

- Student Loans: Decreased by $35 billion, totaling $1.57 trillion. Delinquencies remain historically low due to the ongoing federal repayment pause set until August 31, 2023.

- Delinquency Rates: Mostly stable, with a slight uptick in delinquency rates for credit cards and auto loans. Credit card delinquency rates are back to pre-pandemic norms after a period of notably low rates.

- Housing Debt: $393 billion of newly originated mortgage debt was recorded in Q2, with new foreclosures remaining low.

- Bankruptcy filings, both for businesses and individuals, have significantly increased in the first half of 2023 compared to the same period in 2022.

- Reminder, while banks have the liquidity fairy, ‘we’ get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates–causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.