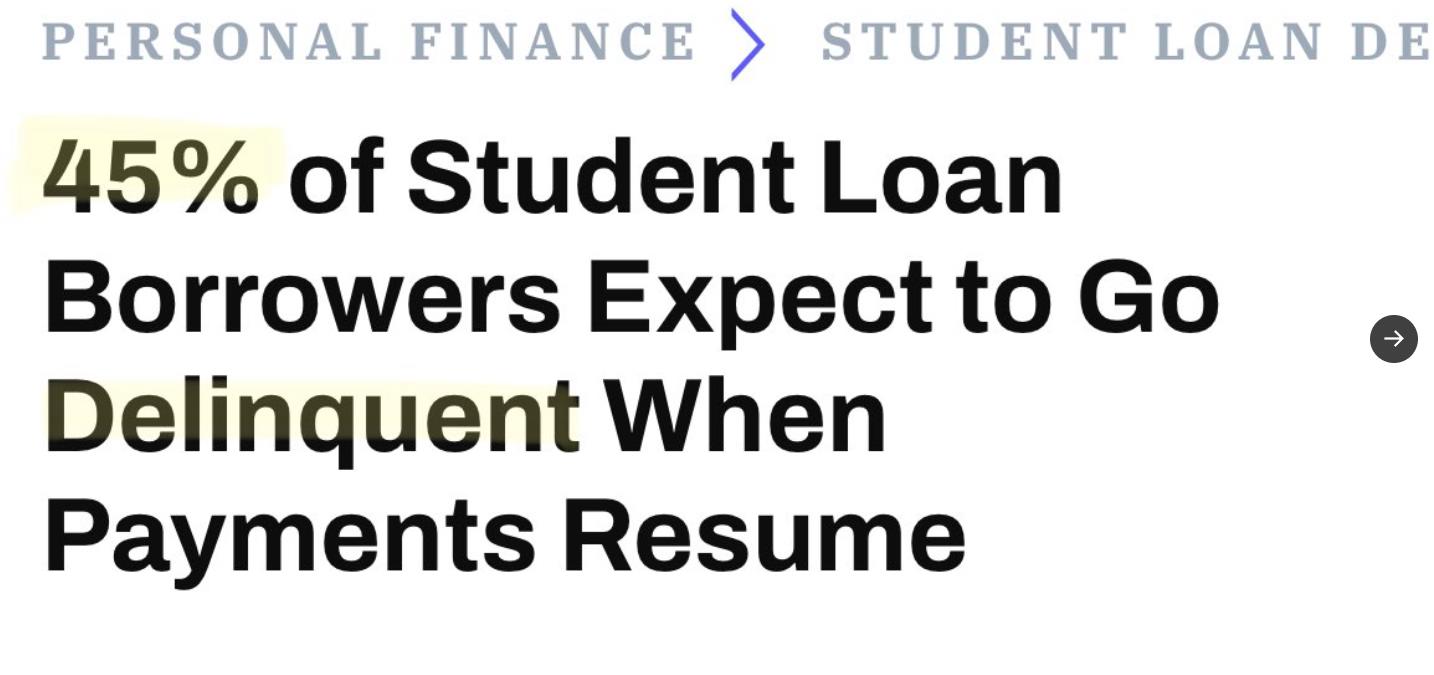

Half plan to default ☝️

But,

Younger people drove the spending over summer 👇 pic.twitter.com/9QpEOcST4v

— Win Smart, CFA (@WinfieldSmart) September 18, 2023

This situation could be quite concerning for several reasons:

- Credit Score Damage: When people default on their student loans, it can wreak havoc on their credit scores. This means they’ll have trouble accessing credit in the future for things like buying a home, a car, or even just getting a credit card. It’s like a financial scar that can take years to heal.

- Financial Instability: Defaulting on loans often leads to financial instability. Borrowers may struggle to make ends meet, and this can impact their overall financial well-being. They might have to put off important life decisions like getting married or starting a family, and that has broader economic implications.

- Less Money to Spend: As folks grapple with loan defaults, they’ll have less money to spend on goods and services. This reduction in consumer spending can hit local economies hard. Businesses might suffer, leading to potential job losses or slower economic growth.

- Government Budget Challenges: Most student loans in the U.S. are backed by the federal government. When borrowers default, the government takes a hit. This can strain government budgets and resources, potentially leading to increased taxes or cuts in funding for other important programs.

- Education Access Concerns: The fear of student loan debt and the risk of defaults may deter some people from pursuing higher education. This could limit opportunities for career growth and affect the skill level of the workforce.

- Potential Policy Changes: A high rate of student loan defaults might push policymakers to rethink student loan forgiveness programs or other interventions. These changes could have long-term economic consequences, including how we deal with the burden of student debt.

In a nutshell, a significant increase in student loan defaults could have a ripple effect, impacting borrowers’ financial stability, spending habits, government finances, education accessibility.

524 views