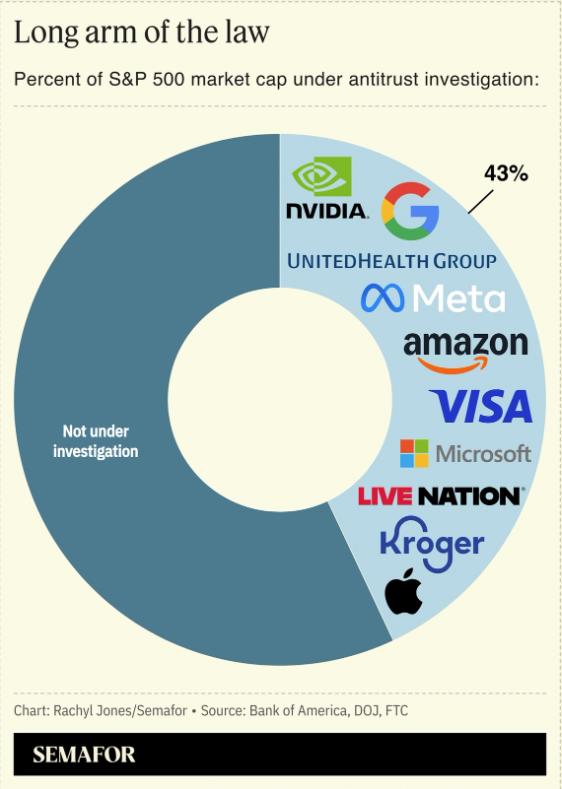

Nearly half of the S&P 500 companies by market cap are currently under investigation by the government. This sweeping examination involves major players across various sectors, with the U.S. Federal Trade Commission (FTC), the Justice Department, and competition authorities in Europe and the UK actively looking into these companies.

This crackdown aims to tackle stock-market concentration and monopolistic practices that could harm consumers. It’s a significant moment in corporate oversight, reflecting a growing apprehension about how much power a few companies hold over the market.

Take Google, for example. The Justice Department is delving into allegations that Google has maintained a monopoly over search engines. Internal documents have surfaced, revealing exclusive deals with smartphone makers and web browsers to ensure its search engine remains the default choice across platforms.

Then there’s Apple. The tech giant is facing scrutiny for its App Store policies, which are under investigation for potentially stifling competition and hurting consumers. Meanwhile, Microsoft is being investigated for its dominance in the software and cloud computing arenas, raising concerns about possible anticompetitive behavior.

These cases illustrate a broader trend of regulatory focus on major corporations. As antitrust scrutiny intensifies, it’s not just about enforcing existing laws. It’s about creating an environment where fair competition thrives and consumers are protected from monopolistic practices.

The implications of these investigations could be far-reaching. We may see hefty fines, forced changes to business practices, or even structural remedies like divestitures that could reshape the corporate landscape.

Sources: