The U.S. economy is headed in the wrong direction even faster. With debt growth outstripping economic growth this rapidly, should we put the dollar on deathwatch?

From Peter Reagan at Birch Gold Group | Reading time: 5 minutes

We are living through an incredible period of economic history in the United States. It should be discussed in college-level economics classes for decades to come.

The national debt has surpassed a staggering $35 trillion for the first time in history. While that number is truly breathtaking (in a bad way), according to the House, here’s how that towering pile of debt breaks down:

- $104,497 per person

- $266,275 per household

- $483,889 per child

According to the same report issued by the House, just one year ago the debt was a mindblowing $32.65 trillion. That means it grew by a whopping $2.35 trillion over the past 12 months! So over the last year, this breaks down to:

- $196 billion in new debt per month

- $6.4 billion in new debt per day

- $268 million in new debt per hour

- $4.5 million in new debt per minute

- $74,401 in new debt per second

During the time I wrote this sentence, the debt pile grew by $700,000. Compare that to the median household income of $74,580 – this sentence cost the nation the TOTAL annual incomes of 9 ½ American families.

The federal government pays interest on its debt, just like everyone else. Over the last three years, the cost of interest alone on the national debt has doubled, to almost $1.1 trillion.

That means even if Congress got its act together and balanced the budget today, our debt pile would still increase by over $1 trillion per year!

How much longer can this continue?

Just how sustainable is the biggest debt mountain in the universe?

Fans of Modern Monetary Theory (MMT) are eager to tell you that government debt is an illusion. Janet Yellen isn’t willing to say that out loud, though she certainly acts as though it’s true.

Here’s a shocking observation of reality that might upset both the MMT crowd and their lead apologist, Paul Krugman:

When you borrow money, the lender expects to be paid back.

That’s the way borrowing works! That’s the way borrowing has always worked, throughout human history.

So when Krugman hand-waves away the national debt by saying:

…the debt we create is basically money we owe to ourselves, and the burden it imposes does not involve a real transfer of resources.

He’s wrong. Dead wrong. (Here’s a more detailed explanation.)

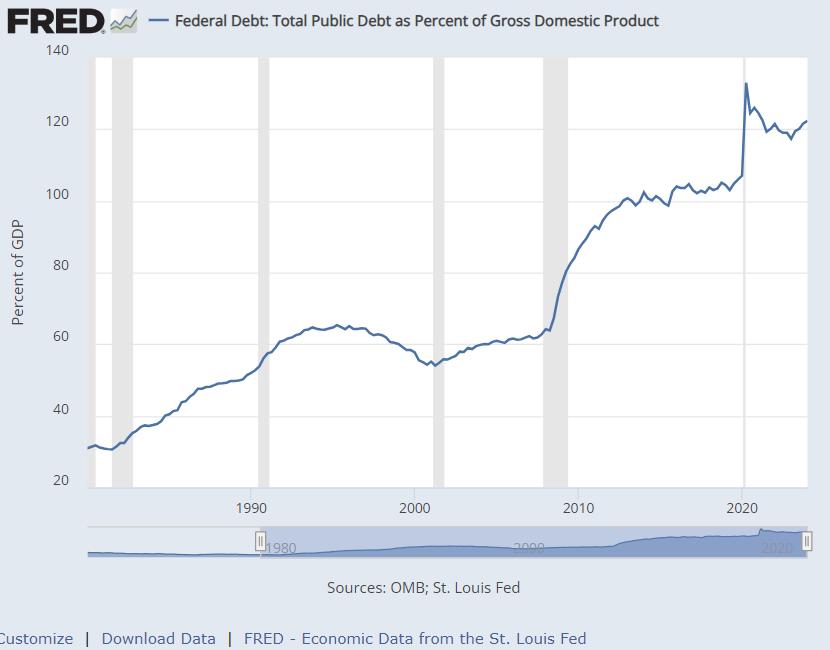

The champions of government debt look to an abstract ratio called debt-to-GDP to establish the sustainability of a nation’s debt.

Gross domestic product (GDP) measures the entire economic output of the country, including consumer spending. Theoretically, if the government taxed every transaction at 100%, GDP represents the total amount of wealth that could be extracted from citizens. The debt-to-GDP ratio is a lot like the mortgage loan to income (LTI) ratio or debt-to-income (DTI) ratio used by mortgage lenders to evaluate whether a borrower is likely to repay a loan.

So the debt-to-GDP ratio is important.

If Biden’s trillions in deficit spending actually resulted in economic growth, as he argues it has, that would be reflected in a flat debt-to-GDP ratio.

If the money was wasted on non-productive pork-barrel projects that didn’t lead to economic growth, well, then we’d expect to see the debt-to-GDP ratio rise.

According to Wolf Richter’s analysis, that is exactly what’s happening right now:

Since January 2020, current-dollar GDP grew by 31%. That was a lot, see the steep curve in the chart above. Inflation had a lot to do with it. Stimulus spending in 2020 and 2021 and then deficit spending over the past two years also had a lot to do with it.

Over the same period, the debt grew by 50%. As current-dollar GDP grew 31% and the current-dollar debt grew by 50%, the burden ballooned.

The burden is expressed as the debt-to-GDP ratio.

The “Debt-to-GDP” ratio since 1980 has been visualized on the official Fed graph below, and it is currently higher than 120% (source):

You’ll see that, in 2016 at the end of the Obama administration, that ratio hovered at 100%.

It’s gotten MUCH worse since then – despite the pandemic-era spike associated with a national lockdown that crushed GDP.

This paints a picture of a government that’s massively increasing our nation’s debts, without creating a significant amount of economic growth.

(Note to the Biden administration: It’s easy to spend money! It’s much harder to spend money wisely on projects that increase national prosperity.)

That upward trend since January 2021 simply indicates that debt is growing faster than our nation’s ability to repay it.

That’s bad news. But that’s not the only scary thing happening…

More money, more problems: Monetary base doubled over the last five years

Economist E. J. Antoni shared a post on “X” that revealed a shocking fact about the total monetary base that the Federal Reserve controls:

Monetary base rose 0.1% M/M in Jun and 2.2% Y/Y – for greater context though, it's up almost 80% since the repurchase agreement fiasco in Sep '19; note how the growth and volatility of the monetary base changed radically in the financial crisis and has never normalized: pic.twitter.com/UXa9rz3FCV

— E.J. Antoni, Ph.D. (@RealEJAntoni) July 24, 2024

Doubling in five years is bad enough – but the monetary base has grown nearly SIX times over since the 2008 financial crisis.

(No wonder the price of gold is up some 3x over the same period.)

Modern Monetary Theory was surely going to have its consequences. Those birds are coming home to roost right now.

What happened to “the wealthiest economy in the world”?

I’ll never forget those chilling lines from George Orwell’s masterpiece 1984:

War is peace. Freedom is slavery. Ignorance is strength.

If we added “Debt is wealth,” that quote would pretty well sum up the state of the U.S. right now, wouldn’t it?

Folks, I don’t know how much more clearly I can put this…

Debt is not wealth! No more than ignorance is strength.

The federal government cannot create wealth. They can print money – which doesn’t create wealth, but simply devalues every other dollar in circulation.

With the money supply up sixfold since 2008, a number of things become clear:

- No wonder housing affordability is much worse today than at the peak of the mid-2000s housing bubble

- No wonder credit card delinquencies are at a 13-year high

- No wonder you need to make over $250,000/year to qualify as “middle class” in a growing number of major metro areas

- No wonder American families are experiencing record levels of financial stress

Because there’s another thing the MMT crowd is wrong about. Government debt doesn’t come for free. To the contrary, we all pay for it – through inflation, the tax no one voted for and everyone pays.

Just look at how the dollar’s purchasing power has been rolling downhill like a bowling ball since 1980 on the graph below (source):

Over 75% of your purchasing power annihilated. Gone forever.

Is it any wonder that the world is actively dumping the dollar? Would you want to own an asset with a 44-plus-year track record of steady loss?

Of course not!

Even though it’s hard to avoid using dollars for everyday transactions, you don’t have to bet your financial future on it. Fortunately there are alternatives.

Now is a good time to take a few minutes and learn about the benefits of owning physical precious metals.

Why? Because investing in precious metals like gold and silver has been a stable store of wealth for thousands of years. Inflation-resistant precious metals not only protect but can help you grow your savings.

Views: 127