via Mike Shedlock:

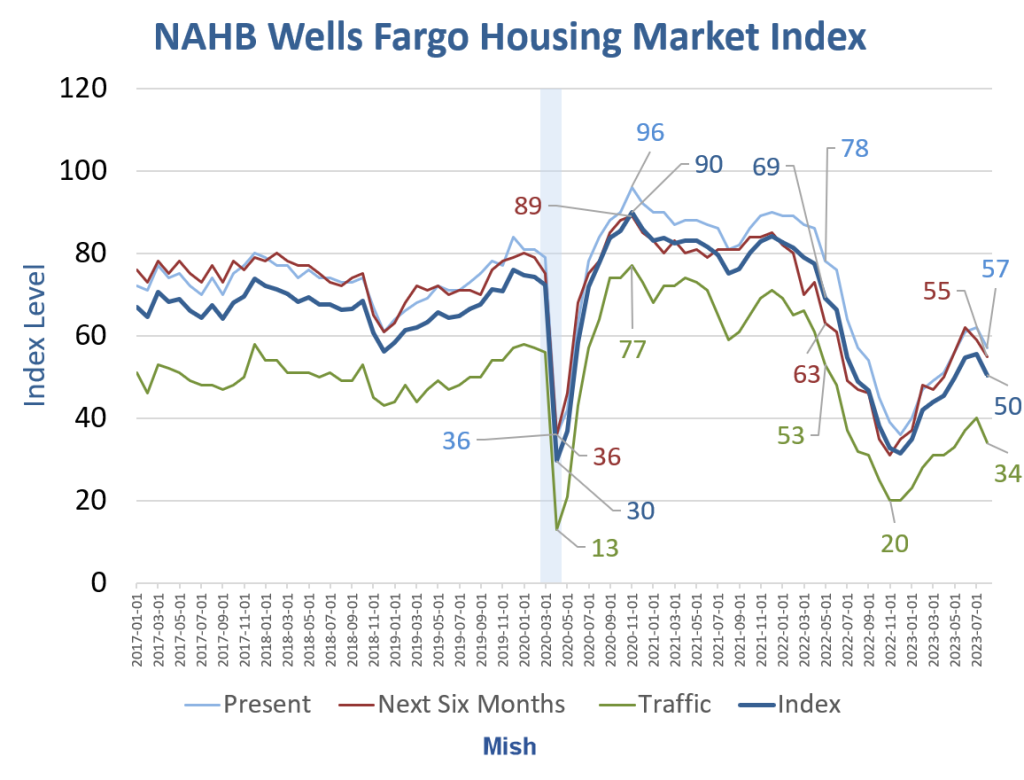

The National Association of Homebuilders (NAHB) Housing Market Index (HMI) resumed its slide in August. Traffic remains in the gutter.

The NAHB/Wells Fargo Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market.

The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.

NAHB Wells Fargo Housing Market Index Since 1985

Traffic remains depressed. Traffic is at levels generally associated with recessions.

Conditions rebounded from even deeper levels earlier this year when mortgage rates briefly fell. Also, homebuilders were able to pass on falling lumber prices and they built smaller homes.

30-year fixed mortgage rates are 7.26 percent according to Mortgage News Daily.

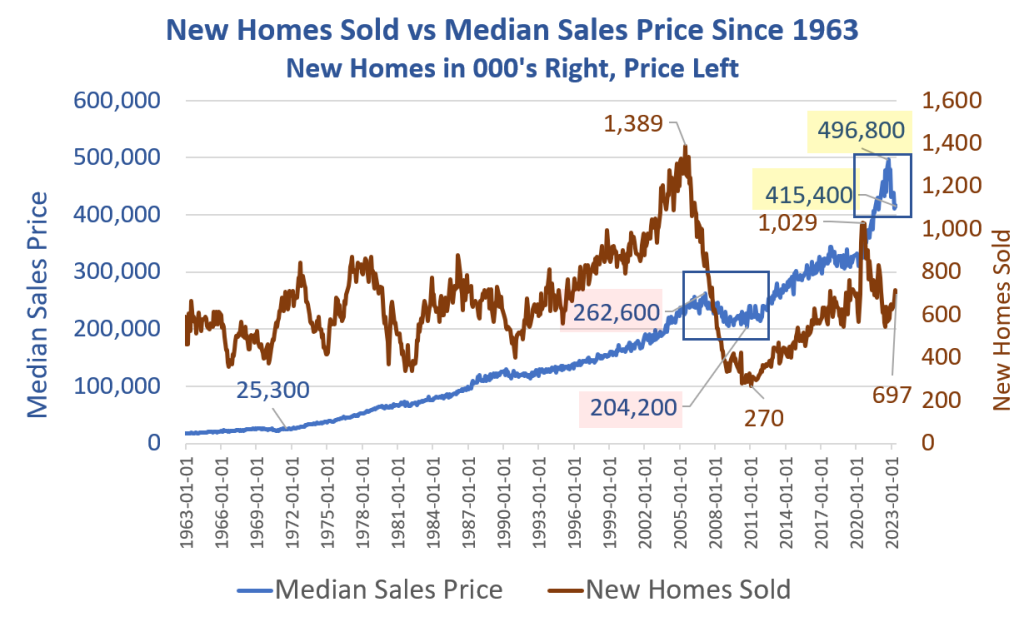

How Much More Will Homebuilders Have to Reduce Prices to Increase Sales?

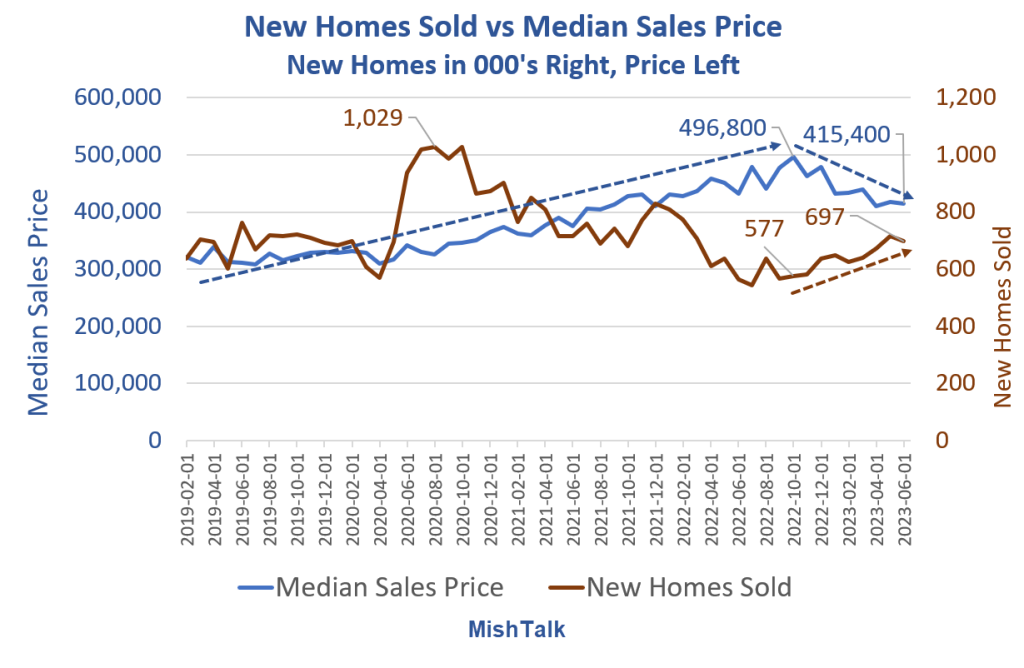

New Home Sales vs Median Sales Price Detail

Buyers hit a brick wall on price with a peak of $496,800 in October of 2022. Median price has fallen 16.4 percent since then.