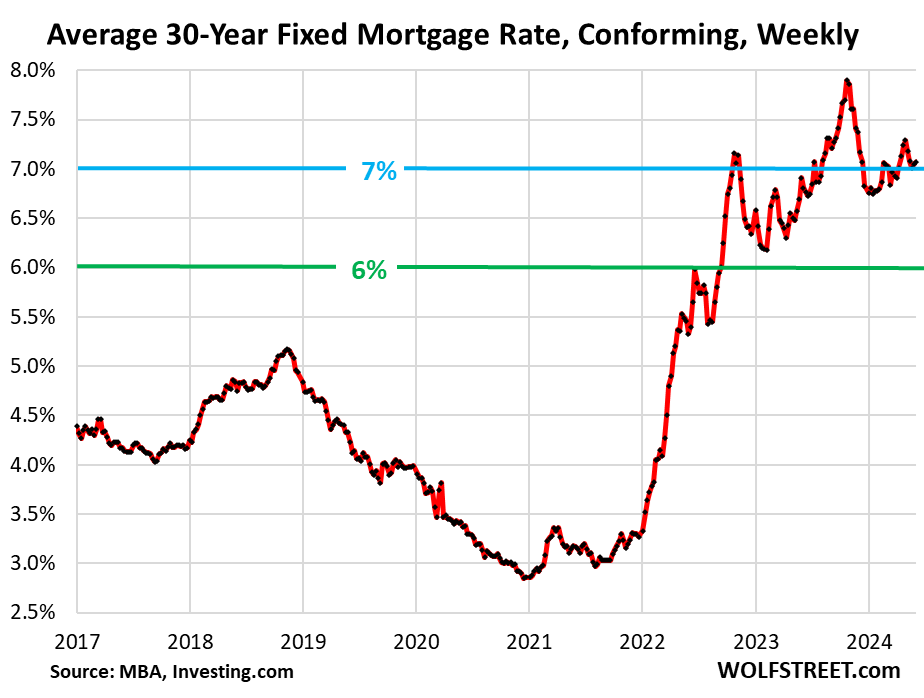

The over-7% mortgage rates seem to have become a fixture in the housing market. The average conforming 30-year fixed mortgage rate edged up to 7.07% in the latest week, and has now been above 7% since early April, according to the Mortgage Bankers Association today. During Rate-Cut-Mania, the average mortgage rate had dropped to 6.76% at the low point in early January.

These mortgage rates are not high compared to the pre-QE era. From 1970 through 2001, mortgage rates ranged from 7% to 18%. What was different then that allowed those rates to function were the lower home prices. When mortgage rates dropped below 7% in 2002 and eventually as low as 5.5% in 2005, they fueled Housing Bubble I, which led to the Housing Bust from 2006-2012. So these 7% rates are fairly healthy rates:

Stuck with a 6% or 7% mortgage that was supposed to be refinanced? Mortgage rates have been above 6% since September 2022. But no problem, the real-estate industry has been telling homebuyers that they should buy now even at these rates because they will be able to refinance at a much lower rate shortly, after the Fed starts slashing interest rates.

READ MORE: