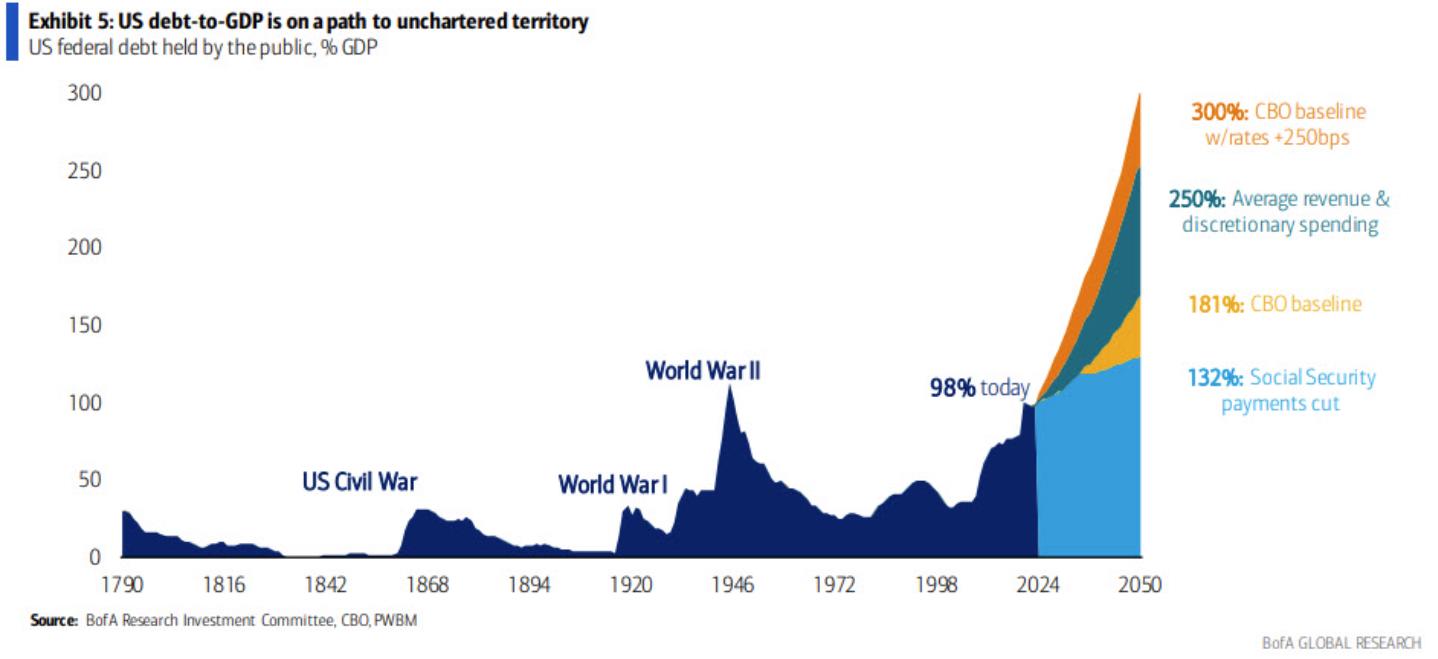

In straightforward terms, let’s address a pressing concern: Inflation is here to stay, and the US deficit is spiraling out of control. Despite Treasury Secretary Yellen’s reassurances, there’s reason to be uneasy about the mounting US debt.

Facing the facts, $1 trillion-plus US budget deficits are becoming the norm, and federal projections paint a grim picture with deficits surpassing $1 trillion through 2033. In essence, the likelihood of witnessing a year with a US deficit below $1 trillion seems increasingly improbable.

As we step into Q1 2024, the US Treasury anticipates borrowing an additional $816 billion, primarily earmarked for deficit spending. The reality is that deficit spending is spinning out of control, with government expenditures projected to surge over the next three decades. Meanwhile, revenue is expected to stagnate, creating a significant gap and paving the way for a substantial deficit for the US government.

This financial scenario screams unsustainability. Adding to the alarm, the Producer Price Index (PPI) reveals a startling 58.8% surge in chicken egg prices, indicative of broader inflationary pressures. Market expert Jim Grant, editor of “Grant’s Interest Rate Observer” for the past four decades, boldly asserts that inflation is now a permanent fixture.

Grant’s perspective suggests that the Federal Reserve might delay rate cuts, challenging the expectations of those anticipating imminent policy shifts. According to Grant, Fed Chair Jerome Powell is likely to exercise caution, bearing in mind the Fed’s failure to identify the inflation surge in 2020 and 2021. Powell appears hesitant to declare premature victories, emphasizing the ongoing challenges posed by inflation.

*YELLEN: NO REASON FOR INVESTORS TO FEEL NERVOUS ABOUT US DEBT

Well akshully, there is… pic.twitter.com/O9KqP7NSo3

— zerohedge (@zerohedge) December 13, 2023

$1 trillion+ US budget deficits are becoming the new normal.

Federal budget projections show $1 trillion+ deficits through 2033.

In reality, it's unlikely we will ever see a year with a US deficit below $1 trillion again.

In Q1 2024 alone, the US Treasury expects to borrow an… pic.twitter.com/tC2USIx4Ef

— The Kobeissi Letter (@KobeissiLetter) December 11, 2023

Curious: If I needed a $34T line of credit, where could I get one of those? Oh, and the line may need to be expanded soon.

Asking for a … ‘friend’. pic.twitter.com/2encL2Z4BM

— James Lavish (@jameslavish) December 13, 2023

Government spending is projected to continue trending higher for the next 3 decades

But revenue is set to almost flatline during this period

This divergence is going to lead to a BIG deficit for the US government

Unsustainability at its best pic.twitter.com/djHqqOXDTE

— Game of Trades (@GameofTrades_) December 13, 2023

PPI: prices for chicken eggs jumped 58.8 percent

— zerohedge (@zerohedge) December 13, 2023

Inflation is ‘permanent’ and you’ll never regain your lost purchasing power, says a Wall Street guru