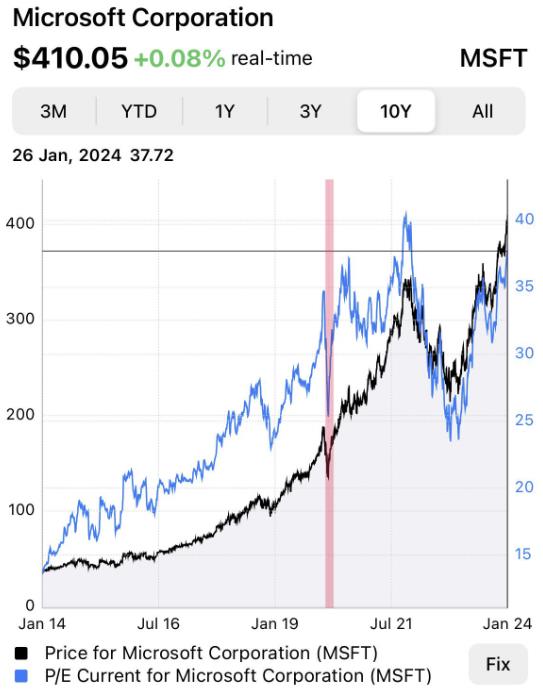

High priced in growth indicates lower future expected returns. For the future, expect low price growth or price contraction if AI isn’t the cash cow the market thinks it is, all while Microsoft remains a highly profitable company that will keep paying it’s dividend.

h/t ChampionshipUsed9855