Six months ago, when looking at Michael Burry’s Q1 13F which in turn followed just a few months after the famous permabear admitted he had been wrong to urge his followed to sell…

… we found that the Big Short had continued the trend of rapidly rotating his entire portfolio and in the first quarter, Burry liquidated the rest of his legacy 2022 holdings, dumping his entire stake in companies like Black Knight, Wolverine World Wide, MGM Resorts and Qurate, and also trimmed his formerly largest holding, private prison operator GEO group, and had reallocated the proceeds in three ways:

- Adding to his Chinese exposure, making JD.com and Alibaba his top stocks (a move which appears to have been driven by the Q4 momentum and which has since fizzled, leading to substantial losses in Chinese names).

- Launching a handful of new positions in energy names such as Coterra, NOV and Devon

- Most notably, a third – or seven of the fund’s total 21 positions – were bank names, and with the exception of Wells, they were mostly distressed, regional, small banks and/or credit card companies, such as CapitalOne, Western Alliance, Pacwest, First Republic, and Huntington Bancshares, all of which had been hammered significantly during the March bank crisis.

In other words, as we put it then, “Burry appears to have enough of being called the “big short” and in this particular twist of the liquidity cycle is positioning himself to be the next “big long.”

Fast forward three months, when back in August we found that in Q2 Burry’s Scion Asset Management made even more dramatic changes to the investor’s personal portfolio.

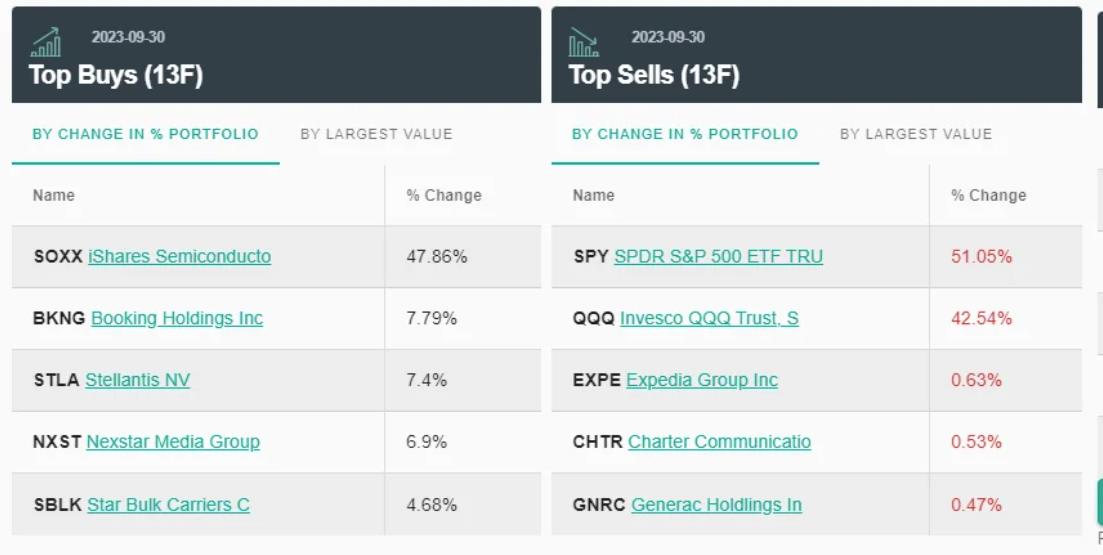

Michael Burry has closed his “$1.6 BILLION DOLLAR” S&P 500 and NASDAQ short position