The metals and mining industry looks to be entering the take-off phase.

The M&A cycle is heating up, institutional capital is starting to deploy capital, central banks buying record amounts of gold, and precious metals are now on the verge of a major breakout.

A long-awaited… pic.twitter.com/2rhys9N2Mp— Otavio (Tavi) Costa (@TaviCosta) December 21, 2023

Fed Backs Self Into Corner Just As Inflation Revives

The magnitude of last week’s dovish swing by the Federal Reserve now makes a rate cut next year highly likely.

Yet, as is so often the case with central banks focused on lagging variables, it could come at exactly the wrong time, with a profusion of indicators showing inflation will be rekindled later next year. Rate-cut expectations look overdone, but any repricing may not come until the whites of inflation’s eyes are seen — when that happens the move will be dramatic.

No analogy is perfect.

But history rhymes because there is one thing that is immutable through time: human nature.

The 1970s were different to today in several respects, but the immutability of human behavior makes it quite conceivable a similar inflation pattern could recur.

Jordan Roy-Byrne: Gold to Soar After Stock Market Blow-Off Top

I have been writing about this for years, but it bears repeating because many gold bugs deny or gloss over its reality.

Although Gold is hovering around all-time highs, the precious metals sector will remain in a secular bear market until the stock market and the economy crack.

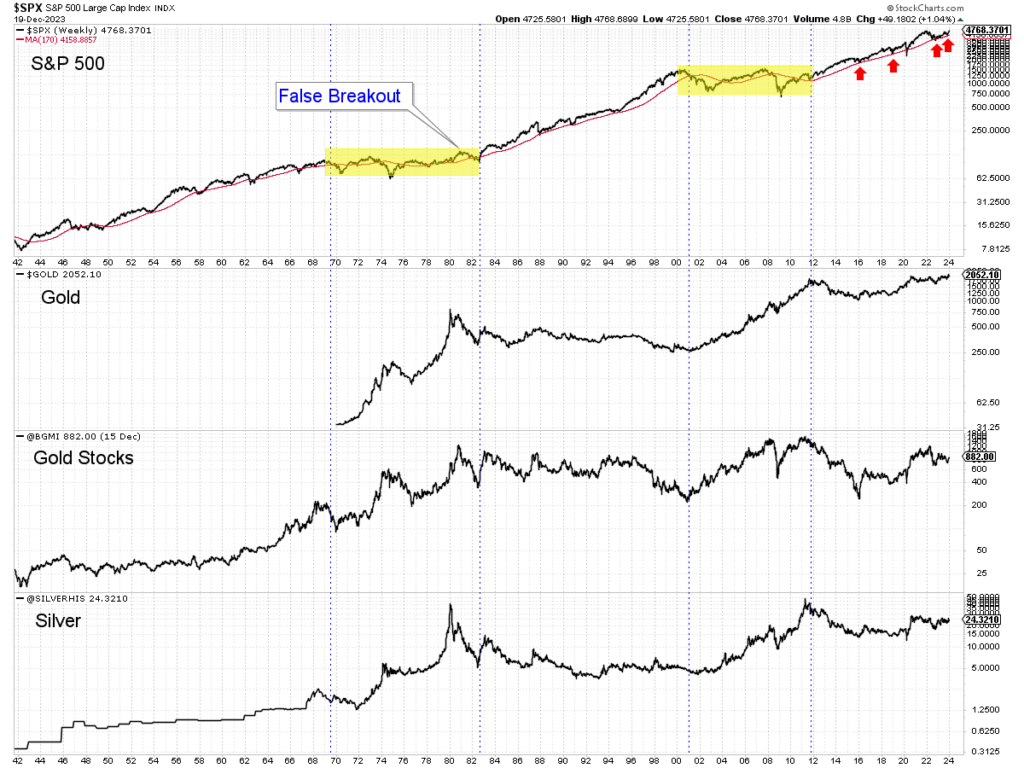

Let’s review the historical picture.

The biggest moves in precious metals were during secular bear markets in stocks. See the yellow.

There is an overlap with the 1960s as gold stocks, a proxy for Gold, exploded higher after 1964. They strongly outperformed the stock market even though the secular bear in stocks did not begin until the end of 1968.

There are some similarities between today and the mid-1960s, but I digress.