The May jobs report is out and, under normal circumstances, would led The Fed to raise rates. But these are not normal times, my friends.

The US economy (allegedly) added 339k jobs in May. That is the good news.

The not-so-good news? A large diverengence between the Establishment survey and Household survey. +339k versus -310k. What’s it going to be?

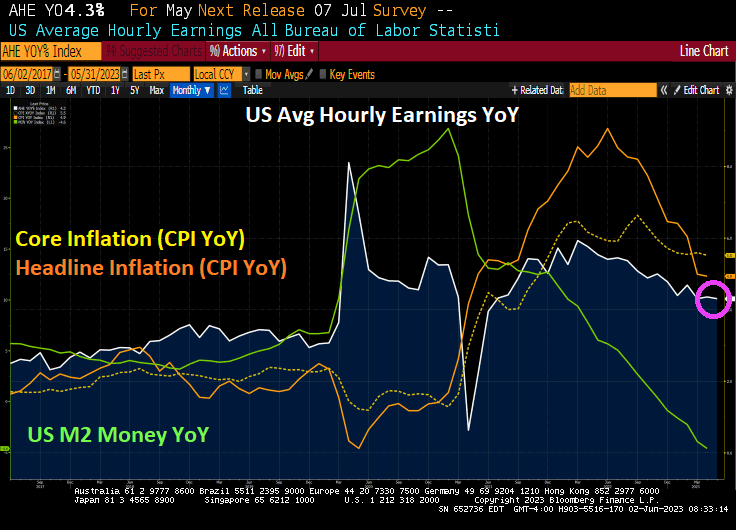

The bad news? While US average hourly earnings YoY cooled to 4.3%, inflation is still roaring at 4.9% (headline) and 5.5% (core). So Americans are still losing ground to inflation.

The unemployment rate rose to 3.7% in May while the underemployment rate rose to 6.7%.

With unemployment rising to 3.7%, the Taylor Rule implies a Fed Funds Target rate of 10.12%. We are currently at 5.25%. Or just a little over halfway there. But The Fed is talking a pause in rate hikes.

Even Powell is getting a headache.

98 views