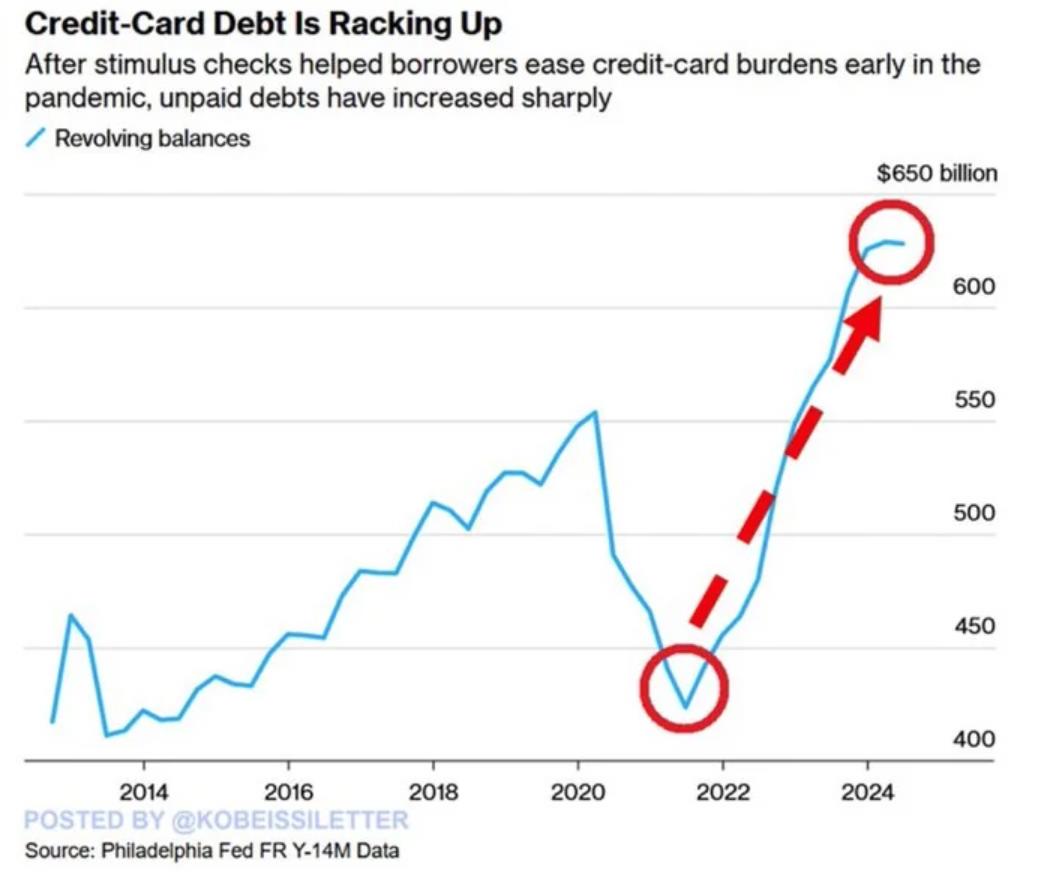

Americans are facing unprecedented financial stress. In a staggering development, U.S. consumers are now carrying over a record $628 billion in unpaid credit card debt every single month. This figure reflects the severe strain on households as inflation, high-interest rates, and skyrocketing living costs continue to erode their financial stability. As household expenses soar and wages stagnate, many are struggling to meet even their minimum payments.

Over the past three years, credit card debt has surged by $204 billion—a 52% jump. Interest rates, now at an average of 25%, have also risen sharply from 15% just a few years ago. For those unfamiliar with how credit card interest compounds, this means consumers are paying more than ever just to maintain their balances, sinking further into debt with every missed payment.

The housing crisis in 2024 is adding yet another burden. As mortgage rates climb, owning a home is out of reach for countless Americans, and those who managed to secure mortgages at lower rates are struggling to keep up. According to a report from LendingTree, the rate of delinquencies and foreclosures is climbing rapidly, putting families at risk of eviction or foreclosure. In fact, the probability of missing a debt payment has now reached 14.2%, according to a Federal Reserve Bank survey—the highest it’s been outside the pandemic since early 2017. This reveals an unsustainable debt load that households simply can’t manage.

Lower-income households are especially hard-hit. As one industry expert noted, inflation is eating away at any wage gains, leaving many workers feeling financially insecure even if their earnings have technically increased. Income inequality continues to widen, making it harder for those with limited means to stay afloat.

The convergence of these factors—a $628 billion debt mountain, surging interest rates, and a deteriorating housing market—suggests that America is edging closer to an economic breakdown reminiscent of 2007.

Source: Finbold