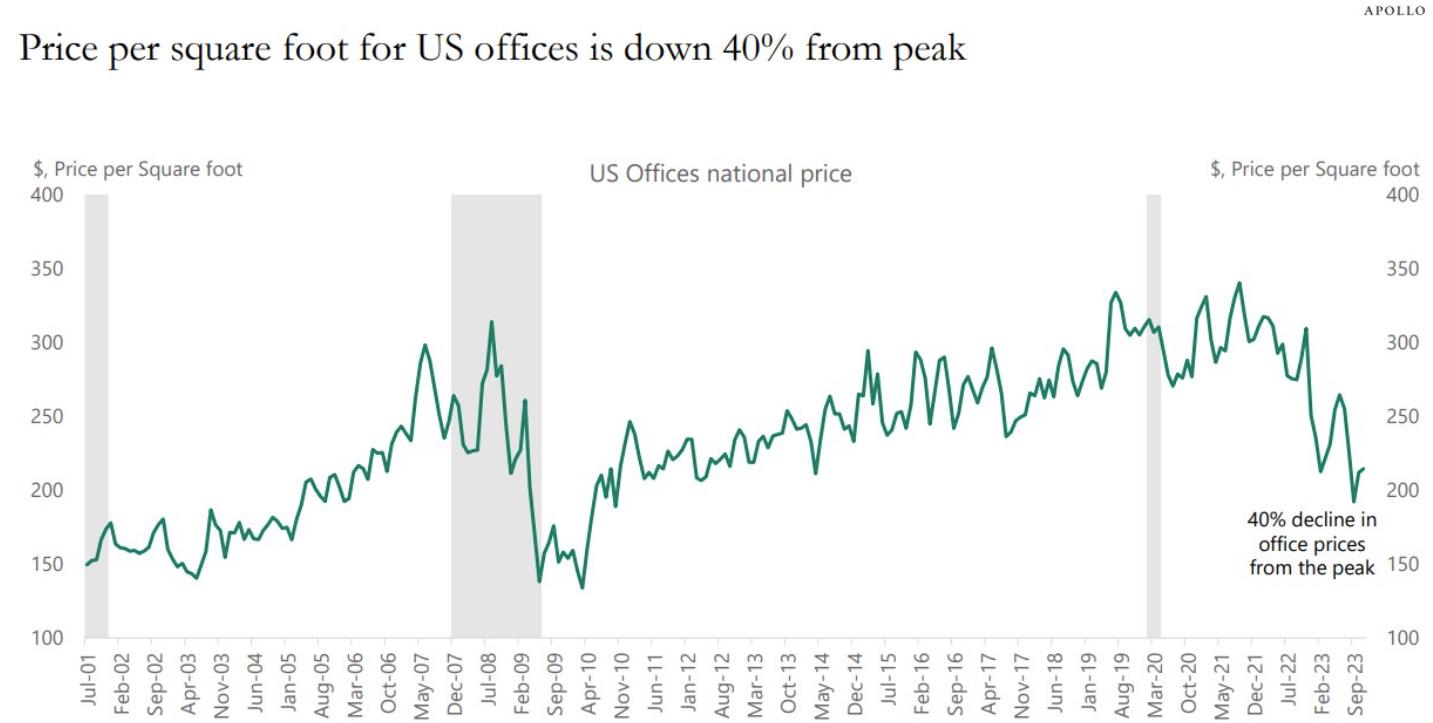

Office building prices in the United States have experienced a substantial downturn, witnessing a significant 40% drop from their peak over the past two years. The past year alone has seen a massive 30% decline, leaving one in five office buildings vacant across the nation. The gravity of the situation is exacerbated by the substantial debt burdens carried by most of these empty office spaces.

With high-interest rates and declining cash flows, delinquency rates are on the rise, paving the way for an impending wave of commercial real estate bankruptcies. As we enter 2024, the commercial real estate sector is set to face a challenging year, marked by bankruptcies that the housing market’s resilience has so far masked.

Amidst the increasing bankruptcies, the narrative of a bear market in commercial real estate gains traction. The price decline of 40%, coupled with a staggering 20% of vacant buildings, raises concerns about the sector’s ability to recover. The lingering question remains: How much further must prices plummet before these buildings attract buyers?

This unsettling scenario signals a likely secular shift in the office space landscape, culminating in a massive de-leveraging and a surge in defaults. The implications extend beyond the real estate sector, as regional banks holding a significant portion of these commercial real estate loans may face a domino effect. A dent in regional banks could trigger a catastrophic chain reaction, leading to further bank failures and subsequent consolidation within the banking industry.

Office building prices are expected to persistently decline as vacancies increase, rents decline, expenses rise, and interest rates remain elevated. This protracted downturn is anticipated to extend over at least five years, marking a challenging period for the sector as leases expire and loans mature.