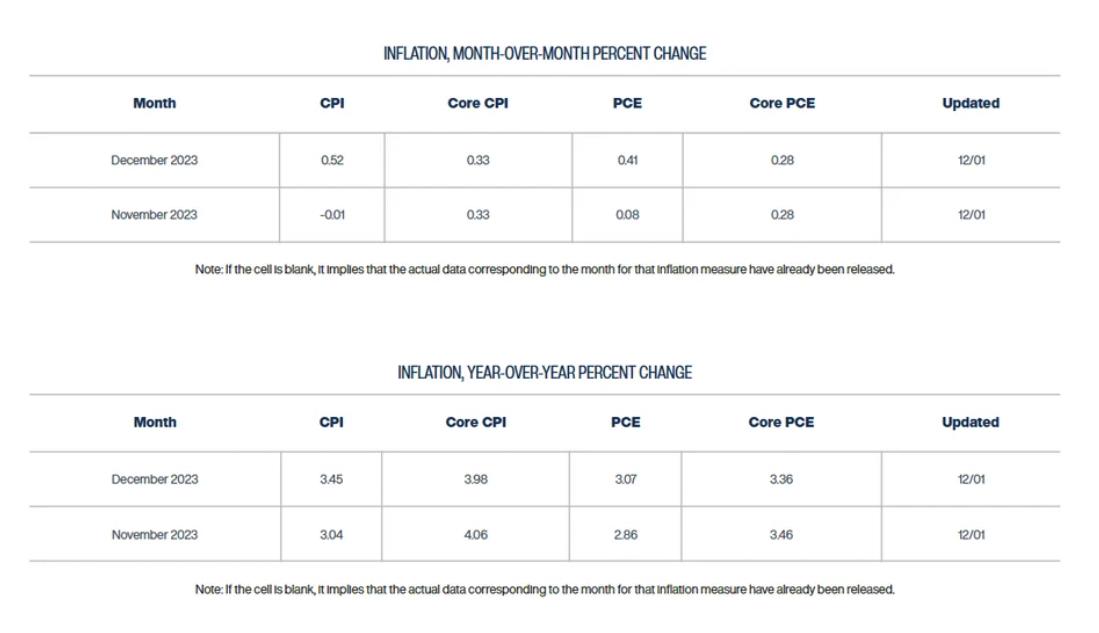

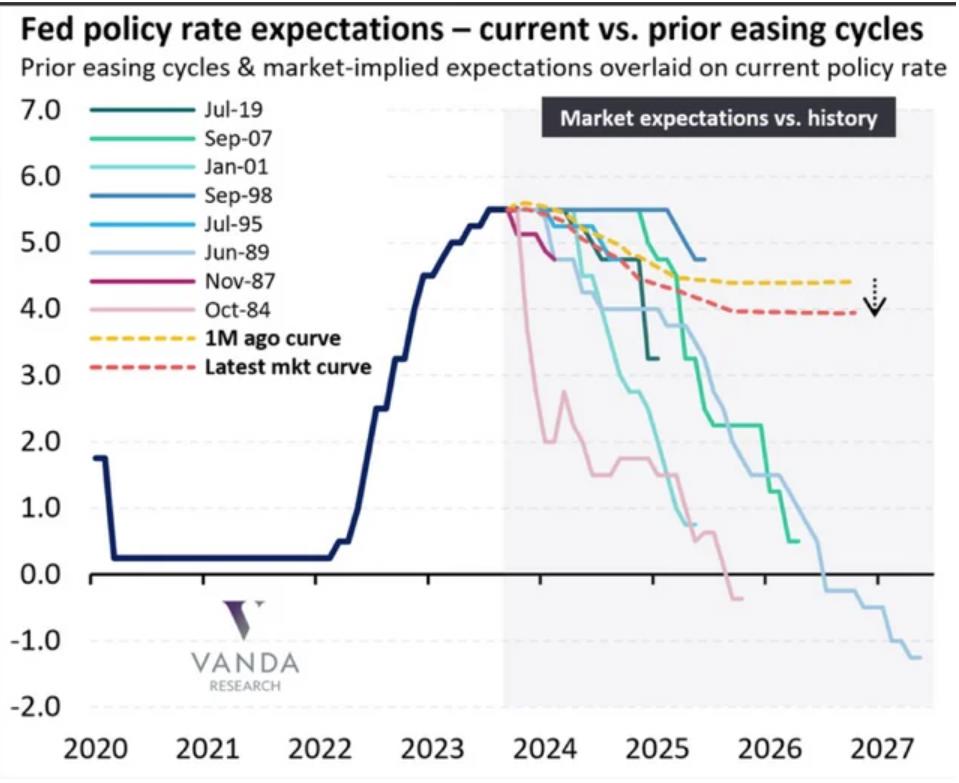

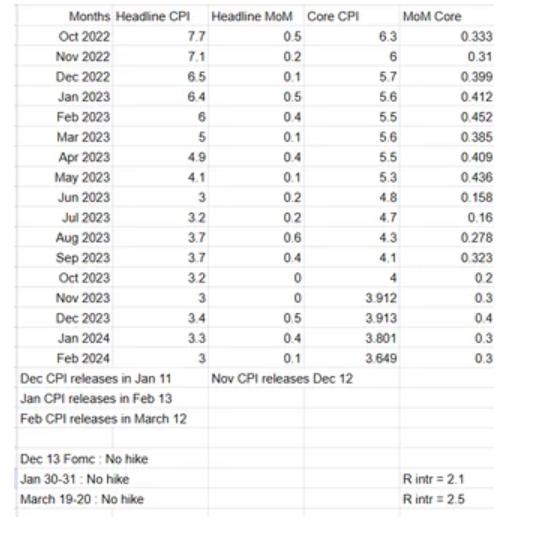

Interest rate futures indicate expected rate cuts from March 2024, with a growing chance of cuts starting in January. Three weeks ago, markets anticipated an additional rate hike and cuts in June 2024; now, there’s a 2% chance of an extra hike and five expected rate cuts in 2024.

Despite these market shifts, Fed Chair Powell called expectations of rate cuts “premature.” This stance contrasts with ongoing robust inflation and projected substantial deficit spending.

The current market conditions raise questions about the accuracy and timing of reactions. Premature and extensive rate cuts by the Fed could potentially worsen inflationary challenges. Recent economic indicators, including a $42 meal for two at Five Guys, adding $1 trillion in fiat debt in 100 days, and the Federal Reserve’s struggles with U.S. Treasury sales, emphasize the complexities of the economic environment. The trustworthiness of the economic system is in question, especially with gold surpassing $2,000, China’s Communist Party accumulating gold, and the absence of a risk premium for the 10-year yield.

Markets probably are reacting too soon — inflationary pressures are still quite strong, and enormous deficit spending is forecasted for the foreseeable future. A Fed pivot on rates to that extent could worsen the inflation fire.

CBO:

Deficits

Percentage of GDP pic.twitter.com/vsfiO6sTL3— David Sommers (@dgsommersmkts) December 1, 2023

https://t.co/d3IARKLddU

$42 for two at Five Guys, yet told inflation easing.

Add $1T additional fiat debt in 100 days. Lousy UST sales, FED booking losses,holding our paper assets.

Gold >$2 K, China CCP buying gold with trade surplus, but system is trusted? 10 yr no risk premium— RJEastHartford (@RJEastHartford) December 1, 2023

Current situation:

1. Stocks are up like we're in a bull market

2. Gold is up like we're heading into a recession

3. Oil prices are up like the recession got cancelled

4. Bonds are up like inflation is back below 2%

5. Home prices are up like inflation is still at 10%…

— The Kobeissi Letter (@KobeissiLetter) December 1, 2023

Here comes sticky inflation once again. Why are we pricing 5 cuts by 2025?

h/t DesmondMilesDant