In a significant market development, the 10-Year minus 3-Month Treasury Yield Curve has remained inverted for a historic 278 consecutive trading days, marking the longest inversion in financial history. The inversion has deepened recently, reaching its lowest point since August, adding to economic uncertainty.

Notably, Broadcom has emerged as a front-runner in the semiconductor industry, surpassing Nvidia and leading a remarkable melt-up. The stock has seen an extraordinary 27% increase with no down days, capturing attention in the market. Call volume today reached 400% of the average, indicating heightened investor interest and activity.

The current situation mirrors panic buying of cyclicals reminiscent of the early days of the pandemic. Previously, high beta experienced a collapse back to the 50-day moving average before a global rally fueled by mega-stimulus measures. However, this time, there’s no stimulus in play.

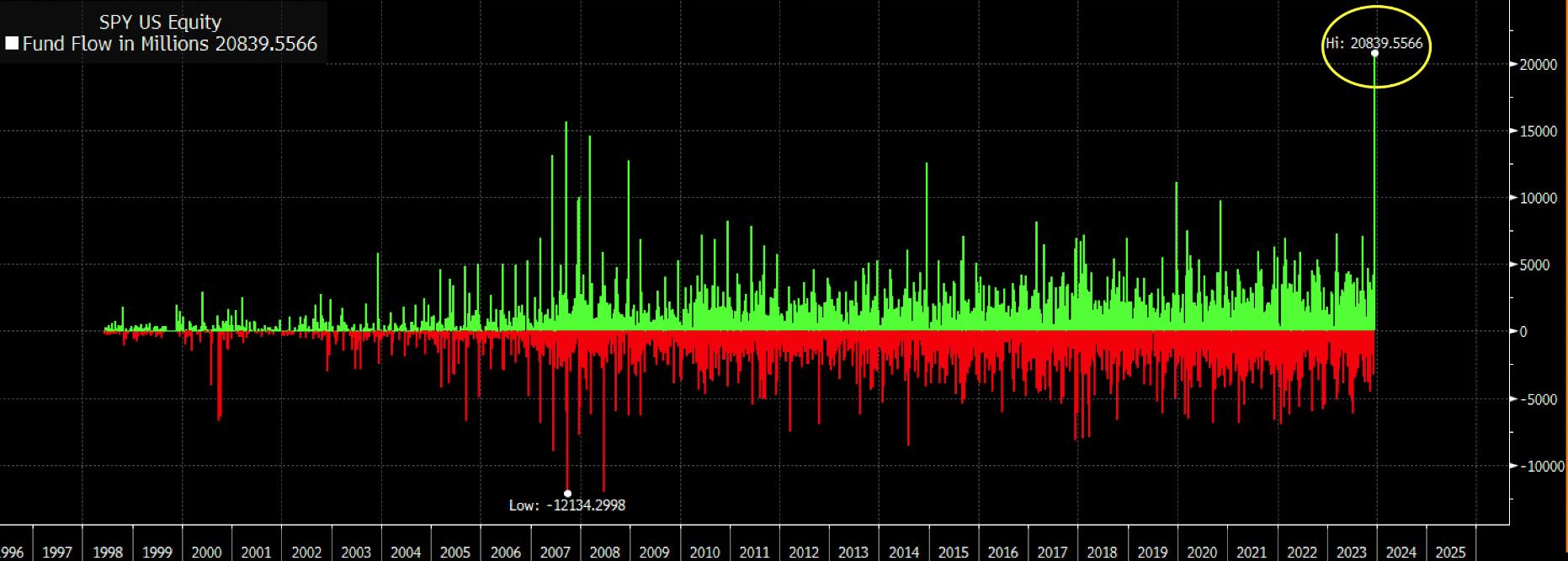

Friday saw a significant influx of $20 billion into $SPY, reflecting ongoing market movements. In contrast, hedge funds have notably reduced their oil long positions to the lowest levels recorded since 2011, signaling a bearish outlook on the economy.

As the market navigates through these complex dynamics, the prolonged yield curve inversion and the surge in semiconductor stocks raise questions about the economic landscape, prompting investors to closely monitor developments in the coming days.

Longest Ever Yield Curve Inversion: The 10-Year minus 3-Month Treasury Yield Curve has been inverted for 278 consecutive trading days, the longest inversion in history. It also just hit its deepest inversion since August. pic.twitter.com/eeI1DXHG4w

— Win Smart, CFA (@WinfieldSmart) December 19, 2023

This can end now:https://t.co/zVlOvnANSK pic.twitter.com/MaY9SALpzY

— Mac10 (@SuburbanDrone) December 19, 2023

Broadcom has taken over from Nvidia, leading the semiconductor melt-up. The stock is up 27% straight-line – no down days. Today's call volume, 400% of average.

The last time this stock made a blow-off top, was the end of the global rally. pic.twitter.com/IwgafosUkJ

— Mac10 (@SuburbanDrone) December 19, 2023

This is the most panic buying of cyclicals we've seen since the early days of the pandemic.

Back then high beta collapsed back to the 50 dma and then mega stimulus kicked in.

This time, no stimulus. pic.twitter.com/1gdmDUr2Bv

— Mac10 (@SuburbanDrone) December 18, 2023

$20Billion flew into $SPY on Friday.

Hedge Funds have reduced their oil long positions to the lowest ever recorded (data going back to 2011) pic.twitter.com/QsjZbG8pWh

— Win Smart, CFA (@WinfieldSmart) December 19, 2023