JUSTI N: A record number of buyers backed out of purchase deals in July due to high costs and economic worries, per Redfin.

— unusual_whales (@unusual_whales) August 30, 2024

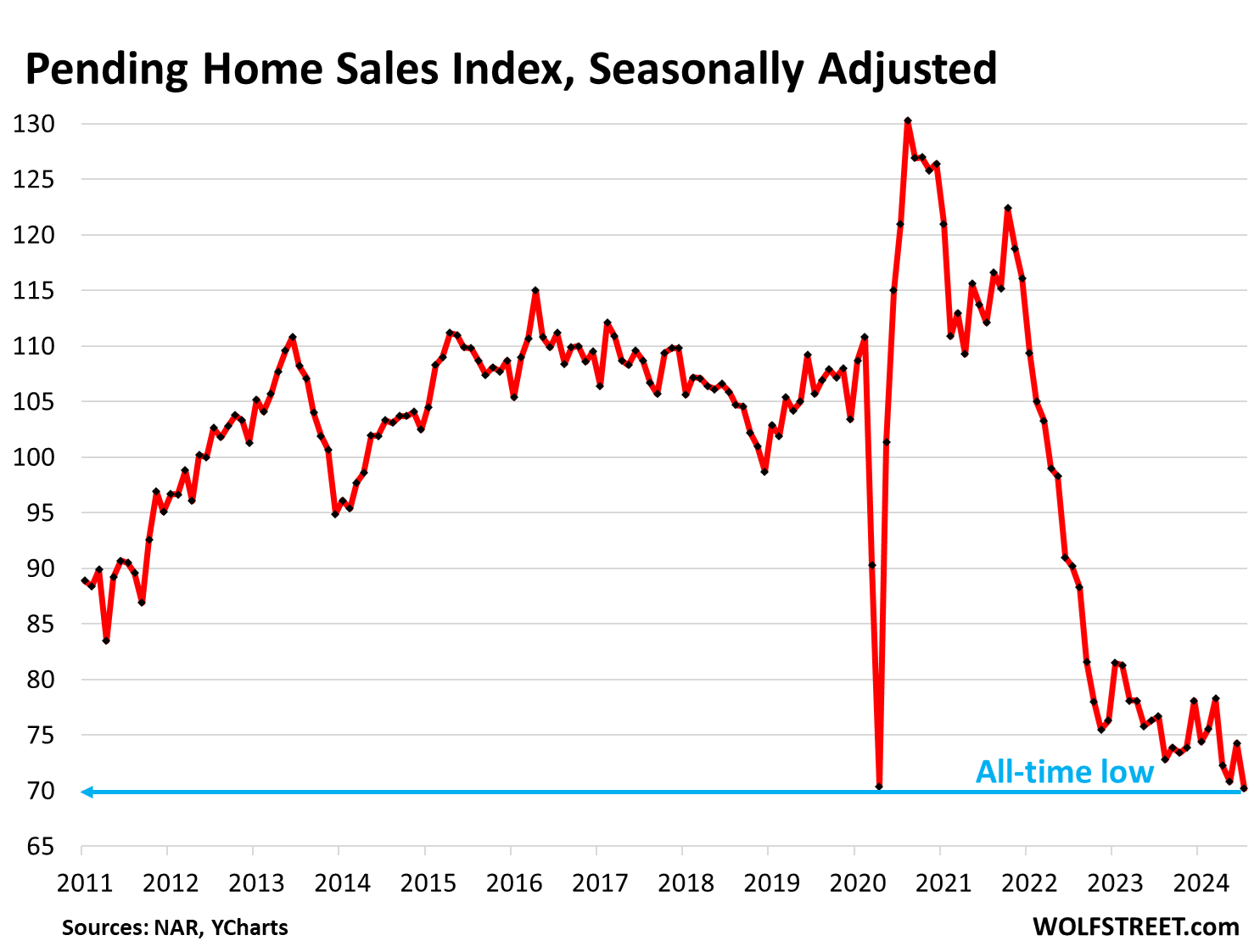

Pending home sales – a forward-looking indicator of “closed sales” over the next couple of months – dropped by 5.5% in July from June, and by 8.5% from a year ago, to an index value of 70.2 (seasonally adjusted), the lowest in the history of the index going back to 2001, when the index value was set at 100, according to the National Association of Realtors today (historic data in the chart via YCharts).

Pending sales are based on contract signings and track deals that haven’t closed yet and could still fall apart or get canceled.

So compared to the Julys in prior years:

- July 2023: -8.5%

- July 2022: -22%

- July 2021: -37%

- July 2020: -42%

- July 2019: -34%.

U.S. in ‘biggest housing bubble of all-time,’ housing expert says

America’s housing affordability crisis is being fueled by a massive bubble that has grown out of control since the pandemic.

According to Nick Gerli, founder and CEO of housing data analytics firm Reventure App, the U.S. is “in the biggest housing bubble of all time.”

“Inflation-adjusted home prices today are almost 100% higher than the long-term, 130-year average,” he said, adding that the only other time in history this happened was just before the 2008 housing market crash.

Between 1890 and 2000, “home prices were closely linked to inflation and never entered a national bubble,” said Gerli, who warned that “this situation is not sustainable.”

The problem isn’t just elevated prices—it’s how quickly prices have increased relative to wages. “We’re at a record disconnect between wages and home prices, with wage growth decelerating fast,” Gerli explained.

At this rate, Gerli said the only two options are for home prices to crash or for inflation to rise out of control. The latter option is harder to imagine because it would lead to a spike in interest rates, making housing affordability even worse.

Although Gerli strongly suggested that housing prices will eventually crash, economists don’t expect this scenario to play out anytime soon. Ironically, they believe that the 2008 housing meltdown prevented another crisis from happening today.