https://www.instagram.com/p/DAZAehJS4P6/?img_index=1

Many frustrated would-be homebuyers in their late 20s to early 40s are finding themselves priced out of homeownership — despite doing everything “right.”

Most members of the millennial generation entered adulthood during the 2008 financial crisis and aftermath. They faced a bleak job market, stagnant wages and mounting student debt, which hindered their ability to save.

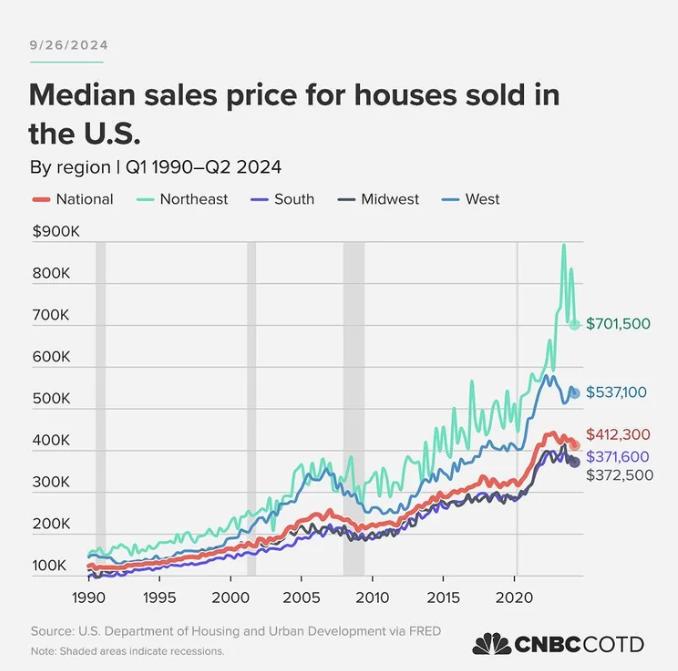

As they enter their peak homebuying years, they face a housing shortage that’s driven the median U.S. home price to $412,300. That’s 40% higher than their parents paid in 1990, even after adjusting for inflation.

If they manage to stay ahead of rising costs of living and save enough for a bigger down payment, they’re further squeezed by higher mortgage rates, which have more than doubled since 2022 and increased monthly payments.

And while buyers must spend more, they often have to lower expectations for what they’ll get: They’re finding that available homes are smaller, farther away or in need of costly repairs.

In conversations with CNBC Make It, millennial buyers describe the trade-offs they face and their feelings of devastation, disappointment and anger that the goalposts keep moving and they can’t seem to win. Details at u/chartoftheday’s link in bio.

h/t Perfect_Alarm_2141