via JOHN RUBINO:

Let’s start with regional and local banks, where two bad things are happening. First, their “safe” bond portfolios have tanked in the past year, embedding paper losses of around $700 billion industry-wide. These losses will produce a steady drumbeat of bad earnings reports in the coming year. But in the meantime, as interest rates rise, money market funds are able to pay higher rates than bank accounts, causing depositors to move their savings to greener pastures. To keep their remaining depositors, banks are having to pay way up, which is eating their profits:

Zions Shares Decline as Deposit, Borrowing Costs Soar Tenfold

(Bloomberg) — Zions Bancorp slumped after the regional lender reported soaring deposit costs, as elevated interest rates force banks to pay up for customer funds.

The Salt Lake City-based lender said the cost of total deposits and borrowings soared tenfold in the third quarter to 2.1%, compared with 0.22% for the same period a year earlier. That was up 22 basis points from the second quarter alone as reciprocal deposits, which are often more costly than those gathered through typical checking accounts, doubled to $6 billion.

Zions also said non-performing assets rose 45% to $68 million, largely because of two suburban office commercial real estate loans totaling $46 million.

Credit card debt now exceeds $1 trillion in the US and a growing number of people are putting day-to-day expenses on plastic. The inevitable result is a spike in card defaults and plunging credit card company profits. Next comes a dramatic contraction in credit card balances as recession forces the newly poor to stop spending.

Discover Profit Tumbles 33% as Credit-Card Write-Offs Mount

(Bloomberg) — Discover Financial Services posted a 33% drop in third-quarter profit as write-offs climbed and the firm set aside more money to cover future loan losses.

Net income totaled $683 million, or $2.59 a share, the Riverwoods, Illinois-based credit-card lender said Wednesday in a statement. That missed the $3.17 average estimate of analysts surveyed by Bloomberg.

Discover, led by interim Chief Executive Officer John Owen, said net write-offs rose to 3.52% from 1.71% in last year’s third quarter. Provision for credit losses more than doubled to $1.7 billion.

Tesla disappoints twice

Tesla’s October 18 earnings report missed pretty much across the board:

- Tesla 3Q Adj EPS 66c, Est. 74c

- Tesla 3Q Rev. $23.4B (Up 9% Y/Y), Est. $24.06B

- Tesla 3Q Gross Margin 17.9%, Est. 18%

Free cash flow was $848 million, only a third of the expected $2.59 billion.

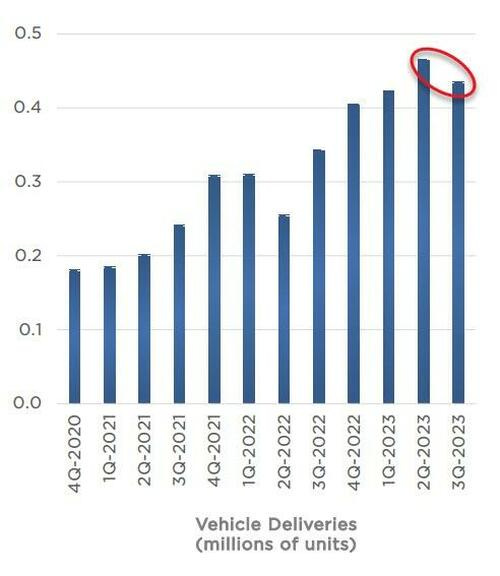

Deliveries rose YoY but declined sequentially:

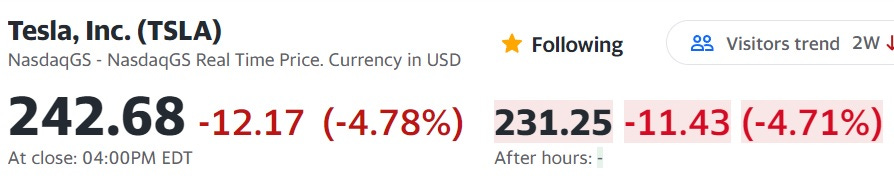

Its stock fell by about 4.7% yesterday on the above news. Then, after the close, a quote from Elon Musk started circulating:

“It’s an amazing product but I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck and then in making the Cybertruck cash flow positive,” Musk said during Tesla’s earnings call on Wednesday.

“While I think this is potentially our best product ever — I think it is our best product ever — it is going to require immense work to reach high-volume production and be cash flow positive at a price that people can afford.”

This sent Telsa’s stock down another 4.7% in after-hours trading:

Commercial real estate is a prime candidate for “first domino to fall”. Yesterday brought more signs of an impending bust:

Bad news for commercial real estate: Architects report a big drop in business

(CNBC) – Architecture firms reported a sharp drop in business in September, indicating that the commercial real estate market could experience even more pain in the next year.

The AIA/Deltek Architecture Billings Index dropped to 44.8 in September, the lowest score since December 2020, during the height of the Covid-19 pandemic. Any score below 50 indicates worsening business conditions. The score shows a growing number of architecture firms are reporting a drop in billings.

The index is a forward-looking indicator of demand for nonresidential construction activity — both commercial and industrial buildings. It aims to predict construction activity nine to 12 months out.

“While more firms are reporting a decrease in billings, the report also shows the hesitance among clients to commit to new projects with a slump in newly signed design contracts,” said Kermit Baker, AIA’s chief economist. “As a result, backlogs at architecture firms fell to 6.5 months on average in the third quarter, their lowest level since the fourth quarter of 2021.”

“I’ll say again, we do need to absorb a lot of multifamily construction currently in place but after that, there won’t be much for a few years after,” said Peter Boockvar, chief investment officer at Bleakley Financial Group.

Combine the above (and dozens of other similar stories) with the 10-year Treasury yield flirting with 5% this morning, and “risk off” seems like the only logical response. Be careful out there.