Rising government bond yields in Japan usually correlates with lower USD/JPY exchange rate.

It should also put a selling pressure on long-term US government bonds as Japanese bonds become more attractive and Japan own $1.2 trillion US bonds.

Source: Apollo pic.twitter.com/gpdwPLMowL

— Global Markets Investor (@GlobalMktObserv) June 2, 2024

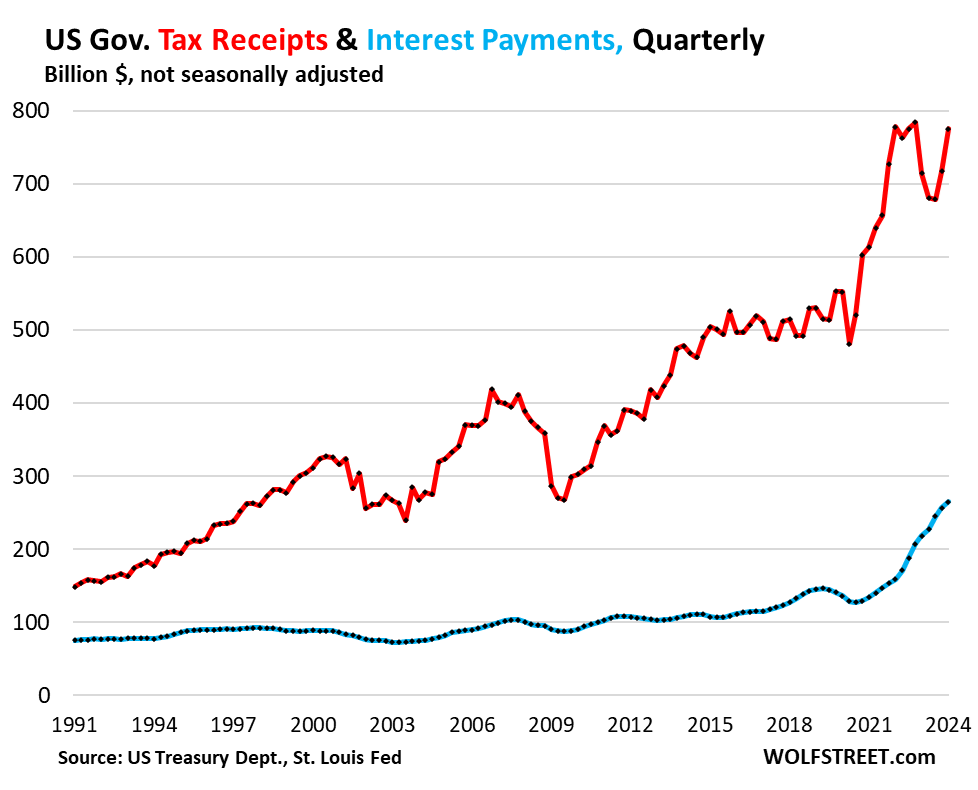

Interest payments jumped to 3.8% of GDP in Q1, the worst since 1998.

Not a good trend, especially as Yellen keeps issuing short-term Treasury bills.

These make up 22% of the $26.9T in marketable Treasury securities outstanding, at ~5% interest rate past yr but 3.23% average on the whole $34.6T fiscal deficit.

Bigger problem is it will keep rising as the current yields are working themselves into the debt pile.

144 views