As summer begins to slip behind fall’s curtain of colors, it looks like the labor market is finally slipping behind the curtain with it. While I had said I expected labor would start to turn this summer, it looked for awhile like it wasn’t going to, especially with the fairly strong jobs reports. Then I reported how all new jobs figures presented this year have been way too high and revised down the subsequent month. So, new jobs were clearly not as strong as we were led to believe all year long.

While President Biden celebrates the strength of his labor market in the headlines today, the actual big news was that unemployment finally started to rise at the end of summer. Unemployment made a significant turn upward from a long-held level of 3.5% to 3.8%, possibly starting that turn (if the upward move continues) that Jerome Powell has needed to see in order to have room to back off on additional rate hikes. However, inflation, which I’ll be covering in depth in my weekend “Deeper Dive,” is not leaving any room on the other side of the equation for a shift yet.

Stocks, of course, latched on to the hope that Powell could stop rate increases now that unemployment is starting to rise, and the president, of course, exaggerated the job gains even more than his statisticians have been doing all year:

“As we head into Labor Day, we ought to take a step back and take note of the fact that America’s now in one of the strongest job-creating periods in our history,” Biden said in the White House Rose Garden. “It wasn’t that long ago that America was losing jobs.”

Neither of those statements are particularly true. We came out of a forced Covidcrash where labor destruction was absolutely intense (as in the worst labor crash in the history of the world, forced upon us all politically during Trump’s final year but also by vaccine mandates in Biden’s first); then we turned the economic circuit breakers back on and saw the fastest rise in employment in history, only because we had forced tens of millions into unemployment, and now they could go back to work — not because of creation of new jobs. Even then employment didn’t rise enough to fully recover back to its longterm trend, though it has recovered back above the benchmark from which the Covidcrash fell.

Job growth and economic growth were strong because it’s easy to throw the switch the other way and see a sudden restart, but that had nothing to do with Biden. Even with Biden’s big spending plans, the job gains (once the overinflated new-job numbers were revised down on each subsequent month) were VERY far from being “the strongest job-creating period in history.” There is a huge difference between laid-off people going back to work at their old jobs by the tens of millions and new jobs being created.

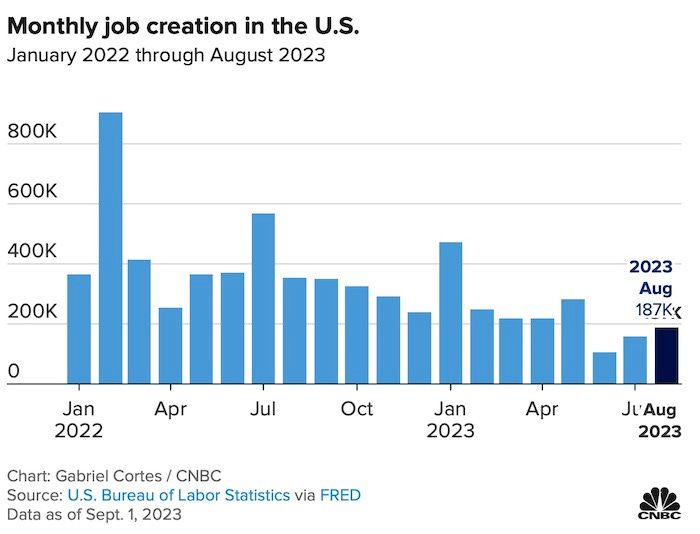

The actual decline in new jobs seen in the graph below is more to blame on Powell and his intentional economic destruction plan to reduce inflation than on the president and all of his spending, but the president’s boast is hot air all the same. We can call the new jobs the “Biden Bubble” — one that is deflating more quickly than he can expel his hot air into it. For that reason, he needs to accomplish his boasting quickly because Powell is at working crashing his campaign slogans before he can stammer them. After Powell is done, the Biden slogan may have to be “Build Back Again … and Again.”

What we do see in the graph, though, is that the downturn in job creation that Powell needs to see to stop adding pressure to the economic brake pedal appears to be coming in. More importantly, shown in other graphs in the articles highlighted in the paid-subscriber section, the unemployment he needs to see is turning up.

With inflation possibly about to rise again, as shall be seen in that “Deeper Dive,” Powell is going to have to keep his foot on the brake for a good long time, even if he doesn’t have to press harder; and there is no saying, just based on this apparent turn in employment, that he won’t have to press harder.

The unemployment rate rose sharply in August, as the summer of 2023 neared a close with a job market in slowdown mode.

Nonfarm payrolls grew by a seasonally adjusted 187,000 for the month, above the Dow Jones estimate for 170,000, the U.S. Bureau of Labor Statistics reported Friday.

Those numbers are far from impressive for Biden. As you can see “job creation” has been generally falling for the past year-and-a-half, and the latest numbers are likely to be revised down in subsequent reports. if the Bureau of Labor Statistics follows the pattern of the Bureau of Economic Analysis that I reported on earlier this week.

Wolf Richter gives a thorough analysis of job openings and the significant looking turn in unemployment in one of the articles highlighted below, and I’ll be including the high points of his analysis in my “Deeper Dive” as well. For now, let it suffice to say, the labor turn appears to have come in this summer as I thought it would after all. It may have crept in, almost unnoticed, but it is becoming apparent now. The stock market’s response today as to what it means for Powell’s inflation war, however, is not likely commensurate with what is actually stacking up for inflation, as I’ll be showing in that analysis.

If you want a small (hopefully) humorous history of how the Fed’s economic destruction cycle works to repeatedly destroy the jobs the Fed tries to create (as if the Fed can create anything other than money out of hot air), I wrote a little book about that, based on the lunacy we experienced from Fed & Friends during the Great Recession: “DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles: The same characters who created bailout bonanzas for banksters in the Great Recession are doing it again. Shall we let them?”