Just look at all the parts that shifted downward again today.

It was all destined to fall because the collapse was built throughout the design. It could be seen as inevitable from the beginning, and all the reasons for that have been spelled out here all along the way so no one could say, “You couldn’t see this coming.”Yes, you could. It’s a house of cards, a leaning tower of blocks. It may come down one block at a time or all at once, but it IS coming down.

Word has it today that “it won’t be a shock to see another bank failure.” That’s because the same conditions are now back to existing that existed when Silicon Valley Bank went bust over a year ago. And that’s because Yammering Yellen is having a hard time now selling her abundance of Treasuries to fund all the deficits present and ghosts of deficits past and credit downgrades due to the ghosts of deficits future. You can see it all stretched out to the horizon and far back in time.

Stocks fell hard again today, and that’s because Yellen’s tough sales have raised Treasury yields to where they are draining money away from stocks via that old familiar stock-bond money pump.

The great bank reserve flush

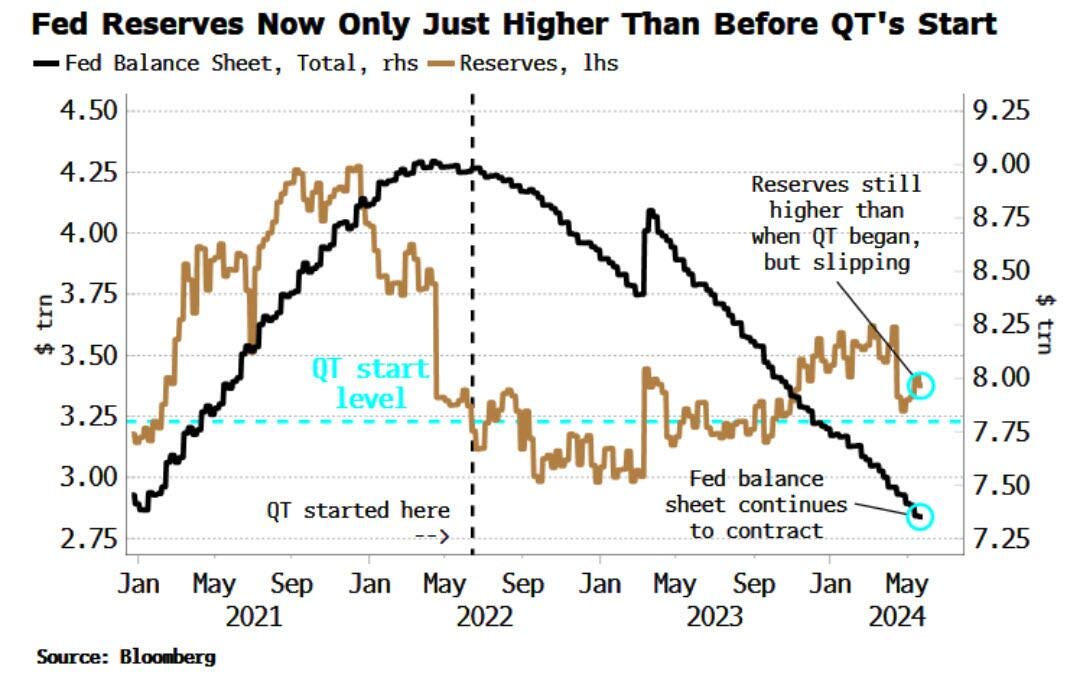

The rise in Treasury yields is key to another major set of problems because it is devaluing bank reserves again. For awhile reserves held strong because Powell talked bond yields back down with faint hopes of Fed cuts that didn’t square with anything the Fed actually decided. Reserves also held strong during the Fed’s QT because banks had loaned the Fed tons of cash during QE in exchange for Fed-owned Treasuries as collateral. As I was reporting earlier this year, that program was being shut off by the Fed, so banks were taking their cash back and getting interest on the principle. However, that has wound down; so, without that helpful cash flow, reserves are diminishing quickly due to the Fed’s QT. I had pointed out a couple of years ago that the reason the Fed likely did all those reverse repo loans while creating more cash than banks needed was to stash the cash to use as a buffer during QT. The buffer has finally drained dry for most banks.

That looks like this:

Risk assets will face a less-easy ride as Treasury bill issuance falls and [longer-term] coupon (notes and bonds) issuance rises, weighing on central-bank reserves.

The Treasury tilted issuance towards bills last year – the Yellen pivot – which allowed the market to continue to rally despite the inundation of government debt…. The Yellen pivot is fading.

But the largest peacetime fiscal deficit still needs funding. That means good old-fashioned bond issuance is starting to take up the slack as bill issuance falls back.

Reserves have started to decline again, draining liquidity from the system.

As reserves decline AND the value of bonds held in reserves also declines because yields are rising due to the Biden-Yellen massive bond auctions, then bank troubles will re-emerge.

Reserves have fallen almost $250 billion just since April, and that is largely because of the end of the Reverse Repo program in which banks had stashed a lot of cash with the Fed. So, that has played out as expected in terms of the end of the program’s impact on reserves.

This will be an increasing absence of a tailwind for risk assets which will eventually become a headwind. Regional banks are among those who may face a particular challenge from declining liquidity, making another bank failure a distinct possibility.

Stocks take some big hits

It’s not surprising then that stocks cascaded down some more today due to attractive bond yields but also with the help of AI-boosted Salesforce now leading the way down by losing a fifth of its value (-19.7%) in a single trading day—it’s worst day in two decades! It missed revenue expectations. With that, the Magnificent 7 shuddered.

So did Kohl’s, causing what Zero Hedge referred to as Kohllapse.

Kohl’s slashed guidance for the full year after reporting first-quarter results that missed about every metric….

“We are approaching our financial outlook for the year more conservatively given the first quarter underperformance and the ongoing uncertainty in the consumer environment.”

Does that ground-level change at a major retailer sound like the “consumer is resilient” and like we are avoiding a recession?

“This very ugly KSS report/guide reflects how big box retailers without 1) a powerful consumables anchor and/or 2) aggressive pricing are being squeezed hard in the present environment,” analyst Adam Crisafulli writes.

With a plunge of 22.8% by the end of the day, Kohl’s even managed to beat Salesforce in the race to the bottom. Kohl’s stock is almost back to where it was during the worst part of the Covidcrisis.

Yet, imagine this: Even Nvidia managed to slide today, chunking off more than 3%.

Of course, the fall in stocks has helped ease the rise in bond yields as money is moving into bonds because of those rising yields—the pump-handle effect where the plunger on one side rises and the handle on the other side goes down. Bond prices rose a little (yields fell) as stock prices fell due to money getting pumped from stocks into bonds. Yields, however, are still above 4.5% on the 10YR, which was where trouble started to seep into stocks.

The flailing economy

Those retail reports don’t sound like consumers are any too strong anymore. This is actually helping ease prices as the wary consumer parts company with businesses that charge too much, causing McDonald’s and Walmart and a few others to get aggressive by promising big price drops. However, goods make up only 20% of the prices gauged in inflation metrics, and it’s hard to say how much a big drop in some prices at a few major retailers will even impact goods overall. Will it ignite a price war with other retailers? It could, but we’ll have to wait and see.

Services, on the other hand, are the stickiest area of inflation, and they make up about 80% of CPI, and wage inflation is now rising, which impacts services the most; so there are plenty of upward pressures on inflation to struggle with; but it’s good news that retailers are realizing they are going to have to cut their greedy bottom lines or lose a lot of market share. (Many profiteered—price gouged—off of inflation by raising their prices significantly more than their costs rose.) They may even bleed a little red ink for awhile if a price war to retain their own consumers takes place.

For a take on what this means for the retail economy, let’s go to one of the biggest retailers that is also bound up with the frozen housing market to see how well we are avoiding recession.

The fault lines of the US economy are ‘about ready to crack’ – that is the stark warning from one of the America’s top CEOs Bob Nardelli.

The former boss of Home Depot and Chrysler says the Biden administration’s policy missteps could create significant challenges for the next president.

Recession coming soon to a theater near you … if we are not already in one now that first-quarter GDP has just been revised even lower than its initial reading (now down to 1.3% growth), meaning we are already in stagflation—the very stagnant economy and rampant inflation that Powell said he couldn’t see.

‘Whoever gets the next stint in the White House is going to be hit with a wrecking ball in trying to correct the missteps and the overspending of this current administration.

‘So we’re in for a rough time, I would say.’

In April last year, Nardelli warned about trouble for retailers, saying: ‘We’re going to see a lot of bankruptcies.’

He was proved correct. More than 5,500 shops shut in 2023 and in just the first four months of this year the retail bloodbath has continued with closures hitting 2,600….

‘Even though we’ve seen 40 percent wage increases in some cases, it’s being totally absorbed by inflation and the cost of living.’

A recent Wall Street Journal analysis found that American households’ net worth has stagnated during Biden’s tenure.

So, that soft landing is looking a little harder now.

Getting it in TheRump

Donald Trump also took a hard landing today. Just as I finished the first draft for this article, Trump got handed a rapid verdict of “GUILTY” on all 34 felony accounts. As jury deliberations go, that sure didn’t take long. And this was the trial I figured was most likely to end in a hung jury.

And, so, the Year of Chaos will likely gain some amplitude as we all get it in the rump this year, thanks to our fearless leaders (Trump included, as we can certainly thank him for the vaccines at warp speed and the health problems they recklessly caused, the endless empowerment of Dr. Fauci with the White House’s bully pulpit and for a big part of this inflation that was laid in with the lockdowns causing shortages during his term and the absolutely massive simultaneous Fed-and-feds bailout programs, many of which were scheduled to play out well into Biden’s term, funded by deep deficits). Neither party gets a pass on these times.

Trump’s trials are some of the crisis points or tipping points that were the basis for my saying this would be the Year of Chaos. Along with the total economic collapse slowly unfolding: More banking crises, especially as reserves now drain faster and commercial real-estate continues to crash. An eventual stock crash as bond yields rise because of the Big Bond Bust that is coming due to Fed QT and the Fed being forced to stay “higher for longer” on interest rates because inflation was certain not to cooperate because it was already rising again in the last half of last year if you knew where to look, and because the Fed has refused to notch up its rates as was predictable. The continuing Retail Apocalypse. Rising oil prices due to expanding wars in the oil region, and all the other turmoil those wars are bound to bring. And then global recession topping all that off with some crushing weight. There is nothing in that scenario that cannot be seen developing now as the Everything Bubble comes down everywhere. With your help, I’ll keep spelling it out here, whether the truth is popular or hated, so the connections between all the parts are not missed.