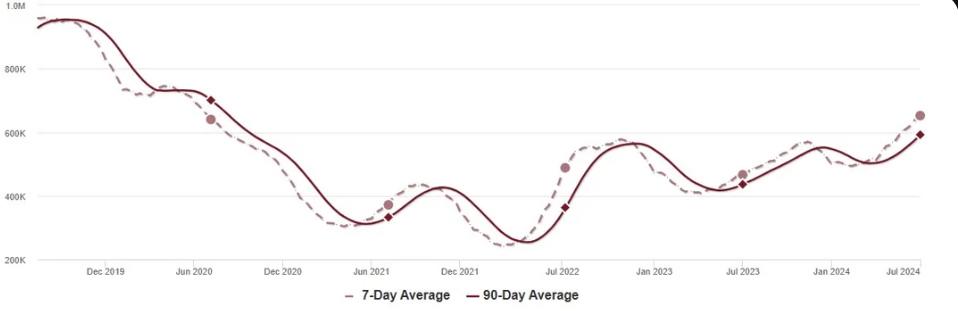

Altos reports that active single-family inventory was up 1.1% week-over-week. Inventory is now up 32.1% from the February seasonal bottom, and at the highest level since July 2020.

This inventory graph is courtesy of Altos Research.

The second graph shows the seasonal pattern for active single-family inventory since 2015.

https://www.calculatedriskblog.com/2024/07/housing-july-8th-weekly-update.html

Housing market sees more price cuts as inventory continues to grow

The median price of single-family homes in the U.S. is just under $455,000. That peaked a few weeks ago and is inching down each week for the second half of the year.

https://www.housingwire.com/articles/more-price-cuts-as-inventory-continues-to-grow/

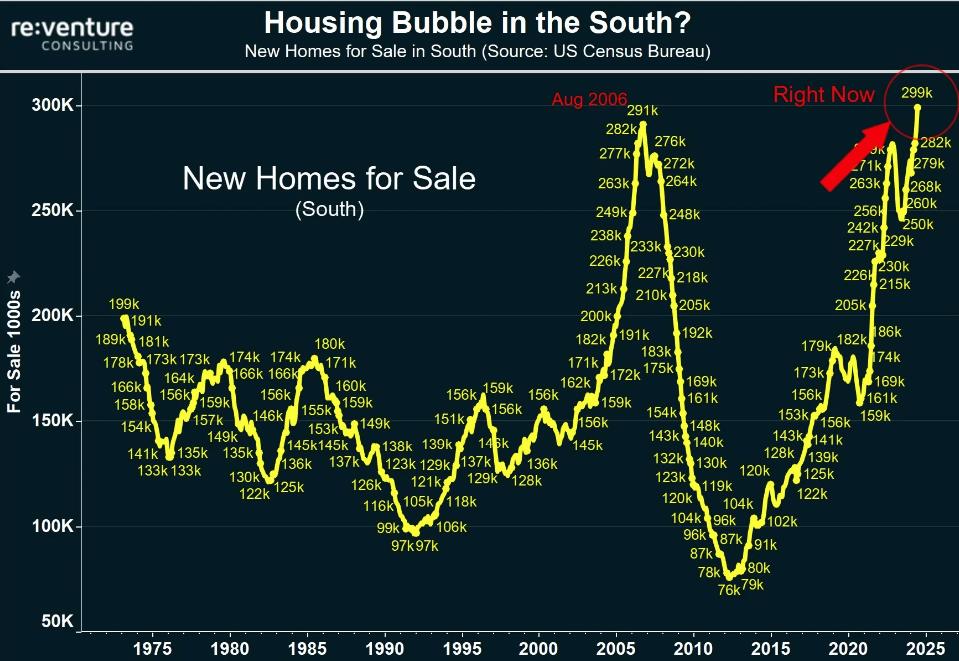

A massive housing bubble has developed, and is about to pop, in the South.

The number of new homes for sale in the Southern Region (FL, GA, TN, TX, etc.) has spiked up to nearly 300,000.

This is the highest level of all-time. Even higher than the previous bubble peak in August 2006.

Before the massive crash.

Many people want you think “this time is different” in the housing market.

It isn’t.

A massive housing bubble has developed, and is about to pop, in the South.

The number of new homes for sale in the Southern Region (FL, GA, TN, TX, etc.) has spiked up to nearly 300,000.

This is the highest level of all-time. Even higher than the previous bubble peak in August… pic.twitter.com/bVB9vCQl4I

— Nick Gerli (@nickgerli1) July 8, 2024

The US real-estate market is headed for a correction, strategist Chris Vermeulen has said, per BI.

Signals in construction activity are mirroring the period leading up to the 2008 crash.

— unusual_whales (@unusual_whales) July 9, 2024

The supply of new homes in Southern states of the U.S. has grown substantially potentially creating a bubble in the housing market, a real estate analyst suggested on Monday.

Home builders in the region responded to heightened demand for homes during COVID by escalating construction. Americans had migrated to the South during the pandemic in search of cheaper housing after stay-at-home orders to slow the spread of the coronavirus gave them flexibility over where they could work. That trend is slowing now, leading to waning demand for homes.

One analysts suggest that a drop in demand has left many homes in the market, creating a potential bubble.

“A massive housing bubble has developed, and is about to pop, in the South. The number of new homes for sale in the Southern Region (FL, GA, TN, TX, etc.) has spiked up to nearly 300,000,” Nick Gerli, CEO of Reventure Consulting, said in a post on X, formerly Twitter. “This is the highest level of all-time. Even higher than the previous bubble peak in August 2006. Before the massive crash.”

A massive housing bubble has developed, and is about to pop, in the South.

The number of new homes for sale in the Southern Region (FL, GA, TN, TX, etc.) has spiked up to nearly 300,000.

This is the highest level of all-time. Even higher than the previous bubble peak in August… pic.twitter.com/bVB9vCQl4I

— Nick Gerli (@nickgerli1) July 8, 2024

AC