by bitkogan

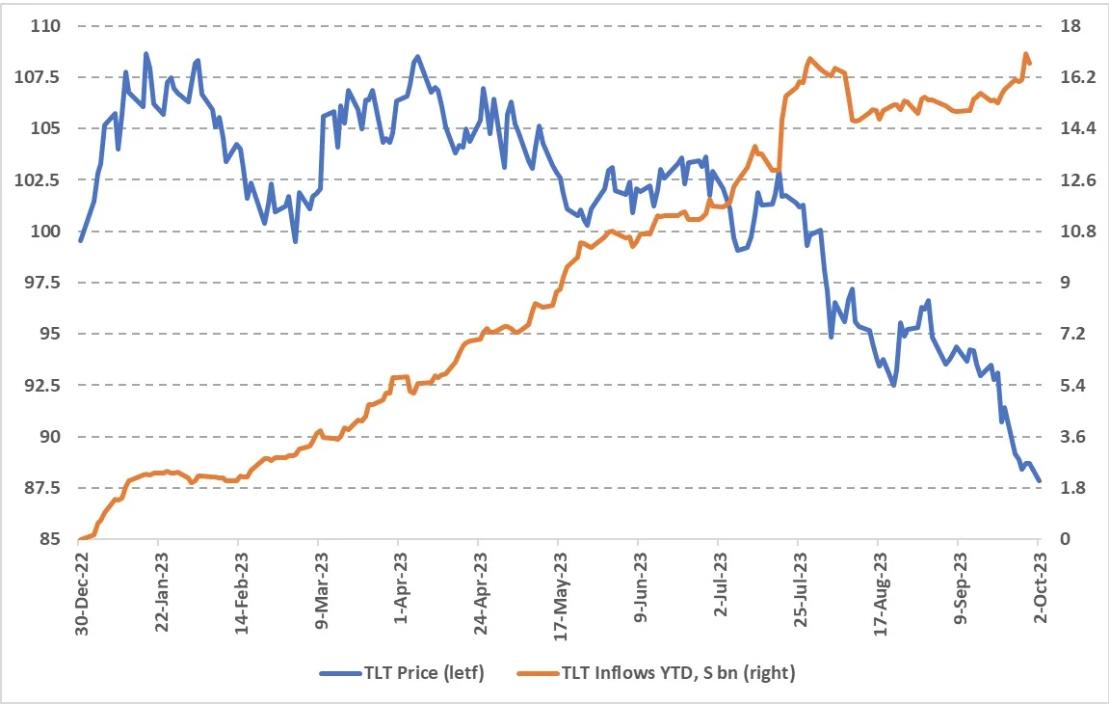

Throughout 2023, TLT has been on everyone’s radar, with hopes of a resurgence. The fund has consistently drawn interest, attracting a whopping $16.68 billion since the year’s start, nearly doubling its assets. Yet, it’s mostly been a downhill journey.

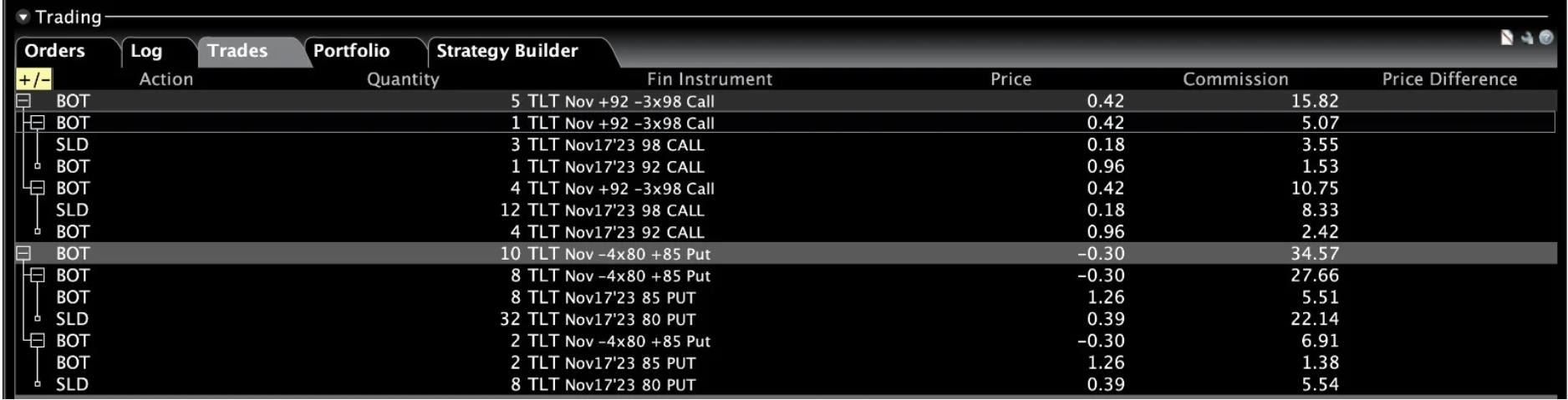

While it’s a stretch to claim today as the definitive low, it feels like we’re in the ballpark. For those willing to take a bold stance, consider a weighted ratio put bet:

- Purchase 10 Nov17 puts at $85 for $1.26 each.

- Sell 40 Nov17 puts at $80 for $0.39 each.

To capitalize on a potential bounce back, integrate a modest ratio call:

- Buy 5 Nov17 calls at $92 for $0.96 each.

- Sell 15 Nov17 calls at $98 for $0.18 each.

This strategy results in a neat credit of $90, against the standard collateral of $30,000.

In essence, I’m sensing a short-term trough. While a recovery might be followed by another dip in TLT, I’d welcome a drop below $85 in November. But should this rebound evolve into a rally, I’ll be all smiles.