Trouble is brewing in the U.K. again.

Back in September 2022, which now seems so long ago, the global financial system nearly entered a debt crisis.

The first country to “get to the brink” was the United Kingdom or U.K. At that time, the U.K.’s new government, led by Prime Minster Liz Truss, introduced a tax cutting program that neither the bond nor the currency markets could stomach.

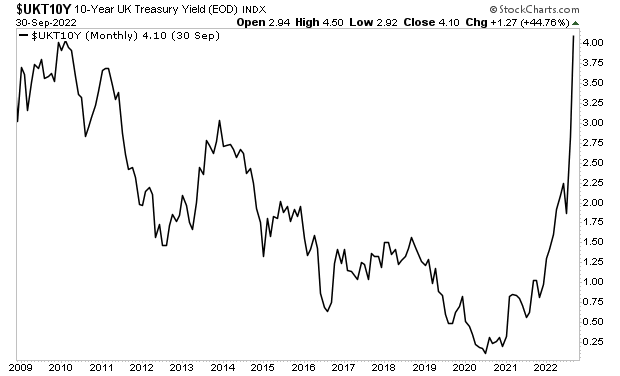

The yield on the 10-Year U.K. Government bond went vertical signaling default risk.

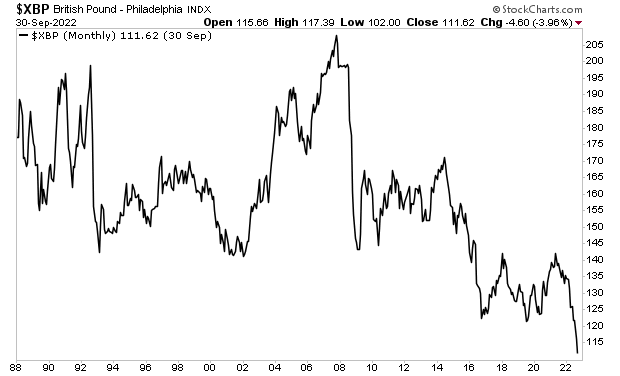

While the British Pound imploded, collapsing to a 30+ year low.

In the simplest of terms, the U.K. appeared to be the first country to enter a sovereign debt crisis. Then, suddenly, in the span of a few weeks, this ENTIRE PROBLEM went away.

The official narrative sold to the public concerning the “solution” to this issue was that Prime Minster Truss resigned and a new government was formed.

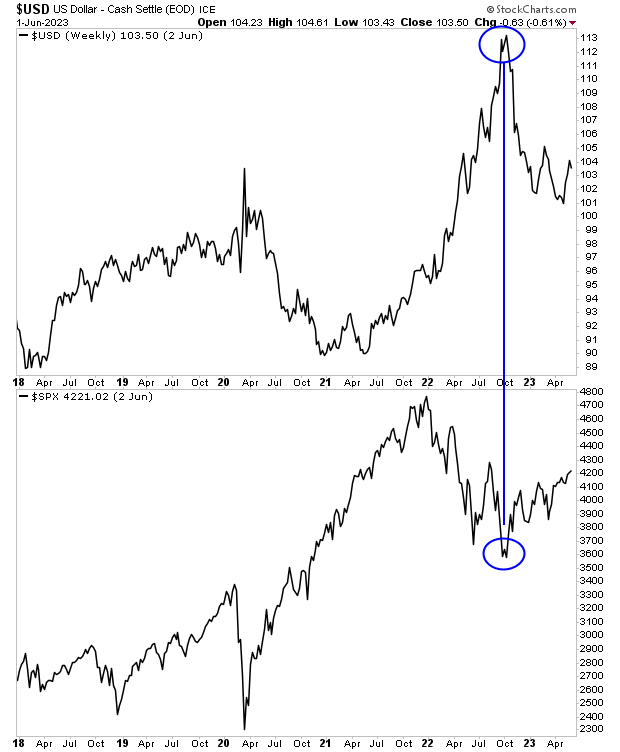

However, it’s rather odd that TWO WEEKS before Ms. Truss resigned, the $USD suddenly rolled over and started to collapse while risk assets like stocks caught a bid. Indeed, the entire global financial system entered one of its most aggressive “risk on” chapters in recent history. And it did this on a dime in mid-October 2022.

Perhaps something or someone else was responsible for this incredible turn of events. Perhaps global central banks coordinated a “behind the scenes” intervention that forced bond yields lower so stocks could catch a bid. We’ll never know the true story, but the global financial system sure as heck wasn’t “saved” by Prime Minister Truss resigning.

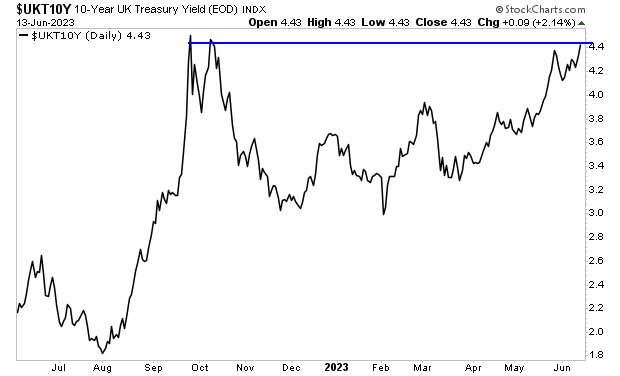

I mention all of this because once again the U.K.’s debt markets are blowing up with yields on the 10-Year U.K. Government bond getting dangerously close to the levels at which things started to break in 2022.