by DesmondMilesDant

Do these things matter?

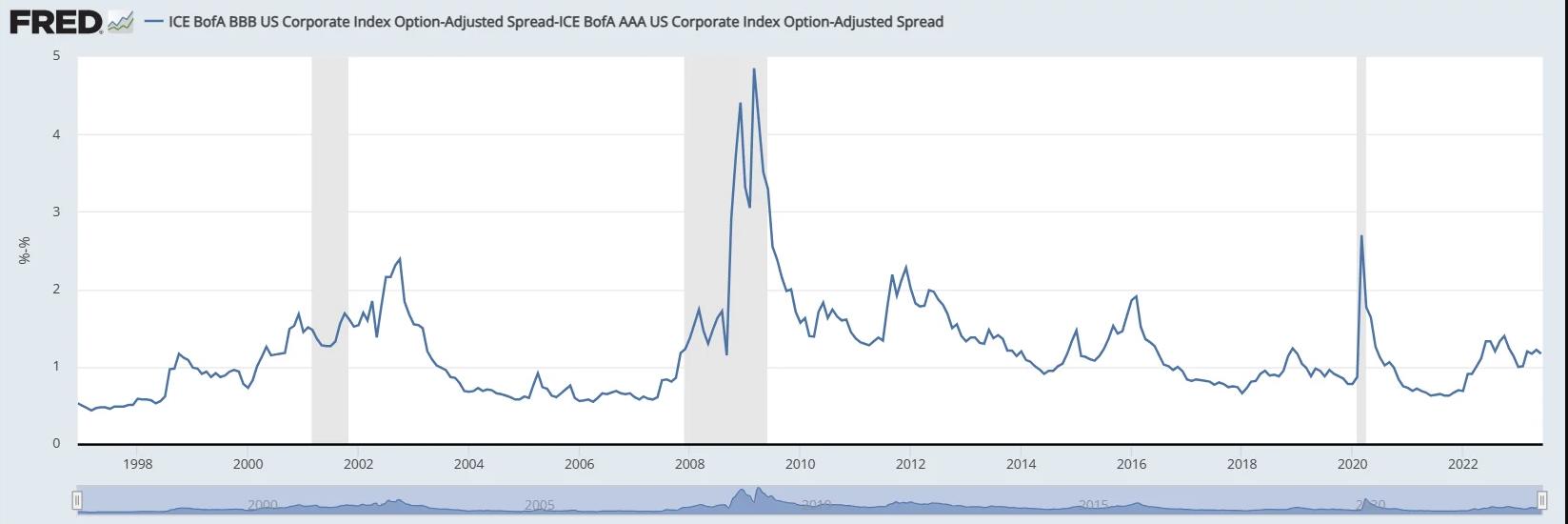

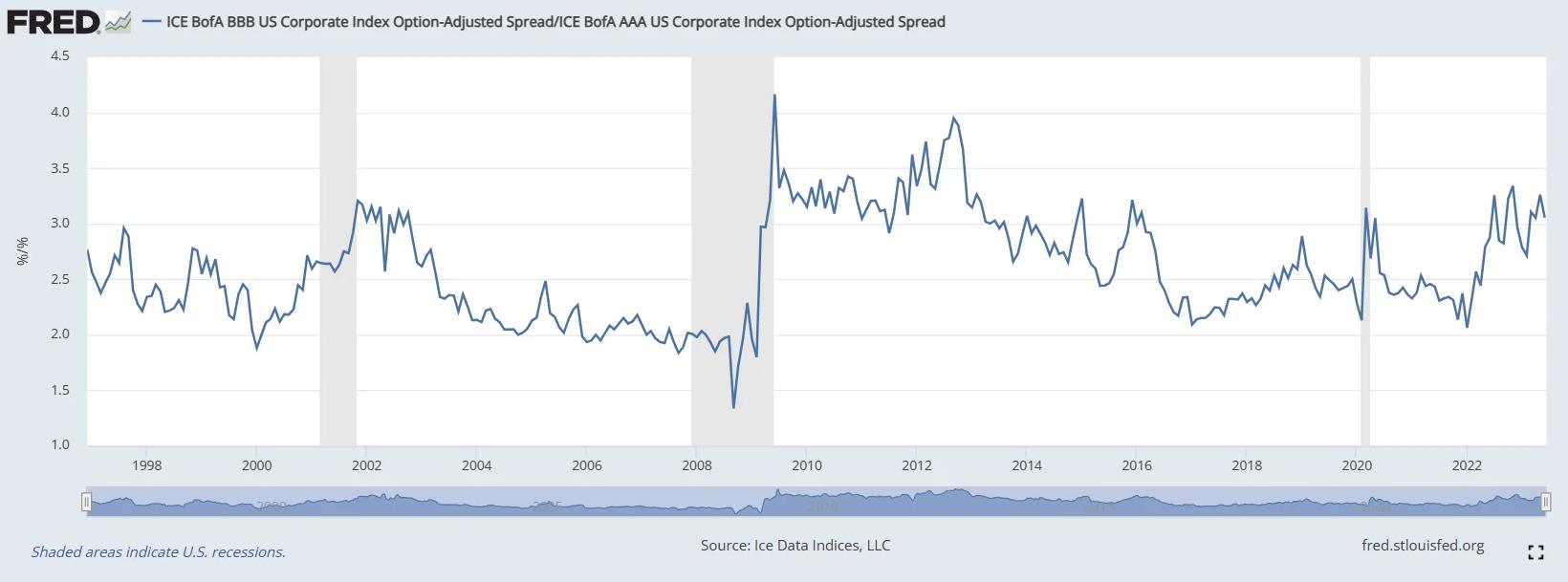

As you can see from the chart, the corporate bond spreads for both BBB and AAA rated bonds have been widening in recent years. This is indicative of increasing risk aversion among investors, as they demand higher yields to compensate for the perceived increased risk of default. However, it is worth noting that even during periods of economic stress, such as the 2008 financial crisis, investment grade corporates still maintained a relatively low default rate compared to other asset classes. Therefore, while there may be some cause for concern in terms of future defaults given the current environment of rising interest rates and slowing economic growth, overall these bonds still remain a relatively safe investment option.